knowledge for college

funding for dummies: when you subsidize something, you get more of it

of a sudden, the internet seems once more awash in ideas such as these:

you can hear the indignation and incomprehension of the woman wall st apes cites.

“$118k for borrowing $41k? clearly this is some sort of unprecedented and predatory robbery!”

it’s a perfect populist talking point: facile yet easy to spread among illiterates.

it “seems” right if you do not understand how anything (especially math) functions.

let me burst the bubble here:

this is how all loans work.

mortgages are exactly the same. by the time you pay off a 30 year mortgage, you've generally paid 2-3 times the price of the home.

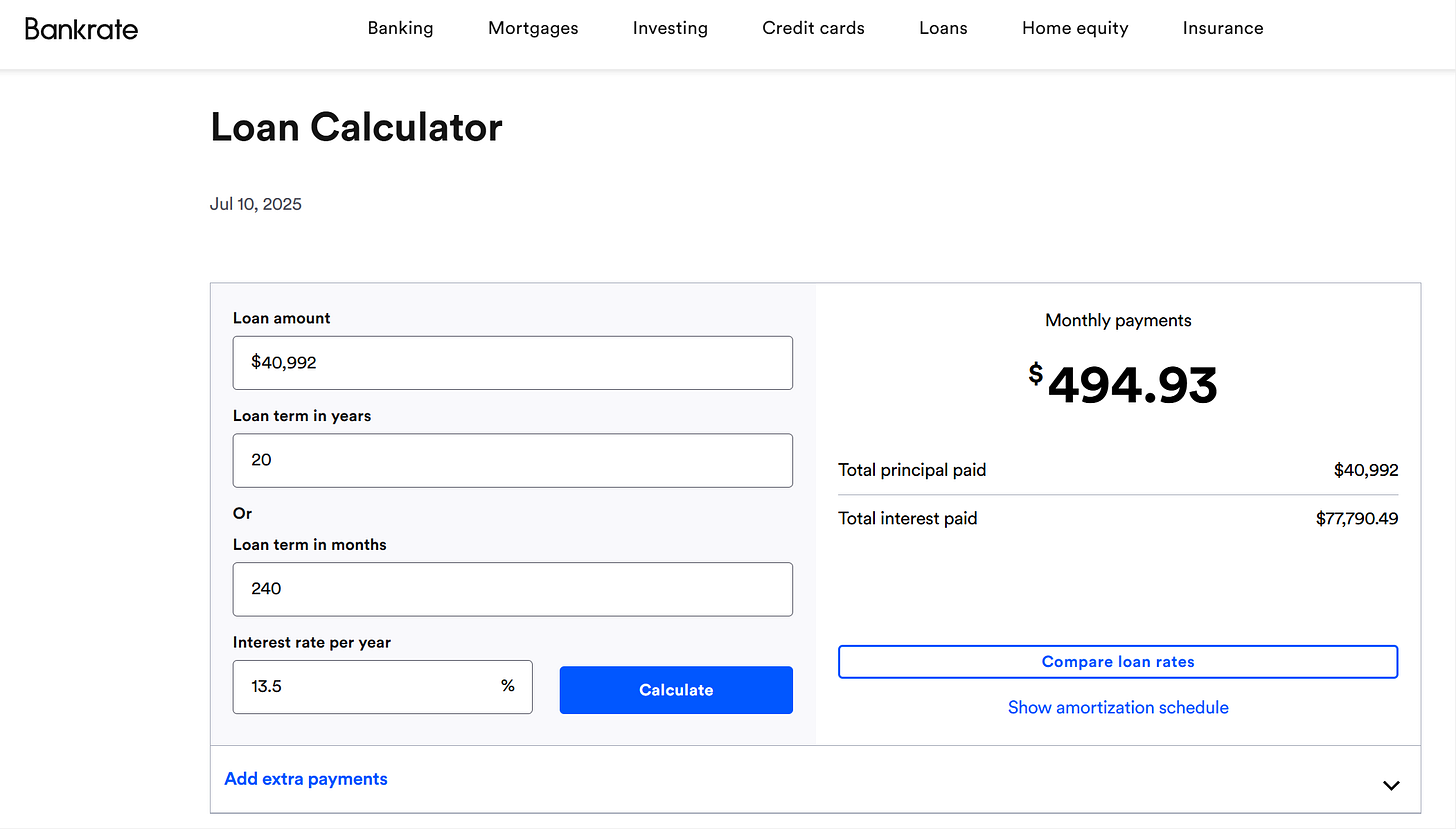

as rates go up and as time extends, this multiple rises. at 13.5% (a generous rate for unsecured debt from someone with middling credit), over 20 years you'll wind up paying about 3X your total borrowing.

