price gouging is a nonsense narrative

(and price fixing is worse) stats with cats looks at the data

it’s clear that the DNC will be heavily focused on ideas of price gouging, corporate greed, and making increasingly economically illiterate calls for price fixing, one of the worst and most discredited central planning ideas in all of history.

price controls never work. they destroy supply and result in shortages. it’s the economic equivalent of peeing your pants to stay warm on a cold night. 20 seconds later, you’re really going to wish you had not done that.

it’s popular with populists, but it’s got a zero percent success rate.

this sort of plan is exactly how FDR prevented recovery in the great depression and kept that depression going for over a decade to such ruinous effect.

it’s all ideas that sound plausible as a first order notion but that wind up creating massive shortages and market malfunctions because price cannot serve its role as a signal to producers to “make more of this.”

instead, as their costs rise, they make less because it cannot be made profitably. so you get shortages, even famine.

ask venezeula (up until recently a net exporter of food) about how that worked out…

"new deal 2.0" is code for "great depression 2.0."

but what of this accusation of greedy grocers (and other such companies) gouging the consumer?

are they really colluding and out to get us?

here is democratic strategist laura fink framing the argument and trying to talk over bartiromo.

i’ll let you hear it in her words.

clearly, the narrative is “record profits mean gouging!” but this is a ridiculously facile and illiterate claim.

it’s pure playing to the peanut gallery.

inflation drives the nominal value of everything, including profits, higher. if a company once had $100 in revenue and $5 in profits and these numbers grew to $150 and $7 in profits, sure, that’s “record profits” but if inflation was 50% in that period, it was a drop in profits in real terms. it was also a drop in margins. what was a 5% profit margin is now 4.7%. that’s the opposite of gouging, that’s margin contraction and lower real profits. and that is what we are seeing across the US right now. businesses are not gouging, they are taking it in the chin to protect the consumer.

