shrinkflation for jobs: yes, it's a recession

when you're right, argue facts, when you're wrong, argue with the dictionary

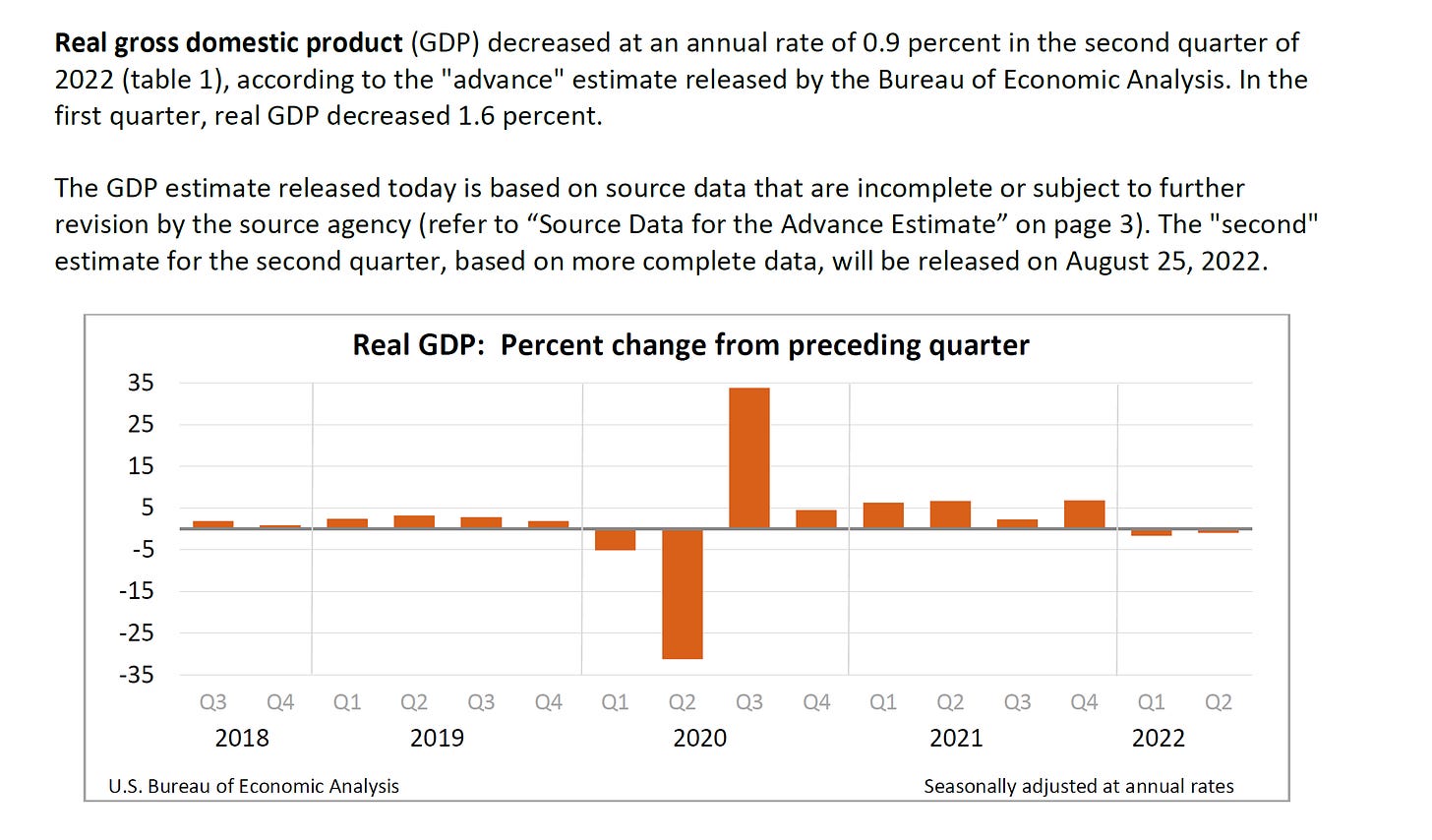

the GDP number is out this morning. as pretty much anyone who could fog a mirror predicted, it contracted. this makes 2 quarters in a row of declining GDP. by conventional definition, that’s a recession. this is really not complicated stuff. well, apparently, it must be because the same folks who cannot tell you what an emergency or a woman is seem to have lost the plot on what a recession is too.