3 minutes with one of 100 available online loan calculators would have made this plain, and it’s not like these terms or the basic function of interest over time were hidden concepts.

there is no trickery here, just math.

there is nothing especially sinister or predatory about these student loans. they work like any car or home loan.

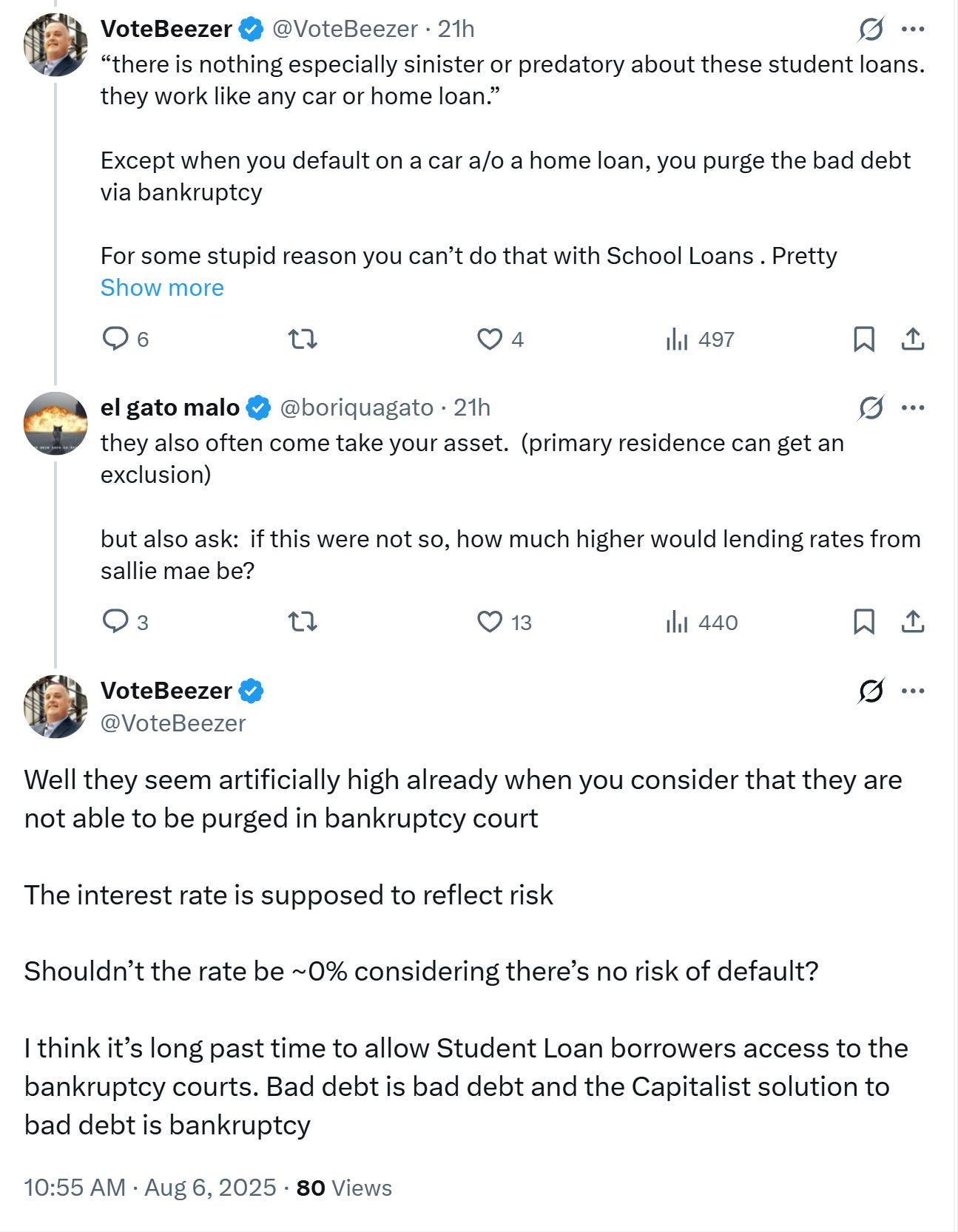

of course, the minute you say this online, the audience erupts in protestations. “no,” they say, “these are not like other loans! they are unusually punitive because they cannot be discharged in bankrupcy. you keep this debt forever, like luggage or some sort of financial herpes!”