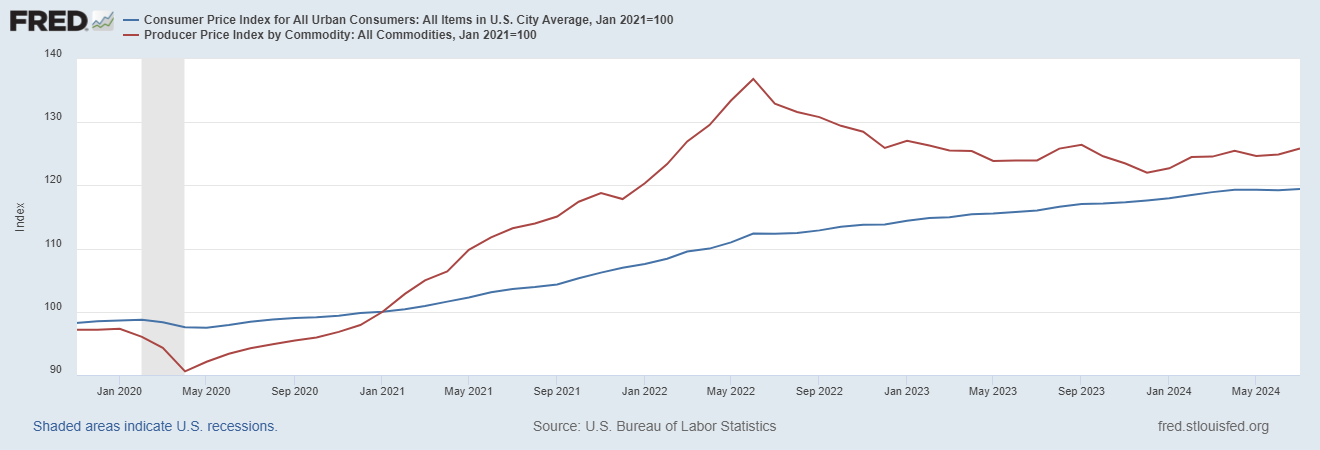

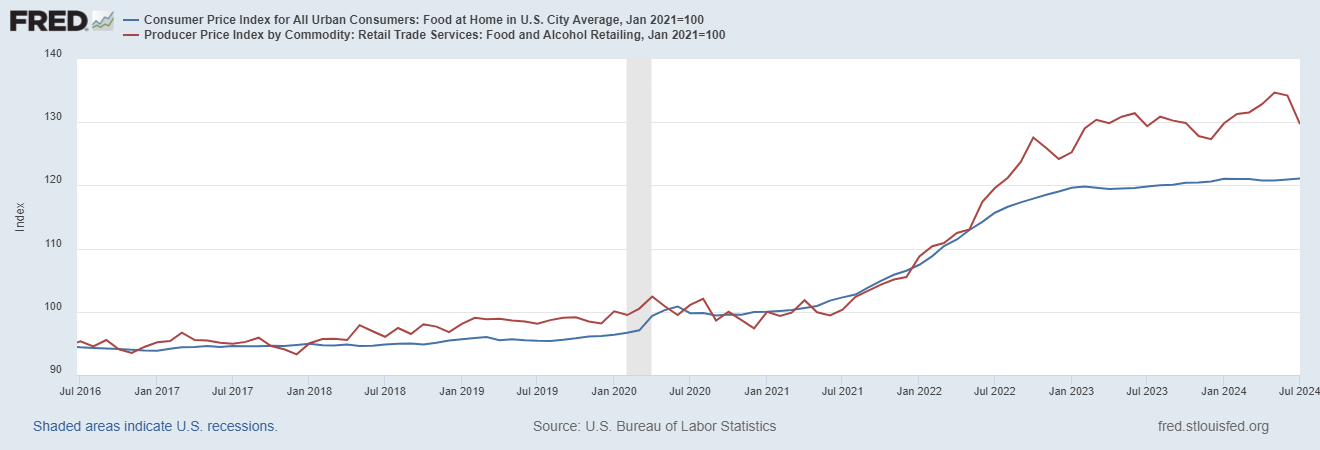

on a sort of broad brush basis, you can see that PPI (producer prices) have outpaced CPI (consumer prices) lately. i set both to 100 for jan 2021.

PPI is 126, CPI is 119.

and that spells margin contraction. prices consumers pay for items are not rising as quickly as price business pay for items to sell to consumers.

and that is the opposite of gouging.

but perhaps this is too coarse a comb and we need some more specific looks at these greedy grocers and their grabby gougy ways?

first we need some sort of means of assessment to spot gouging. i picked 3 metrics:

gross margin, the profits left from sales after paying for cost of the goods that were sold

operating profit, the profits left after all operating expenses

and levered free cash flow margin, a good measure of cash flow including debt service etc

each of these would tend to rise in a company “gouging” which i’m defining as “exhibiting strong pricing power.”

