in praise of the debt ceiling fight

how i learned to stop worrying and love the government shutdown

i am old enough to remember the government shutdown of 1995-6. the gingrich congress had swept in in a mid-term rout of historic proportions due to an unpopular president (bill clinton), a punk economy, terrible ideas from hillary on healthcare, and on the strength of the “contract with america” which laid out the promises and policies these congress-critters would effect if elected. it was a strong piece of both politics and practical praxis.

they locked horns with billy c on the debt ceiling and for 7 and then 21 glorious days, the US federal government “shut down.” non-essential workers were sent home. and the stage was set for a hum-dinger of a negotiation about the future of these extreme deficits.

and in the end, it was great.

best budget negotiation in decades.

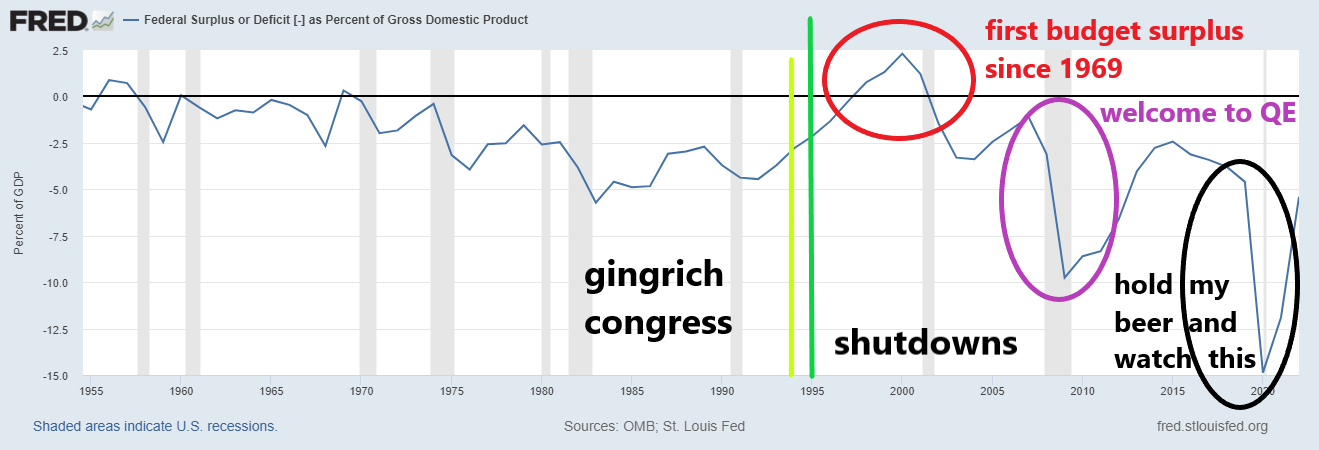

check it out:

the last time everything got shut down by budget negotiations (dark green line) was followed by the first budget surplus in 30 years. it even held up well in the 2001-2 recession.

then 2008 hit and QE ran amok. then covid hit and all concept of restraint evaporated.

there are always histrionics and attempts to “blame” one side or the other and claim the world will end without government burning $20bn a day, but the fact is that:

it was not really that big a deal to live through and most barely noticed

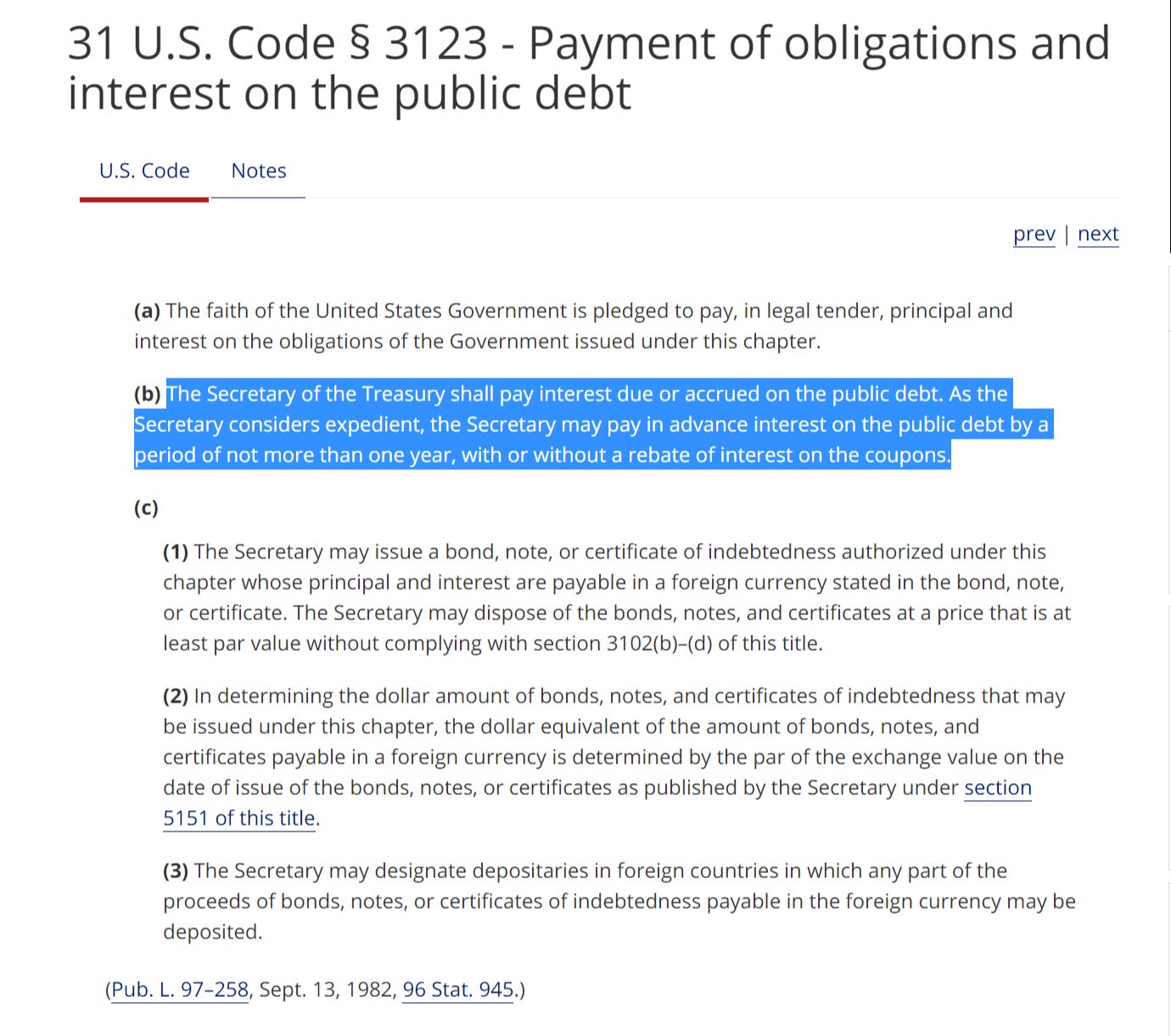

no, that’s not the same as defaulting on debt, the debt was not defaulted on last time, and will not be this time. doing so is actually illegal.

the “fault” lies in spending trillions more that leviathan has, year in year out while running up the unfunded mandates to assure this keeps getting worse

it is not somehow odd or inappropriate to not want to raise the debt ceiling without some sense of fiscal prudence to follow. what is actually odd and inappropriate is the assumption that doing so should be some authomatic/rote process.

and this is probably literally the only tool in the box to address it that could have any effect on what has clearly become an unsustainable process of spend, extend, pretend.

congress controls the purse strings and in a divided government like this (which is a feature, not a bug in the american system) everyone has to agree. and if someone bucks and says “i’m not doing that” well, until you pull them onside the government has to live within its means.

and THAT is the real framing here.

this is not “closing the government” or “defunding the government.”

this is “requiring that the government live within its means.”

and that’s not such a crazy idea.

let’s first address the pachyderm in the parlor:

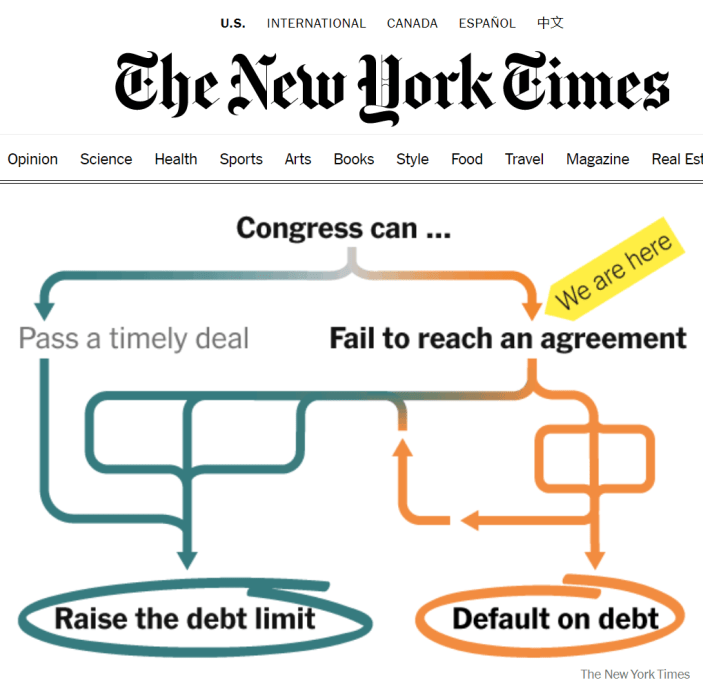

no, failing to raise the debt ceiling does NOT cause a debt default. it did not do so last time and will not do so this time. it’s actually illegal to do that. this clownshow graphic from pravda on the hudson is naught but manipulative mendacity. it’s just the shabby politics of fear monger preying upon the credulous and ill informed.

the reality is very different.

“shall” has a very specific legal meaning here. people tend to forget or not understand that.

it would be illegal not to pay the debt. there is money coming in from tax revenues and withholding. it’s more than enough to pay the debt. failing to pay it would be a choice and an illegal one. it would also likely be unconstitional.

this pastiche of threats is just a bargaining position and a dishonest one. it’s an attempt to sway the populace for political ends by outright lying.

presidential spokesmoppet karin went so far as to call raising the debt limit “a constitutional duty.” this is, of course, complete nonsense.