it’s getting downright silly how the people who claim to be running the world seem unable to identify anything and either believe that they can prevent the chickens from noticing that they are being eaten by renaming the fox a bunny and telling everyone that bunnies don’t eat birds or just have flat out lost so much touch with reality that they think the map is the terrain and that editing it will move rivers.

we’ve reached the point of redefining “redefining.”

the simple fact is that the economy looks BAD and no amount of willful blindness at the NBER or brandon bluster can change that. it’s just more governmental credibility being fed into a woodchipper as they prove over and over who the real source of misinformation is.

everybody thinks they understand GDP, but as can be readily seen right now, this is not true.

so let’s start with some very simple definitions: GDP is a measure of output. it’s the quantify of goods and services produced in an economy. they measure it quarter to quarter and then annualize that change to arrive at the headline number.

it is reported in real terms, which is to say, price level adjusted terms. it’s seeing to measure output in “cars” not “dollars.” so if you sell 2 sedans for $25,000 each on quarter and 2 of the same cars the next for $30,000, revenues rose 20%, but real GDP is flat.

this cannot be done in actual units and units vary (one car might have upgraded wheels or a bigger engine) so it is done using a price level measure called GDPd (GDP deflator). obviously, this is always an approximation and people fight vigorously over whether it is too high or too low. it’s easy to fall down simplistic rabbitholes like “everything is higher quality” or “they defined inflation out of existence” and there is some merit to each (and no, shadowstats is not “real” inflation, it’s vastly oversimplified) but the real problem is that measuring GDP is really, really hard.

how do you compare a 2022 ford mustang to a 1979 ford mustang? i mean, it’s objectively better in pretty much every way. but how much better? how do you quantify it? how do you value a spotify subscription vs buying CD’s or netflix vs going to the movies? how much better is a 2022 PC vs a 2021? people think of GDP as this well known, straightforward figure. but it’s not. it’s a metric that predates a shift to an information economy and all kinds of changes in available services and care. that’s worth keeping in mind.

but, as ever, we work with what we have, so let’s:

recession is a contraction in real output. the traditional threshold is “2 consecutive quarters of decline.”

we just had them. (always go pull the full release with all tables and supplements)

as we dig deeper, we see more cause for concern:

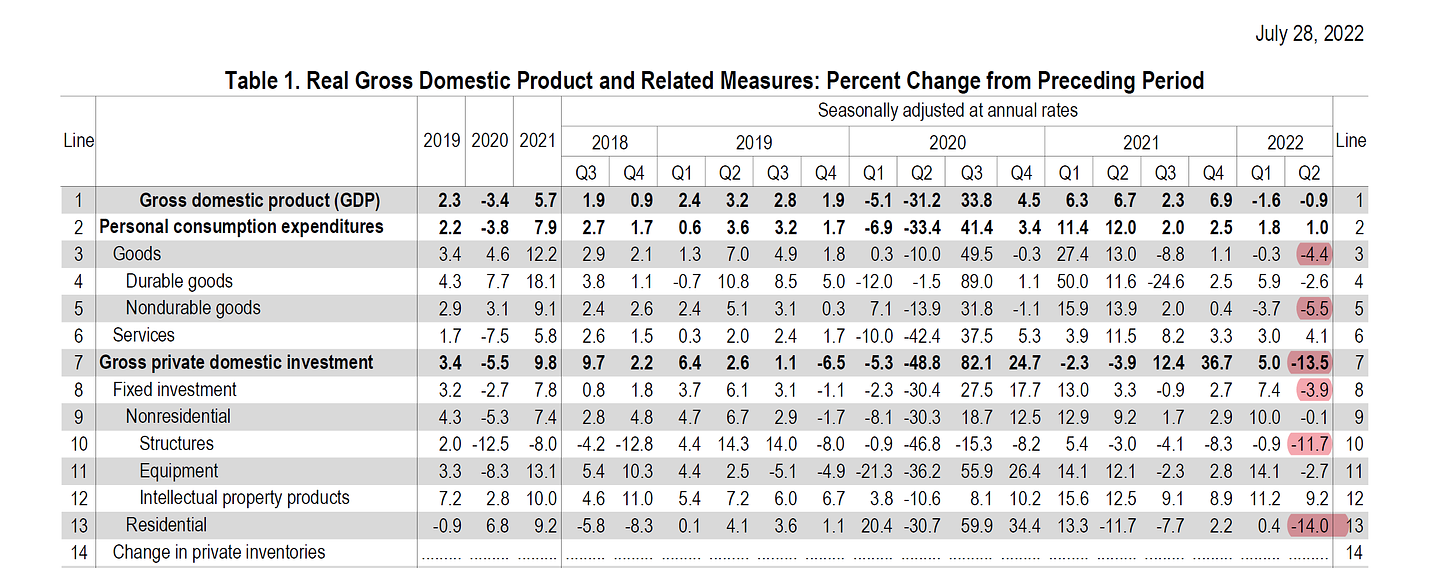

personal consumption of goods is falling apart, especially non-durables.

more worrying, investment fell off a cliff. based on a later table, gross private domestic investment culled 2.73 percentage points off the number which was, in aggregate, only a 0.9% drop.