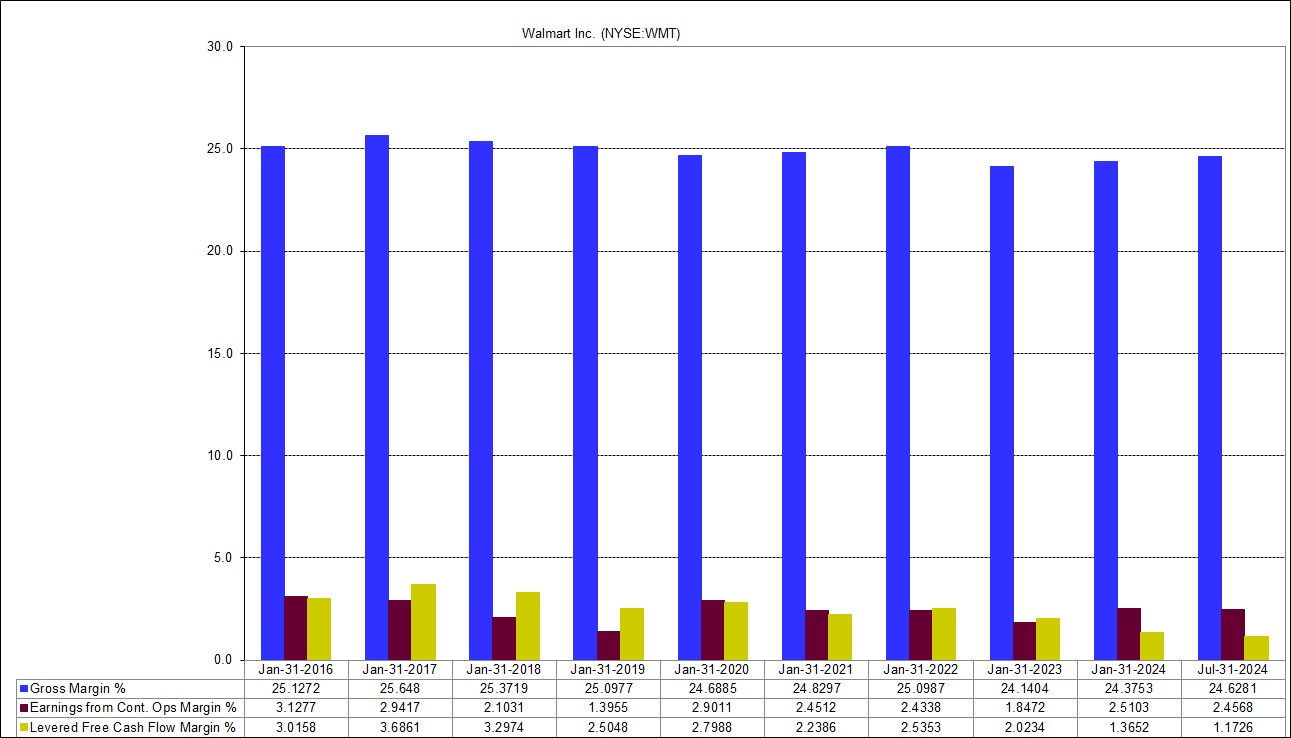

i started with walmart as a broad gauge for lots of consumer products and grocery and as the number 1 grocer in the US.

(source, S+P CAPIQ database)

(the july period is trailing 12 months)

gross margin: down

op margin: down

LFCF margin: crushed

this is not a company gouging, it’s a company getting gouged. they have lost approximately a point on gross margin and this has flowed most of the way through. cash flow has really taken it on the chin.

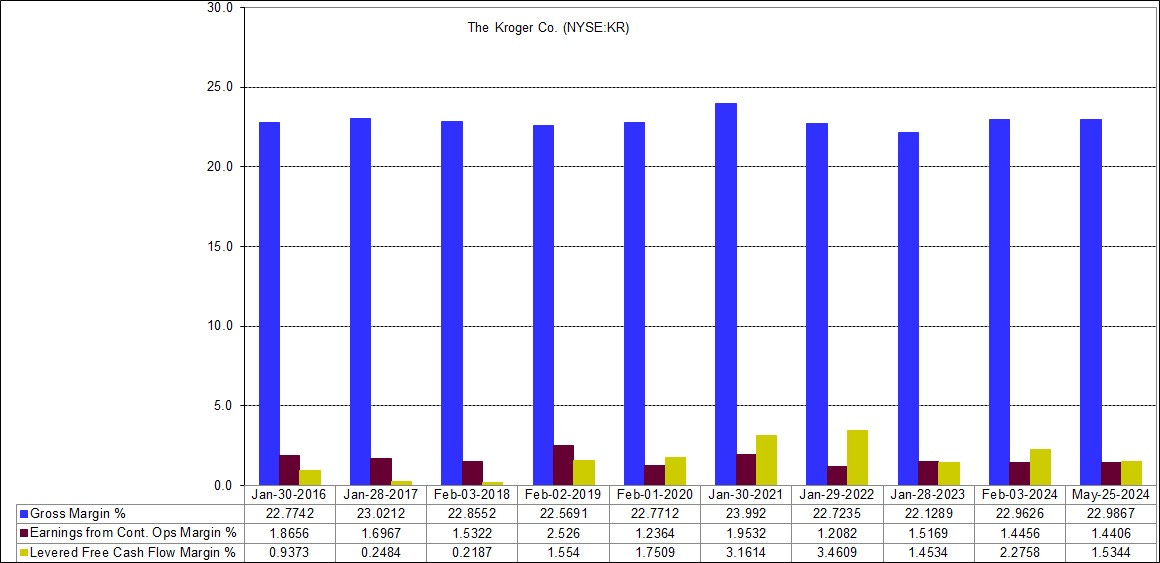

kroger, the #2 grocery chain looks like this:

it’s all pretty similar to 2019 with a bit less operating profit.

again, hard to see the “gouging” at a company with operating and cash flow margins in the 1.4-1.5% range flat with pre-covid levels.