we were having a discussion on this on X the other day, so the responses are quite fresh in my mind. this is a representative example from a seemingly sophisticated individual whose bio describes him as active in GOP politics in PA. i’d like to use it as a basis for discussion.

these seem to be popular misconceptions and misapprehensions about the nature of debt in general and student debt in particular.

ideas like “the rate should be zero if there is zero risk” ignore the basic concept of the time value of money. money today is more valuable than money a year from now because near-term consumption is more valuable than consumption a year from now. to see how this is obviously so, consider a simple thought experiment:

i ask you to loan me $1 million for 20 years. i promise to pay it back then, in full. in the intervening time, i will keep the money in an account from which it cannot be withdrawn at a federally guaranteed bank. there is zero risk. you will be able to see and verify the money at all times.

will you lend it to me for zero interest?

of course you won’t.

no one would.

that’s time value of money.

but the bigger (and more popular) issue to take with student debt is that “it cannot be cleared in bankruptcy” or perhaps “it’s overpriced.”

but this winds up representing a partial assessment to the point of being outright wrong.

firstly, anyone taking out the loan knows (or ought to know) the bankruptcy provisions. 5 mins on the internet would tell you. it’s not like this is some hidden fact.

but the loans themselves are highly favorable to borrowers.

i would argue that it’s not overpriced and that, in actuality, it’s an awful piece of paper from a lender’s standpoint because of its mandated, built in structure contains terms impossible for them to gain surety around and an embedded transfer of wealth/subsidy of the worst borrowers by the best.

firstly, these loans are not zero risk and carry meaningful risk of default.

payments were suspended for years during the times covidian to mask this, but it’s all surging to the fore now. this is a trainwreck.

1 in 6 (17%) of federal borrowers for student loans are in default. (over 270 days delinquent), and a shocking 31% are now 90 days in arrears.

auto loans run at 5% default (using far more stringent standards), mortgages at 4%. credit cards run about 14%.

so, student lending is some of the highest-risk lending around. given the default rates, you’d expect interest rates similar to credit cards (currently ~24%). adding to the problem here, these loans contain a set of embedded terms that not only limit borrower payment, but automatically extinguish debt at certain time limits whether the debt has been paid off or not.

and this needs to be taken into account.

