“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury.

From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship.

The average age of the world's greatest civilizations has been 200 years.

These nations have progressed through this sequence: From bondage to spiritual faith; From spiritual faith to great courage; From courage to liberty; From liberty to abundance; From abundance to selfishness; From selfishness to apathy; From apathy to dependence; From dependence back into bondage.”

― Alexander Fraser Tytler

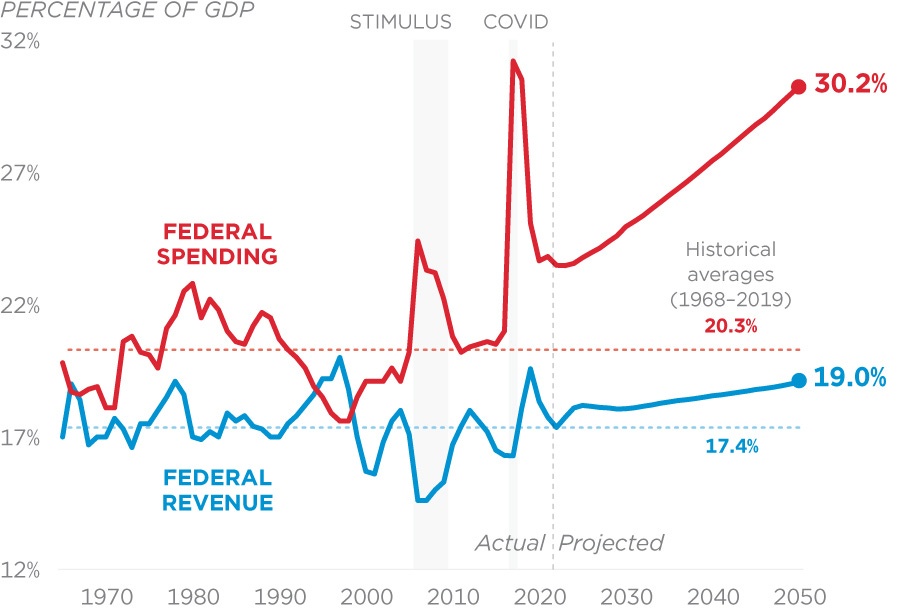

this is the clear state of america today and it’s quite literally about to sink us. deficits, debts, and entitlements are the whole ballgame. since the short term success of the gingrich congress on actually reining in spending in the 90’s, it’s been a one way ratchet that spikes every crisis but never goes back to previous levels. this is badly out of control.

(graphics from “federal budget in pictures.”)

this is deep dependency and you cannot just “tax the rich” to pay for it. the US already has the most progressive tax system in the OECD. our rich pay a greater share of taxes relative to their share of income than anyone else’s. the top deciles do not just pay “their fair share” they pay pretty much everyone’s share. the bottom 70-75% are net recipients of benefits.

and try as you might, you just cannot squeeze that any harder. higher rates on cap gains actually result in lower collections once you pass about 15%. same with higher marginal rates. the rich, it turns out, will adjust and adapt and find ways to lower their tax burden/structure their affairs such that taxes are avoided or deferred. that’s just how it is. past a point, the laffer curve laughs last. “hauser’s law” is called a “law” and not a suggestion for a reason. the only real way to break this is to broaden the tax base by upping the tax rates on low income earners (as the EU does). see if you can get THAT passed in the US…