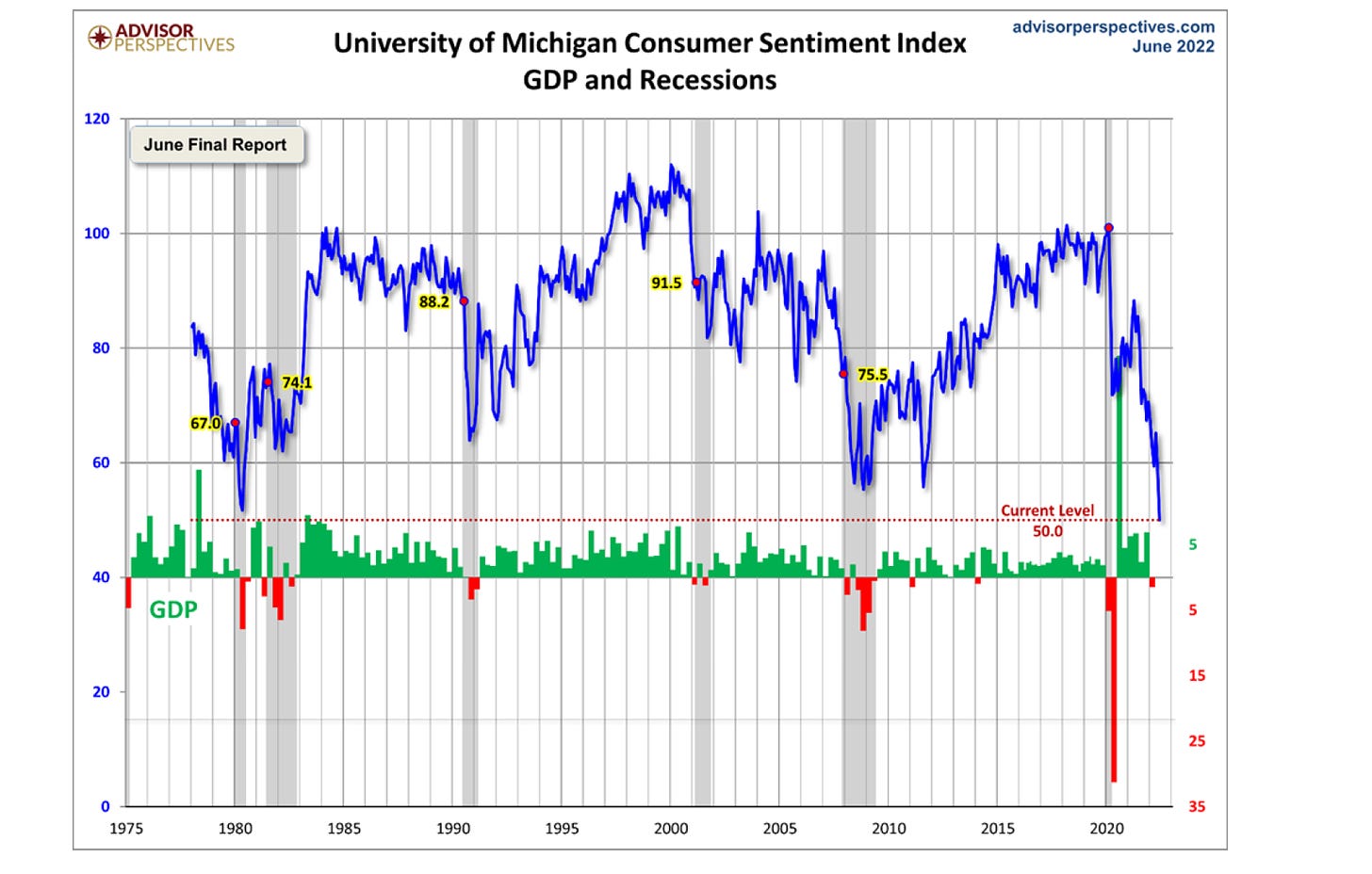

this is a massive drought in investment and that’s a big issue as investment is the fuel for future growth. this augurs poorly for the future and appears to align with the precipitous drop in confidence levels.

worried people do not invest. they hoard.

broke people do not invest, they spend on necessities.

personal savings rate dropped to 5.2% in Q2 from 5.6% in Q1.

and yet real GDP still dropped 0.9%.

that really ought to be that. the NBER has declared recessions for less. it did so in 2001 despite only one Q of consec decline.

and yet everyone is fighting over this being a recession.

to be fair, the 2 Q’s in a row definition is not hard and fast and is debatable in terms of how useful and descriptive it is, so let’s examine some of the claims being made:

jobs are good so it can’t be a recession! GDP must be good! this seems to be a popular claim.

it does not hold water.

let me illustrate:

yes, unemployment is low but his is because the jobs themselves shrank

US employment is still ~1 million lower than in feb, 2020 and population is considerably higher so the unemployment rate looks low.

but the bigger deal is the shrinkage of the jobs themselves. everyone may be working, but they are getting paid less in real terms to do it because their wages are not keeping up with inflation.