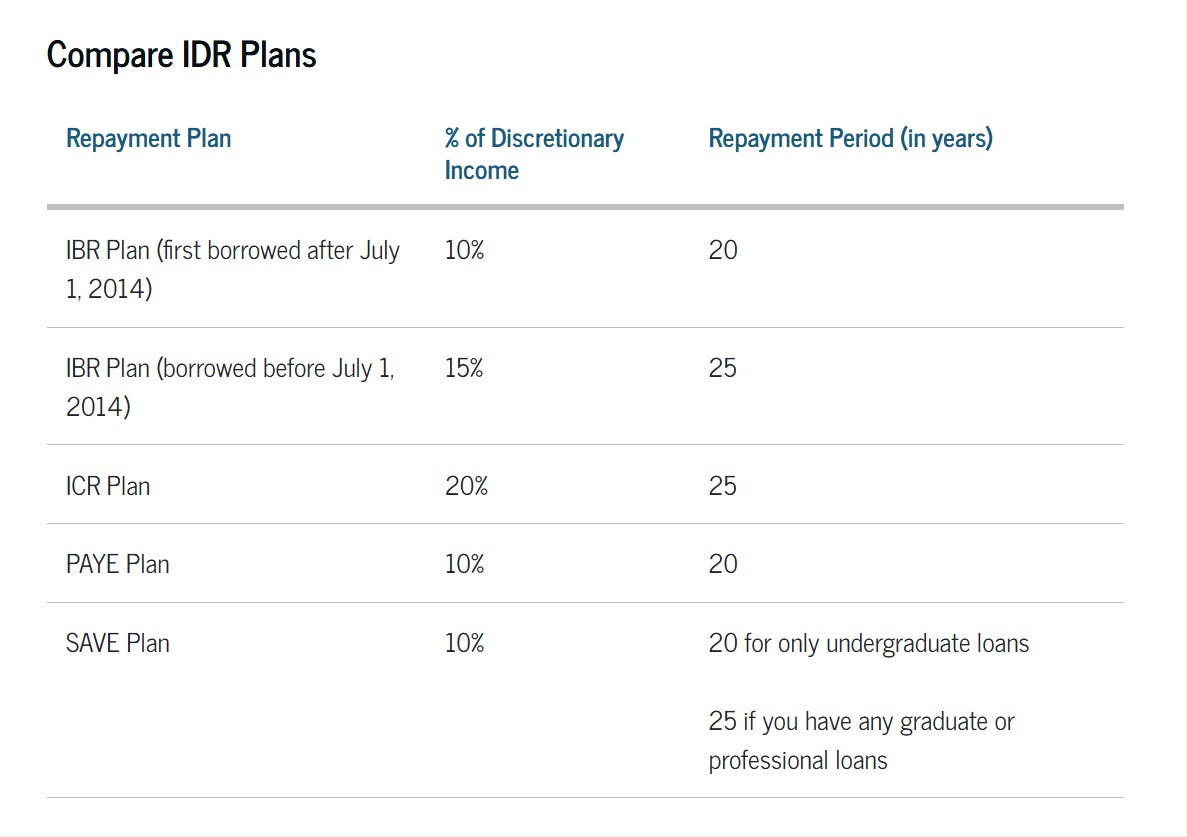

they have had repayment rates capped at 10% (was 15% pre 2014) of disposable (after tax) income and duration limited to 20 years.

consider this situation:

earn $60k, call it $50k disposable income. 10% a year is 5k. max payment over 20 years is $100k. your overall payment will be about triple what you borrow, so any borrowing over about $34k will wind up written off in the end. they’ll get their money back but the effective interest rate will plummet.

that's an outlandishly favorable loan term, esp if you borrowed big (say, $200k, or the $400k you'd drop on a top college or grad school)

you can then go take some piddly job or not work at all, and the lender is in the lurch and will not even recover principal.

as an offset, "cannot be discharged in bankruptcy" is trivial relative to this risk.

federal student loans (like sallie mae) are also NINJA loans. (no income, no job, assets). they are offered without credit checks. do people seriously think, given how aggressively other federal programs are gamed that there would not be a whole conveyor belt of "BK on graduation day" filings (after running up huge credit card bills) to dump student debt if it could be so easily discharged?

if so, i have some social programs in which i'd love to have you fund my participation.

this is another classic example (like rent control or subprime mortgages) where well-meaning populists broke a market to “protect people” and now blame the breakage on “predatory capitalists.”

just make it a regular loan with no payment caps, no built in forgiveness, and dischargable in BK, and apply basic credit standards and the the rate would plummet.

so would the cost of college.

these loans exist to lend to the uncreditworthy and fund their college careers. the colleges love them because they massively up demand and thus price. the spiral in college costs is debt fueled.

cut the lending, drop the demand. drop the demand, drop the price. drop the price, drop the need for lending.

works just like sub-prime mortages. it's the same agencies running the same cargo-cult playbook of telling everyone they need the marker of success by inverting the idea of “the marker makes you successful” and “the sort of people who get this marker have the other traits linked to being successful.”