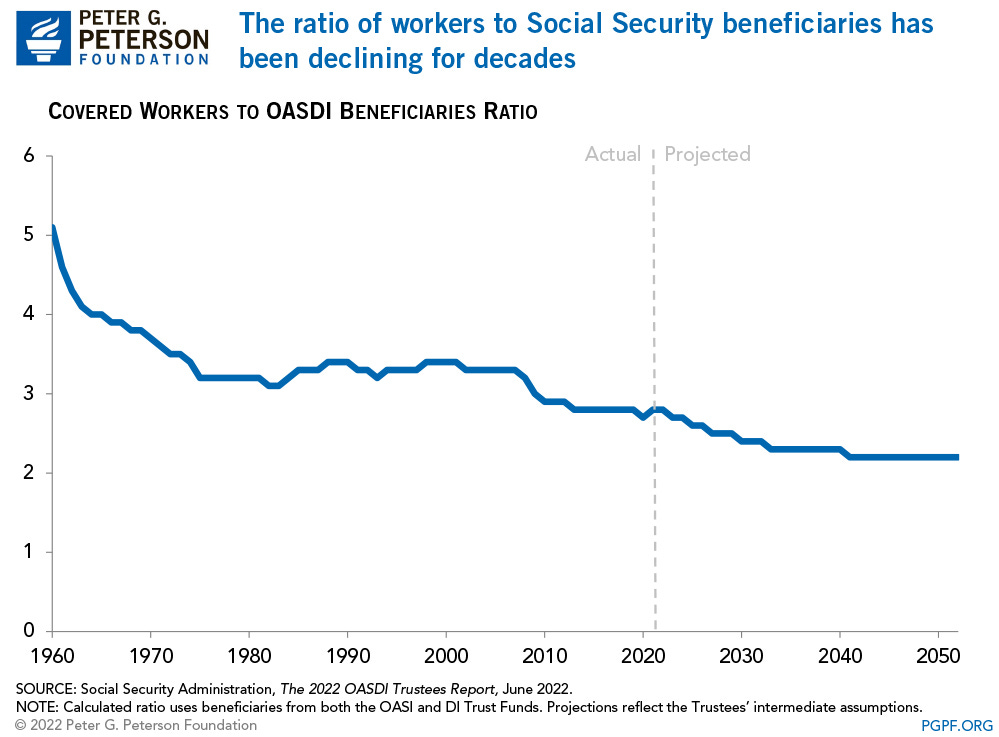

entitlements were always a ponzi. when SS was put in place, the average lifespan was 65 so the median recipient got nothing. now it’s about 77, so a typical recipient gets 12 years of payments.

what used to be 5-6 workers to cover each beneficiary is now fewer than 3. meanwhile, the COLA (cost of living adjustments) on SS ratchet up the nominal payout guaranteeing rising costs per beneficiary.

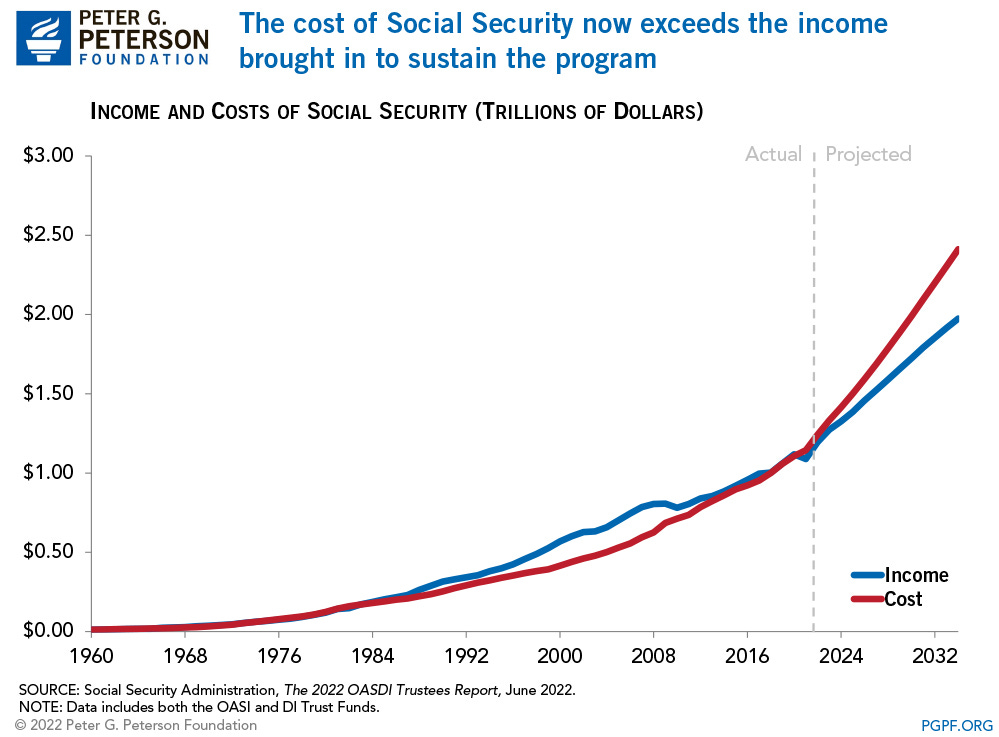

and this is causing trouble

and it’s about to get worse.

