the mythology of government job creation and growth stimulation

dear government: you didn't build that.

government does not create jobs. that is not, cannot, and should not be its proper role or even a useful vision of that role.

of course, pretending that government creates jobs is one of the primary roles of government and, like so many other myths that have pervaded our lives, it’s just nonsense that has been beaten into the collective consciousness through endless repetition.

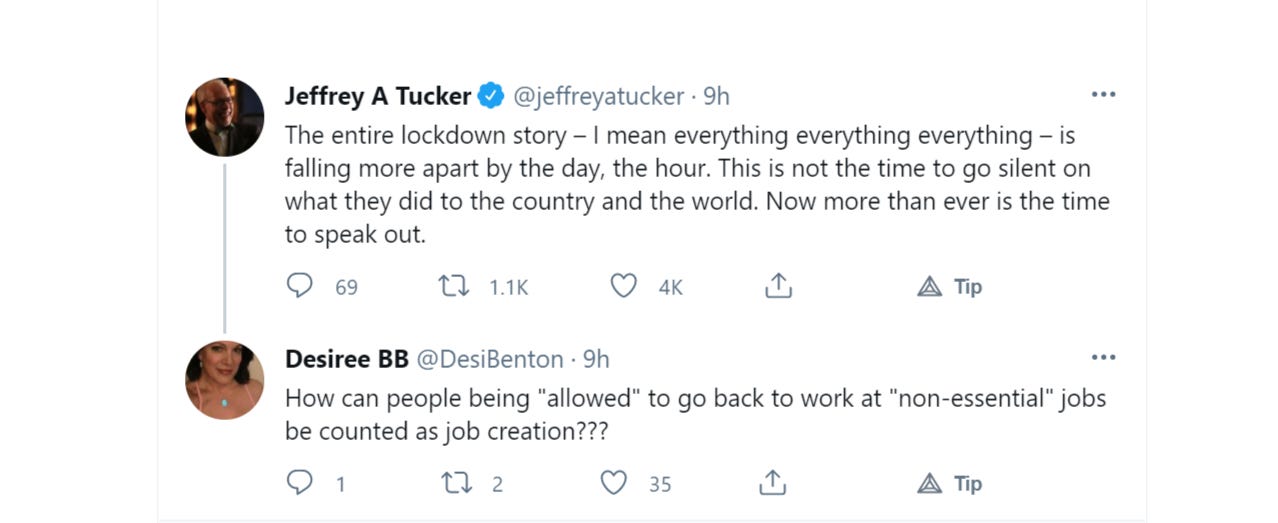

and we’re seeing it in spades now as the government tries to claim credit for being less in the way than it was a few weeks or months ago. in that context, desiree’s question is actually quite poignant:

this is like the kid that keeps kicking over your sandcastle refraining from doing it one time and saying “look, i built a castle!” while pointing at the one you made.

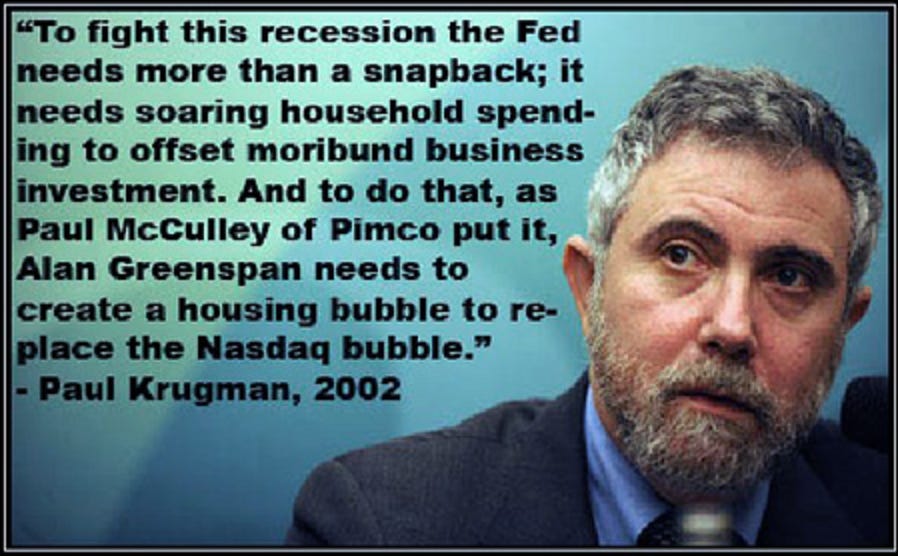

banning work then allowing it again and claiming you created jobs is a stunt so shabby that only a keynesian would fall for it, and these are people who literally argue that paying people to bury dollar bills in the ground so that you can pay others to dig them up is actual GDP and that you can print and stimulate your way to prosperity.