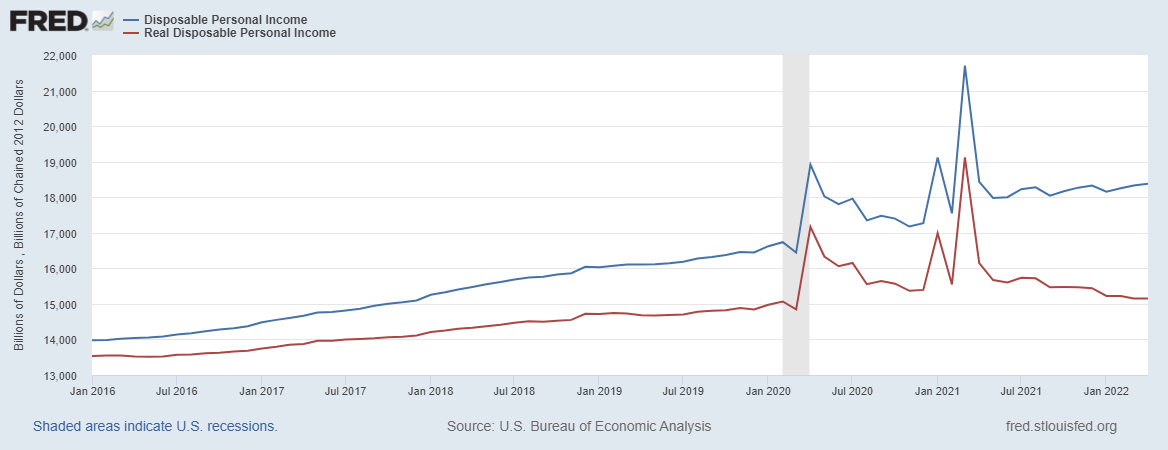

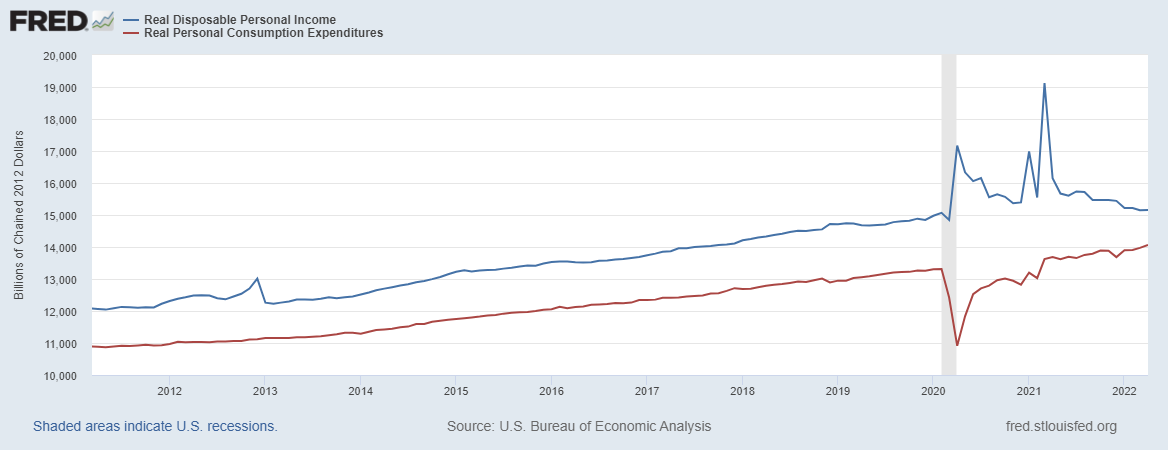

you can point at disposable personal income rising but that’s a red herring in times of high inflation. what matters is REAL disposable personal income. and the 2 series have been diverging sharply.

real DPI has been down year on year every month this year so far. it was down 6.15% from a year ago in june.

that, amigos, is recession.

shrinkflation is when you keep the price the same but make a product smaller. what was 16oz becomes 12. still $5.99. but that is not “flat” GDP. that’s contraction.

what’s going on right now is shrinkflation for jobs. we’re making them smaller rather than having fewer.

but this does not change the situation in terms of aggregate real buying power.

real DPI = (number of jobs) X (real after tax compensation for jobs)

increase the # 1% and drop the comp per job 7% and you’re still falling like a shot dove.

the US consumer has been on a collision course with its budget. spending has been rising but income declining.

and spending growth is falling hard and did so in q2 GDP.

and investment is the bullwhip tail. that gets cut before most spending does.

if we track real DPI/real PCE as a sort of coverage ratio, we can see that june is about as far as it historically stretches before something gives.

and what gives is always spending.

we’re seeing that now.

the fact that rent is exploding is not helping.

so, sorry to the “this is not a real recession” crowd, but it is. and i don’t think it’s over. at all.

this drop in investment presages more issues to come and inventories remain high despite having dropped a fair bit in q2. folks like WMT are missing numbers and all the folks i know in advertising and ad sales (which are a fair few) are saying the world went off a cliff back in feb-mar. that’s also a leading indicator and the facebook/meta numbers are starting to show it.

packages were down hard at UPS and covered by higher price.

and if anyone needs one final tiebreaker, well, here it is. the most potent contrary indicator in the last 30 years says “no recession.”

it’s a recession.

Every time Jean-Pierre lies, a unicorn dies.

It’s not a recession, it’s a trans recession