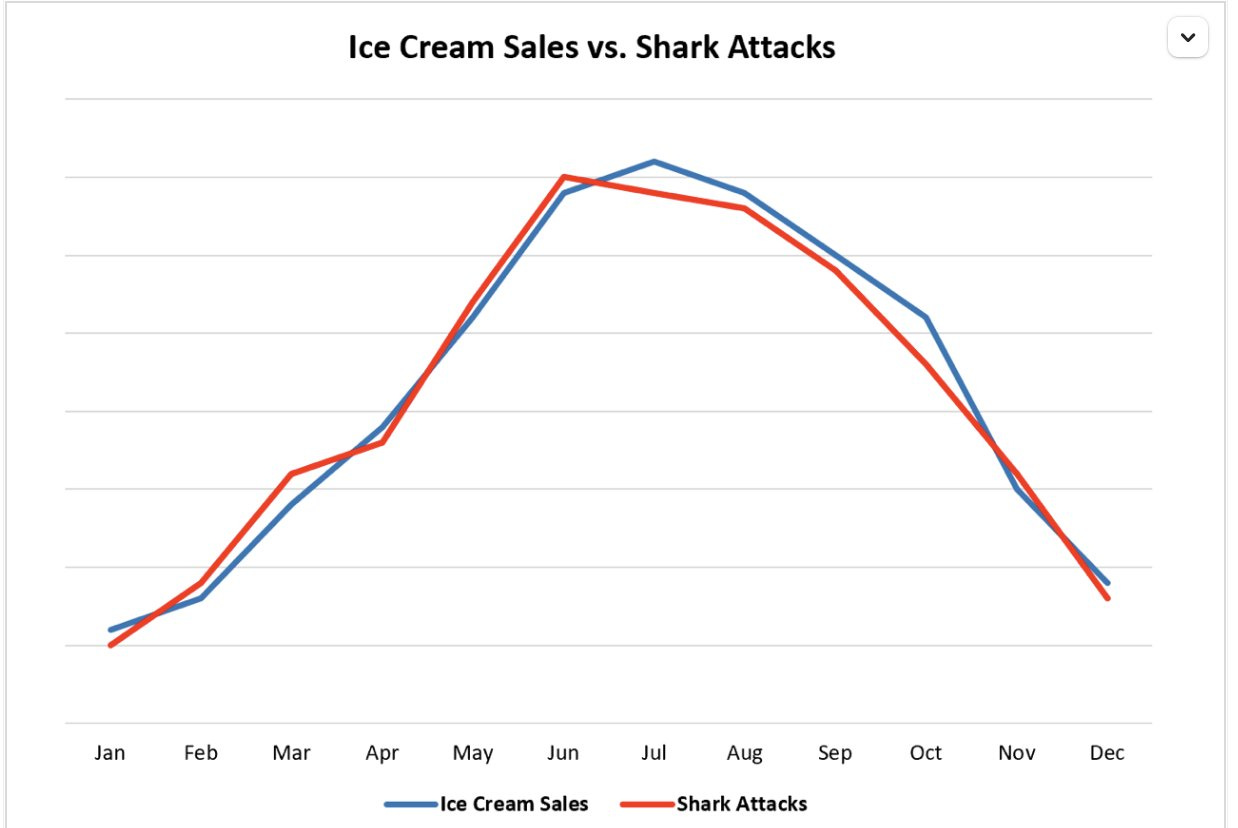

it’s just people falling for this silly chart, over and over:

“college degrees cause success” or “owning a home will make you middle class” are as foolish a claim as “ice cream causes shark attacks.”

it’s all third factor drivers. certain traits produce success: intelligence, dilligence, determination, conscientiousness, talent, etc. they also produce things like “college degrees” and “home ownership.” but the obverse relationship does not hold. giving someone without these traits a house and mortgage is not helpful; it’s harmful. you’ve handed them something they cannot afford or sustain and loaded them under obligation they cannot shoulder. and the price of these cargo cults is severe.

student loans are no different. it’s a pile of badly structured debt heaped upon the unwary by selling them a bill of goods (that a degree is the path to a better future) whose reality is something quite different. it’s a debt trap sold as a business opportunity.

the fact that this is a surprise to people, especially the borrowers themselves, speaks volumes.

it seems like the key issue here is that we're sending people to college who do not understand how interest, lending, or loan terms function.

and you know my views on over educating the midwits.

university used to be for the top 3-5% of intellects, a serious and seriously difficult undertaking suitable for and completable by only a very small group of people whose IQ cutoff was likely around 125. the standards were rigid and many aspirants to sheepskins went home empty handed.

jamming universities full of 100's and 110's broke the system, forced it to dumb down, and drove it away from ideas of logic and critical thinking and into doctrine and regurgitation because the "customer" was no longer capable of the former and thus had to be served the latter.

the whole idea of what it once meant to be educated had been lost and replaced with a fugazy not only incapable and undesirous of spotting itself as fake, but desperately desirous of passing itself off as the genuine article.

there is literally no one on earth so stupid as the wise fool indoctrinated into dogma they have mistaken for comprehension and erudition.

therein lies the true malpractice here. while the mafia may impose upon you “an offer you can’t refuse” the modern university-federal funding-lender industrial complex is hard selling you on “an offer you cannot understand” and vastly expanding university rolls and acceptance and performance criteria to the point of breaking the product and turning it to junk.

at the same time, prices soared and so those fooled by this pitchman’s patter were sold ever more degraded goods at ever more inflated prices.

the woman above speaks of spending over $40k on one year of tuition. how do you do that without considering return or understanding how interest compounds?

if you cannot manage to do these things, is “university” really the place for you?

imagine what this floods the schools with.

of course it broke.

and it broke the university.