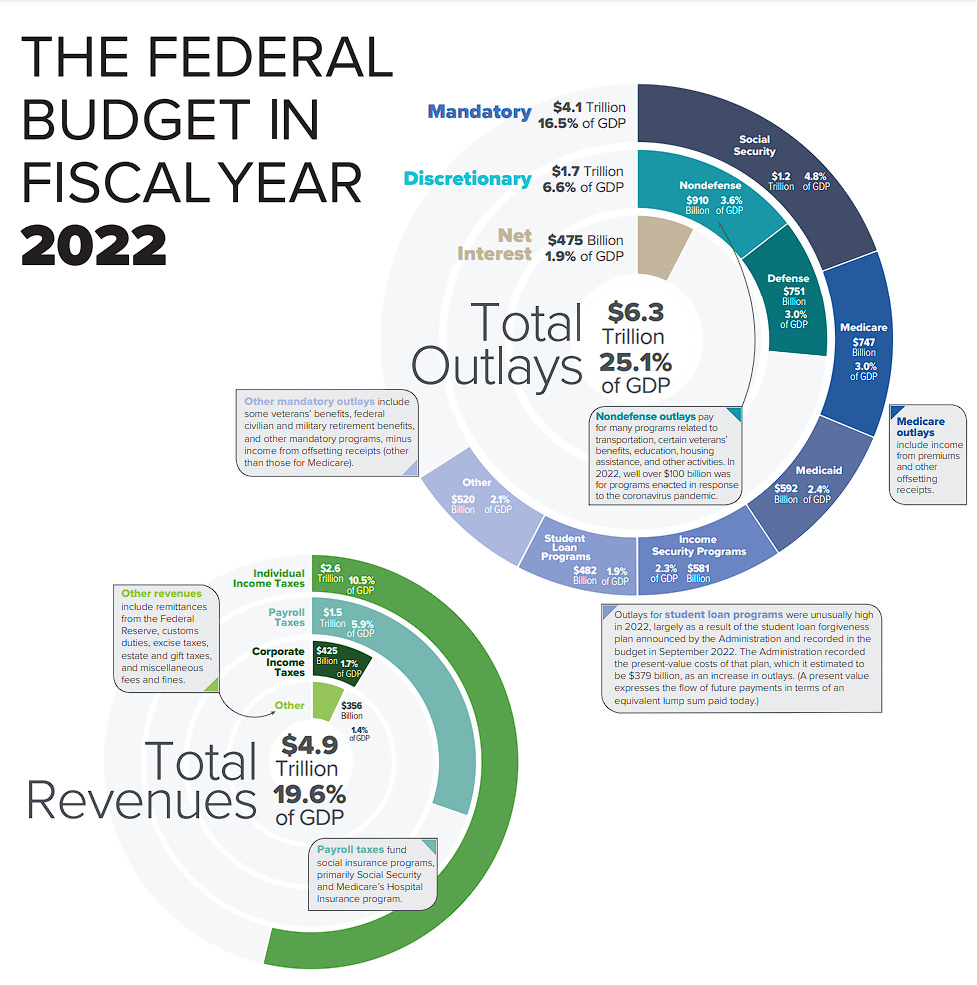

the fact is that the US not only has a severe public debt problem, it has an even bigger accrued labilities one that’s going to ensure that spending runs utterly out of control and cannot be stopped.

the issue is really simple: take mandatory spending (mostly entitlements) and add in debt service and you’re at $4.6tn. total revenues were $4.9tn. and interest expense is exploding. entitlements and interest are likely to equal the entire revenue base in 2023. but we still have $1.7tn in discretionary spending. literally none of it will be funded.

they talk about deficits as a % of GDP, but this is a minimizing approach. perhaps the better way to look at it is as a % of income. 1.7/4.9 = 35%. we spend 35% more than we take in. and as social security and medicare explode, this just gets worse.

the whole situation is untenable.

we’re digging the hole deeper at a dizzying rate.

and we need a new kind of solution, one rooted in hard facts.

no more issuing debt, having the Fed buy it, and spending like a particularly profligate sailor on marseille shore leave. no more extend and pretend with over $100 trillion of unfunded liabilities.

honestly, we’re aiming WAY too low in this current discussion.

this whole debate is about reducing the amount of deficit spending uncle sam undertakes over the next decade from $19.8 trillion to a mere $15 trillion. not spending, deficit spending. this is hardly the stuff of oliver twist novels.

frankly, the paltry size of this reduction in the rate of damage is pretty disappointing and all the tearing of hair, rending of garments, and desperate cries of “however shall we manage!?!” are kabuki theater. it all is.

the US public debt stands at $31.5tn, up a sizzling $8.2tn since 2020. this has now eclipsed US GDP and stands at 124% of last year’s figure. but frankly, this is a sideshow.

the main event is unfunded liabilities from social security/medicare/medicaid and the rest of the entitlement-verse. they stand in excess of $100tn and the total of the two is ~$135tn. this is greater than $1million per american household. doopsie.

it’s clearly already unpayable and it’s rising rapidly. there is no gray area, no wiggle room. it’s unpayable expect by printing money in monstrous amounts and probably not even then as most of these payouts are indexed to inflation so more inflation from printing money just makes future liabilities rise proportionately. you cannot print your way out of that is some sort of price spiral cram down. (not that this will likely stop them from trying as a sort of low energy, lazy “take what comes and act like it was inevitable kick the can fatalism.)

all you do is crush savers and reward reckless borrowing. the liability grows with you.

it’s already eating us alive and it’s not going away.

if you want to watch US politicians get the vapors, talk about “balanced budgets.” they act like it cannot be done. but it can. it has. and it must.

we need to find a way to get there.

because this cannot go on. it’s breaking everything and “debt to zimbabwe and beyond” is not a plan, it’s a pitfall.

the simple fact is that the US desperately needs entitlement reform and that the hour to get going on it to avert calamity is long past. we’re well into the part of the game of decision deferral where there are no good answers. someone is going to take a beating. but it’s only going to get worse and more widespread the longer we wait.

and this sort of “we’re going to hold your crazy budgets of profligate plunder hostage” brinksmanship by a few principled congresscritters is probably the only tool in the whole box that can move this boulder even an inch.

so do not vilify the instinct.

support it.

learn to love the shutdown.

closing government is opening amercia.

hell, it’s basically a patriotic duty.

make it known you want MORE and that these cuts are not deep enough. let’s start addressing the actual problems and not just the symptoms. the nasty part of this spend and pretend cycle is coming and will only get worse for being put off.

time to take back the power of the purse.

we SHOULD be fighting about this.

we need to be fighting about this.

it’s literally the fight for the viability of america,

time to up the voltage.

I agree. The government reminds me of a crack addict who blows through all his stuff and then demands more money because if he doesn't get it, he'll have to do stuff he'd rather not do because of your failure to cough up the money he MUST have for his next hit. Someone needs rehab badly.

Make Ron Paul the Secretary of Treasury