i’m not going to spend further time addressing these hallucinatory exercises in circular definitions. if you believe that, well, nothing much is going to get through to you…

so let’s look at more mainstream ideas:

the standard rejoinder to this is “but my infrastructure project!” and “multiplier effect.”

there is a deep-seated belief that infrastructure and government spending drive the economy. this is because of a classic “what is seen and what is not” problem. it works like this:

everyone sees the government spending money and then sees a new bridge across a river.

that spend was economic activity

the bridge looks useful and like it can aid in generating more economic activity

so people assume that this activity grew the economy

what they miss is the activity it prevented, the activity it crowded out, and the activity it replaced. this is the “unseen” aspect of the equation.

the money to build that bridge came from somewhere. even if they just printed it, it came from a reduction in the real buying power of all savers. (that’s what inflation is) but so did the labor, the steel, the concrete, the machines and cranes and tools. every input used to build that bridge is an input not able to be used elsewhere as well as an artificially generated demand rise that increases the price of those inputs for all other uses.

price is the signal economies use to allocate resources efficiently. disrupt that, you disrupt the economy.

it’s actually a very complex scenario, it’s just that the complicated part is hard to see.

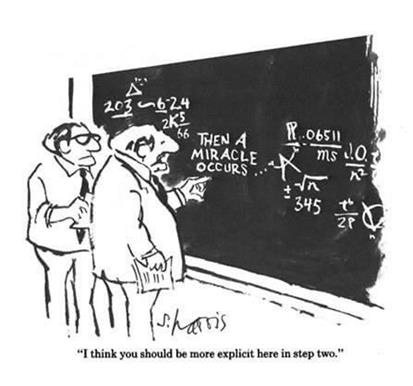

over the years, the keynesians have made a living peddling simple prescriptions by either ignoring the unseen part completely or by claiming their use exceeds it through some presumed multiplier effect. this is a deeply fraught analysis.

it’s literally not possible to perform in an real sense because you cannot ever measure the relative values in a coercive system.

if you have $10 and i offer you a cheeseburger or a t-shirt, i can readily see which you value more. you are free to pick it or to pick neither and keep your $10.

this is why the basis for all economic efficiency is free-choice and the right to say no.

economists call this “pareto optimality” (PO). you seek it by engaging in voluntary commerce where each transaction makes all parties in it better off and keep doing so until no more such transactions exist.

the ability to say “no” is what assures mutual benefit from transactions. if you do not feel you’ll be be better off, you say no and because you (presumably) know your own preferences and utility function, you’ll get it right. (you certainly have a much better chance than anyone else would)

but let’s go back to the $10 example. now, instead of a choice, i take your $10 and give you a cheeseburger. you have no choice in the matter. i say “look, you have a cheeseburger! you’re better off! you should thank me!”

but this is now impossible to prove. maybe you only value cheeseburgers at $7 and really needed a t-shirt and would have happily paid $12. i not only cost you $3 on the burger, i prevented a $2 surplus on the shirt.

one can do A LOT of harm by presumptively re-allocating resources.

now imagine how complex this is in the real world where the choice is always 10’s of thousands of goods in functionally infinite combinations. you cannot possibly prove that taxing (via excise or inflation) an individual to buy them X made them better off. trying to aggregate it across a society is just laughable. the only way to actually know people’s preferences is to give them the freedom to seek them.

pretending you can to push pet projects and crony capitalism and make people better off has a literally 0% chance of being pareto-optimal. there is no way to even tell if it got value for money, much less value vs other possible uses of the inputs.

anyone claiming otherwise is trying to sell you a bridge, often quite literally.