the enstupiding of the student body at once made universities unfit for purpose and rendered them fertile soil for halfwit ideologue instructors that the students lacked the critical faculties to call out. any insitution that is not a conscious meritocracy will become an anti-meritocracy as B’s hire C’s and both seek to drive out competition from A’s.

this made the universities into a potent combination of arrogant, incapable, and dogmatic cancel culture cauldrons uncritically exporting the worst ideas they could conjure in service of their political paymasters and ideologies.

then the paymasters flipped and a great many things changed.

as is often the case, maher has a valid point here but the part that he and a lot of smart people seem to miss is this:

defunding “science” was not some mistake or error.

we desperately needed to defund "scientific research" because it wasn't scientific research, it was a bunch of grant-grubbing ideologues pushing dangerous pseudo- and anti-science while wearing the flayed skinsuits of a once august discipline. they danced around the burning pyre of "scientific method,” hooting like lordlings of the flies, peer reviewing one another to gatekeep orthodoxy with the savage militancy of the true zealot. they suppressed dissent, adulterated data, and foisted false findings upon an unsuspecting public pre-programmed to “trust the experts.” shockingly little of their work replicated, and whole disciplines became so adulterated and captured that once reputable journals actually inverted, claiming lead as currency and rejecting gold.

that is where the universities went because once you get addicted to government money, government orthodoxy follows fast. every time.

science is not made in such ways.

slaves are.

propogada is.

it’s institutional capture writ large, and, amidst institutions stripped of what should have been their intellectual immune systems, it ran amok.

education became politics.

this was a fear well founded and foregrounded back in the time when i was in college.