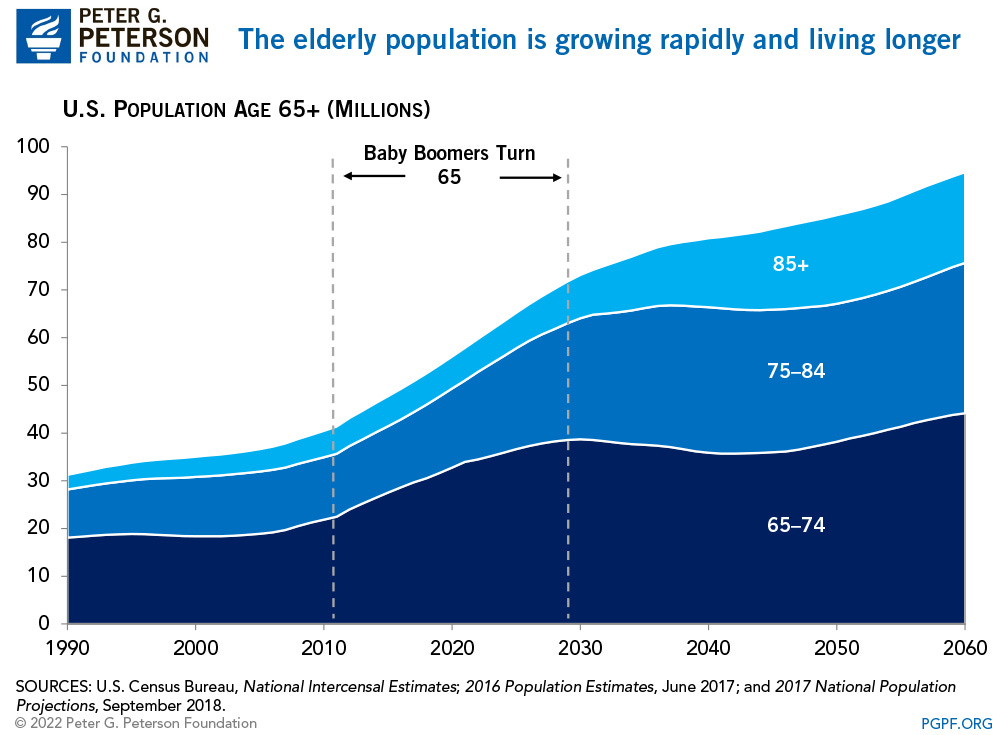

and the stress to medicare and social security are going to be devastating, on and on, deficits without end.

it’s a ponzi in every way right down to “last in, nothing out.”

the 75 year unfunded liability of SS alone is $22.4 trillion. add in the health system costs and you’re likely pushing $80 trillion.