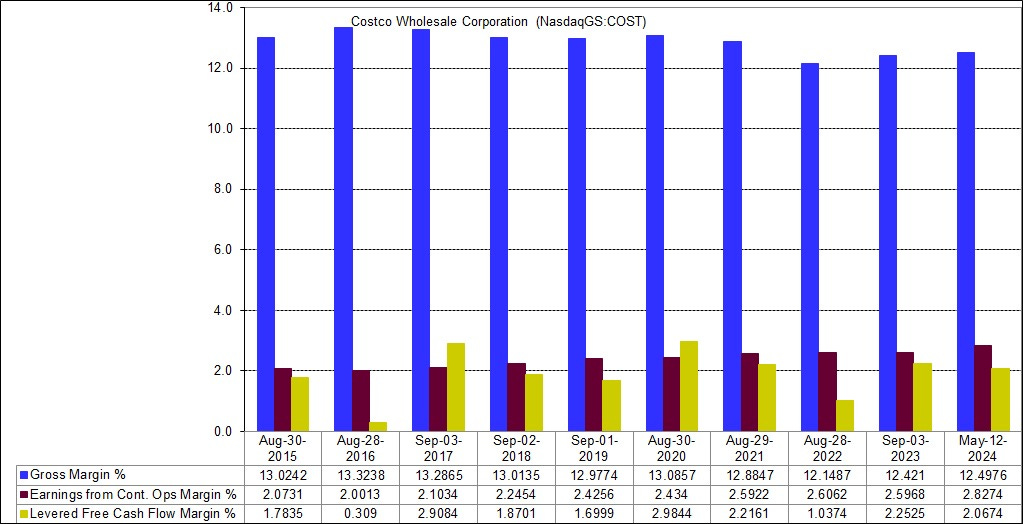

costco (#3) faired a tiny bit better.

gross margins are down from 2019 but op margin is a bit better and cash flow about 2% (likely from increase traffic as people “traded down” to wholesale stores offsetting their fixed costs better)

still, hard to call a 2% cash flow margin “gougy.”

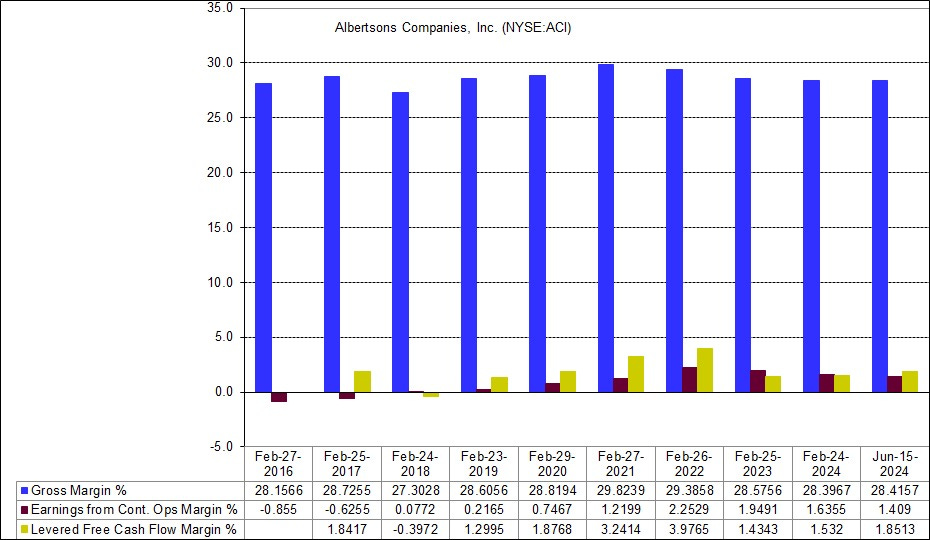

albertsons (#4) is more profitable than 2019, but was also struggling then. gross margins are pancake mix flat, operating margin is 1.4% and cash flow 1.8% pretty much right in line with industry norms of 1.5-2%.

and they have been dropping for several years.

there is just no one in this space that manages to extract profit margins of more than 2%ish percent as a pure grocer (walmart and costco likely get some benefit from selling lots of non-grocery items).

(note: i did not include amazon because so much of their business and profit is amazon web services and has zero to do with consumers or grocery)

it turns out grocery is a hyper competitive space with ruthless competition and incredibly low profits.

the pure grocers struggle to get about 1.5% operating margin and everyone is constantly trying to cut one another’s throats.

they have lacked the pricing power to mark up food prices faced by consumers to keep them in line with the prices they themselves have paid. (130 vs 121, again set to 100 for 1.1.2021)

this grocery gouging narrative is pure hogwash.

it’s an entirely fabricated fact used to support a policy with a 100% failure rate.

this is the most dangerous kind of populist pandering and it’s exactly how you destroy a high functioning system of food production.

price controls do not result in low prices, they result in shortages.

the laws of economics are not optional.

this is not a ride you want to get on.

Taxes and inflation are government gouging.

Unfortunately, most Democrats today are economically illiterate.