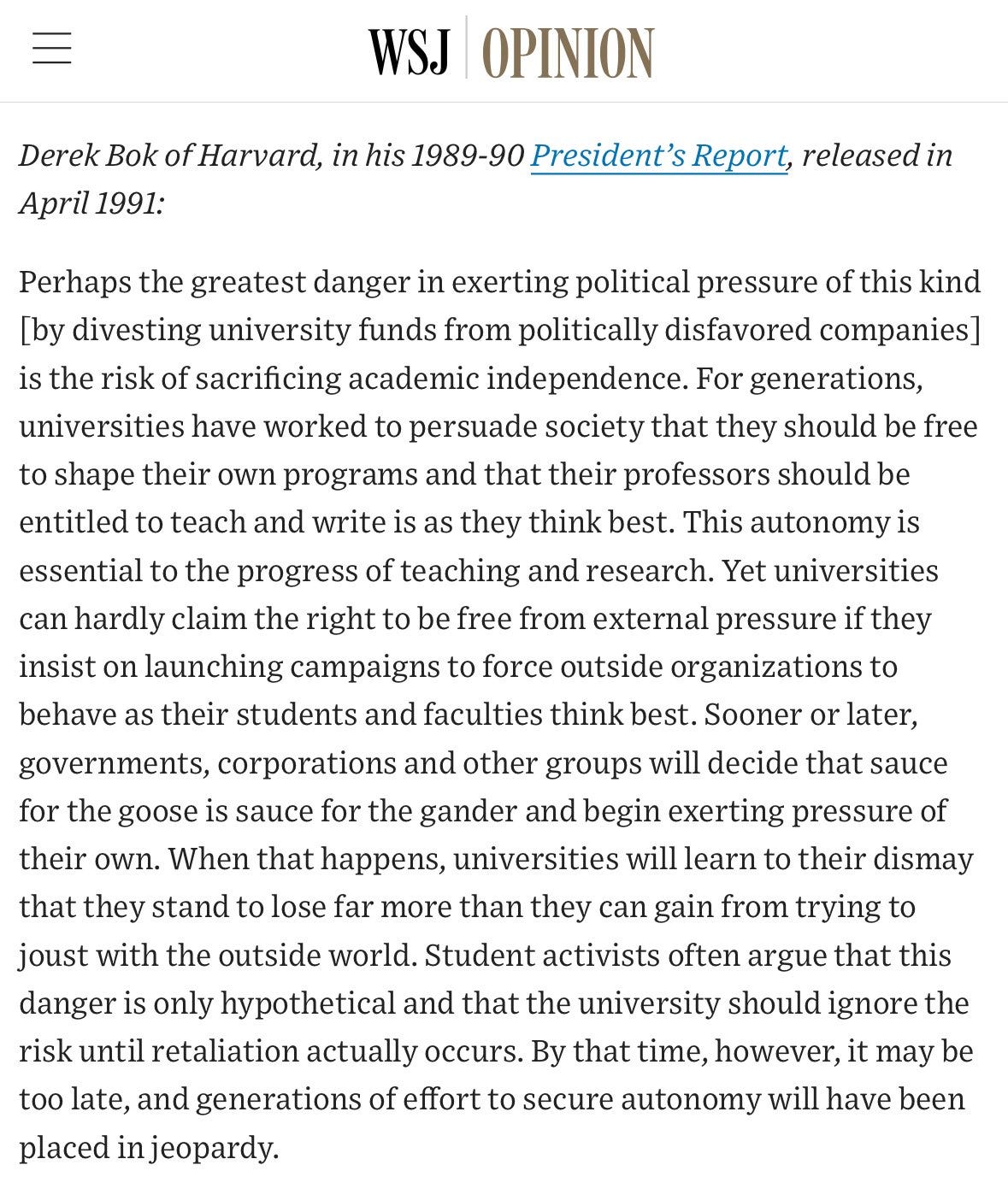

consider this missive from derek bok, lawyer, former dean of harvard law, and president of harvard from 1971-91. (and, ironically, again as a brief temp when summers was pulled down by anti-science cancel culture mobs). one cannot help but contrast this to the overt and conscious politics of later leadership (such as serial fraudster and plagarist claudine gay)

he predicted what was to come if universities chose this path with remarkable prescience and clarity, and now comes the whipsaw. internal capture by one faction of government drove academic focus on all manner of politically relevant topics from critical race theories to gender to climate science to phony and even oppressive medicine. the primary products of university became indoctrination into dogmatism and cancel cultism masquerading as science and expertise. everyone lockstepped into proselytization of same to justify and prop up the politics of the supporting regime.

show me the politics of the gold givers, and i’ll show you the politics of the pipers they pay.

the whipsaw is the breakage of the uniparty. love trump, hate him, or try to take a nuanced view, the one fact remains: he stands as instanciated nemesis, the elected avatar a people sick to death of hubris and desirous of laying pride low. he did not start this ideologiucal fall, he was elected because this fall had started. but he will hasten it and that is not bad thing.

there is a simple maxim in economics:

if you subsidize something, you get more of it.

we have been subsidizing the hell out of higher education, lavishing astonishing largess upon universities and funding the fodder for the gaping maws of their increasingly irrelevant diploma mills and ideology factories. it all turned political, then rancid, and now the blowback is erupting in full force.

the beneficial struggle of idea contending against idea was subsumed by the struggle sessions of ideologues imposing ideological purity tests and assaulting any who would not comply.

of course it has to burn.

but if you want a fire to go out and stay out, you need to stop feeding it fuel.

and this means “stop giving people who have no business in college subsidized money to attend college.”