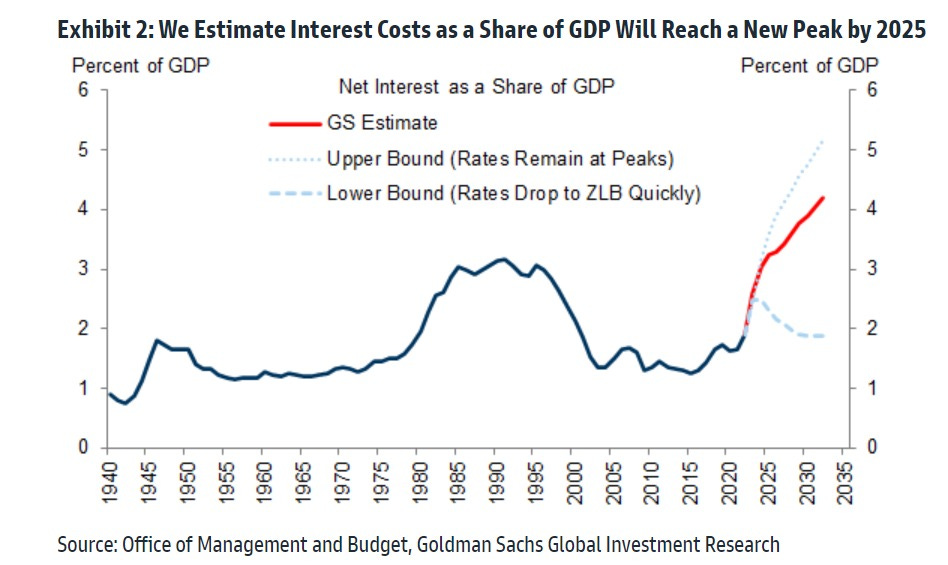

to call that “unpayable” is an act of extreme charity. it’s fiscal armageddon, especially once higher rates bite and persist as deficits explode and start eating 5% of GDP to service.

for all that the millennials come in for criticism, it’s the boomers that are plundering america and no one can stop it because they are such a potent voting block.

they are OUTLANDISHLY expensive and by the time they finish their locust-like consumption of the US federal budget, there’s going to be nothing left but mountains of debt. barring massive reform, gen X is not getting the social security they were promised (and paid for). i’ll be surprised to get any. even if they means test it, they probably cannot save either SS or medicare. the numbers are just impossible.

this is the cycle: vote yourself largess until you break the system and collapse into a dictatorship.

it’s human nature. there’s no fixing it within a “democratic” structure that can hand out goodies and the captured classes that generates.

if we want to survive, we need to change the structure.

it’s essentially politically impossible to cancel these programs.

so here’s my simple suggestion:

anyone on welfare, medicare, medicaid, or social security loses their vote until they have been off the dole for 2 years.

you can either live off the state or you can decide what the state taxes and spends. not both. no more voting yourself goodies from the kids and leaving them with a huge pile of unpayable debt.

pick.

the issue of paygo is coming. the SS rules say “no more out than in” once this imaginary “trust fund” is gone. does anyone believe the congress will have the guts to let that happen and cut payouts while the boomers are voting? because i’m just not seeing it.

even “means testing” is unlikely to make sufficient difference. that’s like 10-20% savings max and it’s devilishly difficult to pass because the boomers affected by it are literally the most politically powerful people in america. and that means that this problem is going to eat us.

the bill is arriving.

it’s the very definition of “taxation without representation” for retirees to vote themselves more goodies paid for by younger generations who they are going to stick with the check (but almost certainly not allow to eat because the ponzi will have collapsed).

it’s intergenerational dine and dash at a restaurant no one can afford.

and there is no way to stop it if people are allowed to vote themselves largess from the public purse and no new system can be sustained until that capability is excised from the republic.

i realize it’s bit of a radical idea, but i’m honestly curious: other than fiscal collapse from being plundered, what’s the alternative?

Boomer here. The assumption underlying Social Security is that age demographics would continue as the have since the founding. Namely, each generation would be larger and more productive than the last.

Where are your children Gens X and Y? You have sacrificed your future on the altar of reproductive rights. It is you who are reproducing below replacement rate.

I, like many of my despised generation, am well into my "golden years". I still work, am still taxed, and pay more taxes than I receive in benefits.

Reap what you sow (or don't sow, in this case).

If only we could introduce an experimental gene therapy that reduced the life expectancies of Americans in general & Boomers in particular. It'd be hard to get them to take this jab, so we'd probably have to scare them - tell them it's the only way to stop a deadly disease that otherwise would have killed them. And then, of course, people would get wise to it because other people started dying...Well, then we'd better control the media, make it impossible to get that truth out until it's too late. If only such a thing were possible. Unfortunately, it's not because the CDC and FDA are too concerned about public health to allow such a dangerous jab to become widespread. Thank God our government is only looking out for us & would never act upon its financial incentives to kill us.