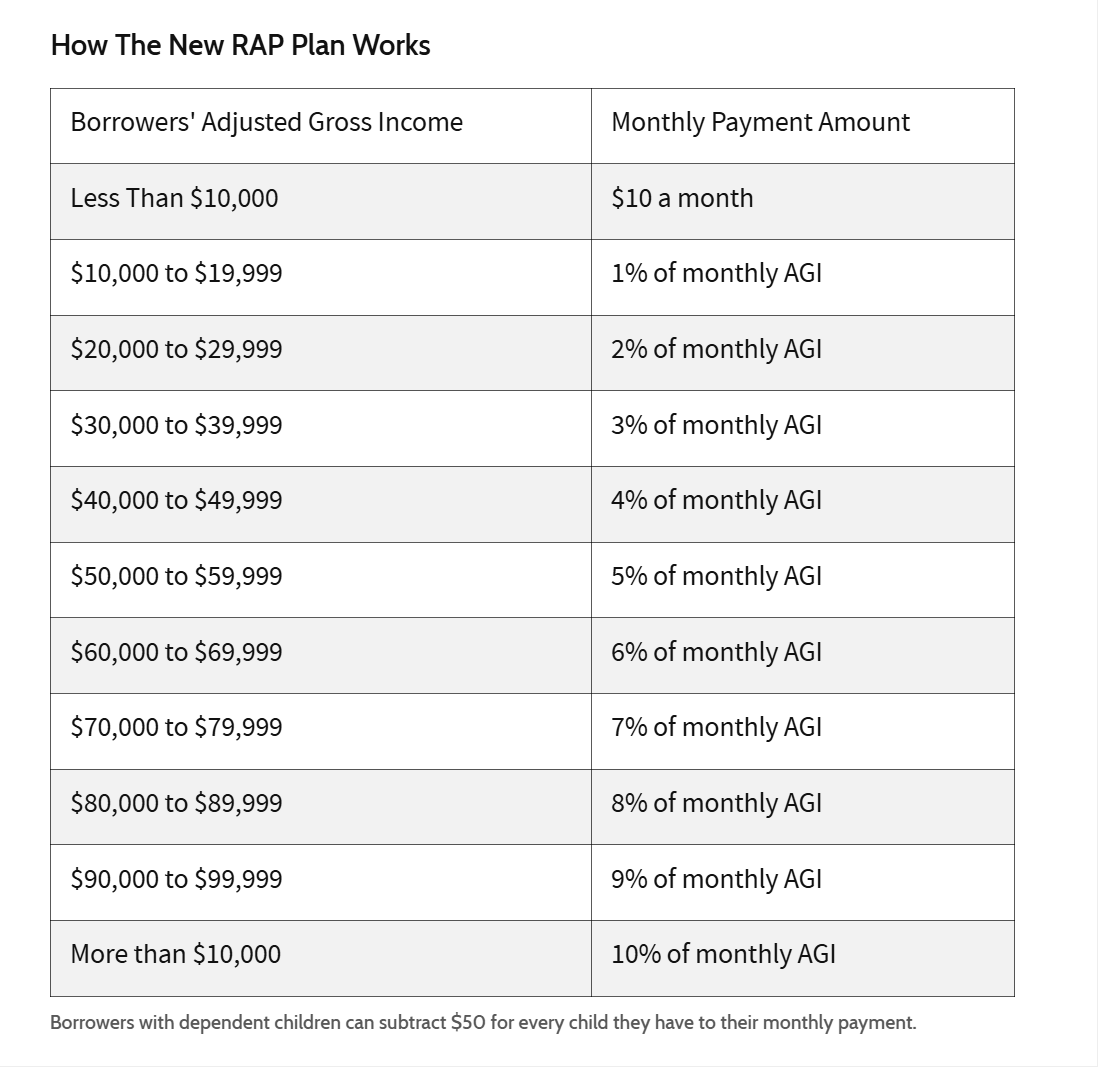

people speak of the “big beautiful bill” as though it was some major fix here, but it wasn’t. in many ways, it made these loans worse and worsened the inbuilt subsidy of the worst by the best.

it does limit the “parent plus” extension to the $57k stafford loan limit for undergrad, but it’s still $80k over 4 years plus the $57k and the payback terms got FAR more permissive.

it’s still $137k per kid and now you can pay a pittance if you fail to earn.

the phrase “married filing separately” could have a huge impact here.

and still get your loans discharged after 30 years whatever it was you managed to pay.

this is just making it easier and more affordable to get a pricey degree and take a silly job (or no job at all) which cannot pay for it.

these new plans are painting over rust.

if you want universities to become sound again and their prices and curricula to rationalize, the spigot of easy NINJA money needs to be turned off. federal lenders should provide nothing here. all they do is harm.

let the market return to balance. let demand by students attenuate, let supply of “college” drop, let college quality rise, let those who cannot hack it fail out, and let faculties once more come to teach critical thinking and assessment.

just leave colleges alone.

entirely alone.

no more accreditation, stricture, or oligopoly. no more free money, grants, tax free status, or endless federal support and subsidy. no more federal role in lending or special federal rules to lend to students.

taking federal loans and tax free goodyrooms and grants out of the university system would be like returning the wolves to yellowstone.

it’s the only way nature will begin to heal.

I was talking to an older co-worker who graduated law school in the 1970s and he never had to fill out a professor evaluation form as an undergrad at the end of each semester and he was speculating that now professors are at the whim of the student’s opinions of how well they taught since students now had a professor’s tenure by the balls basically. And that could have an impact on whether they felt comfortable challenging students whose opinions that might differ from theirs, thus changing how they taught. IDK.

But it got me wondering how and when the student evaluation started and was it in the 1980s – the same time that government student loans started guaranteeing that colleges would be paid, thus tuition would skyrocket and create dumbass majors like gender studies.

Well done. You have dissected and explained exactly what I have tried to tell people for years without the style you have shown here. It actually comes down to understanding basic math and having something called "personal responsibility". This last point is sorely missing in todays western societies. But as you note, nature has a way of working things out and back into balance. Get ready for some change. It's coming good and hard. Thanks for your work.