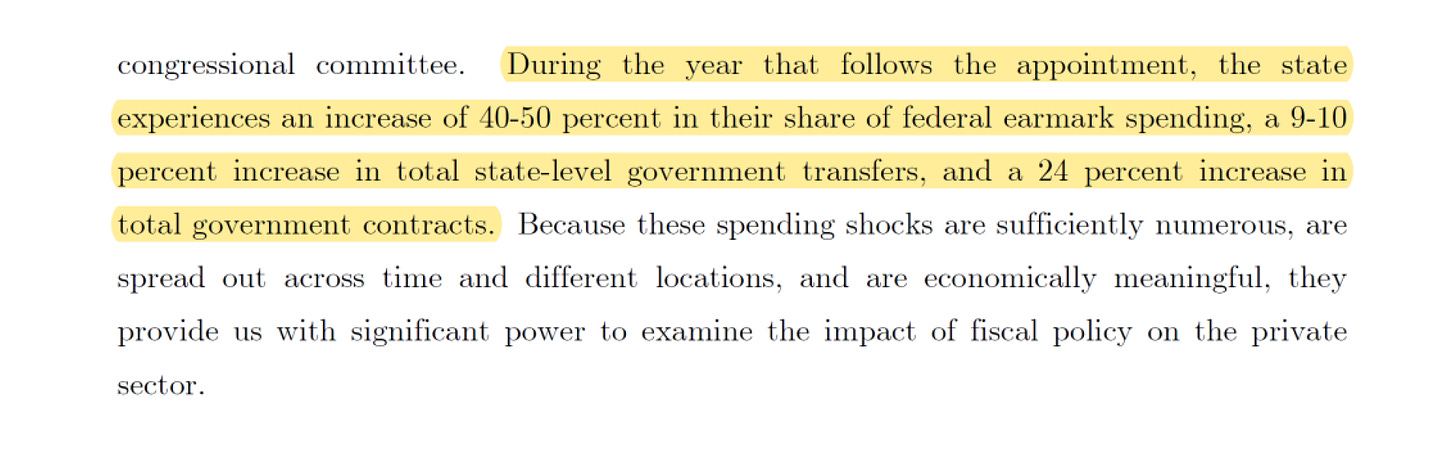

while one cannot prove the benefit, we CAN prove the harm, especially if we can demonstrate that even just showering people with goodies where they are subsidized by those who did not get any does real damage. HBS published a fascinating paper on this a ways back (HERE) which used a clever methodology to assess keynesian style stimulus in a kind of best case scenario by studying the effect of “powerful politicians” on their home states and districts.

i say “best case” because taxing kansas to pay iowa would seem to generate the best possible case for iowa. they get the full “stimulus” at subsidized cost.

the authors examined the localities represented by senate and house committee chairs and looked for the benefits of such patronage by looking at the politicians ascending to such roles and then comparing regional behavior after the fact to that which had existed before.

unsurprisingly, they found a significant rise in pork flowing into the districts:

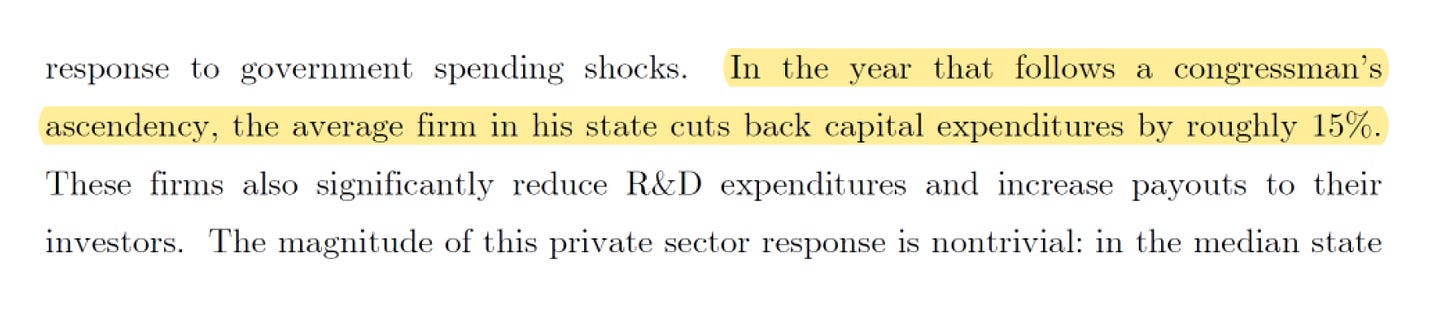

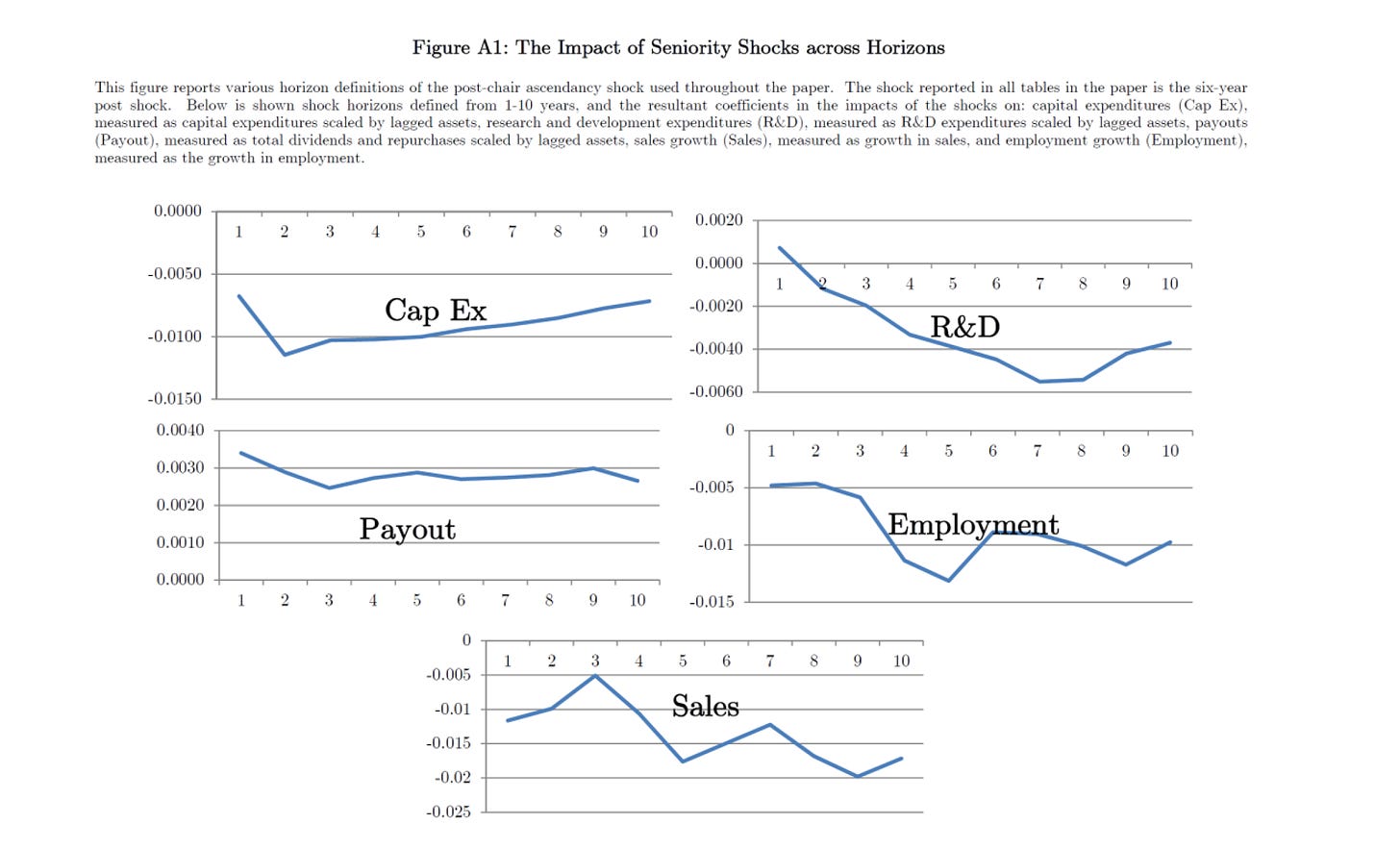

the surprising (to many who had not studied this) result was that this flow of stimulus resulted in suppressed overall growth and employment

these shocks can be surprisingly durable (though this may relate to tenure as committee head as it does show reversion when positions are lost).

so keep this in mind when the stimulus salesmen show up at your door. this is not creating jobs and productivity even in best case scenarios, and stimmy bills are never best case scenarios, they are cavalcades of pork and cronyism to shower money on the connected, build things that may or may not have any real use, crowd out the private sector, and to overpay while doing it.

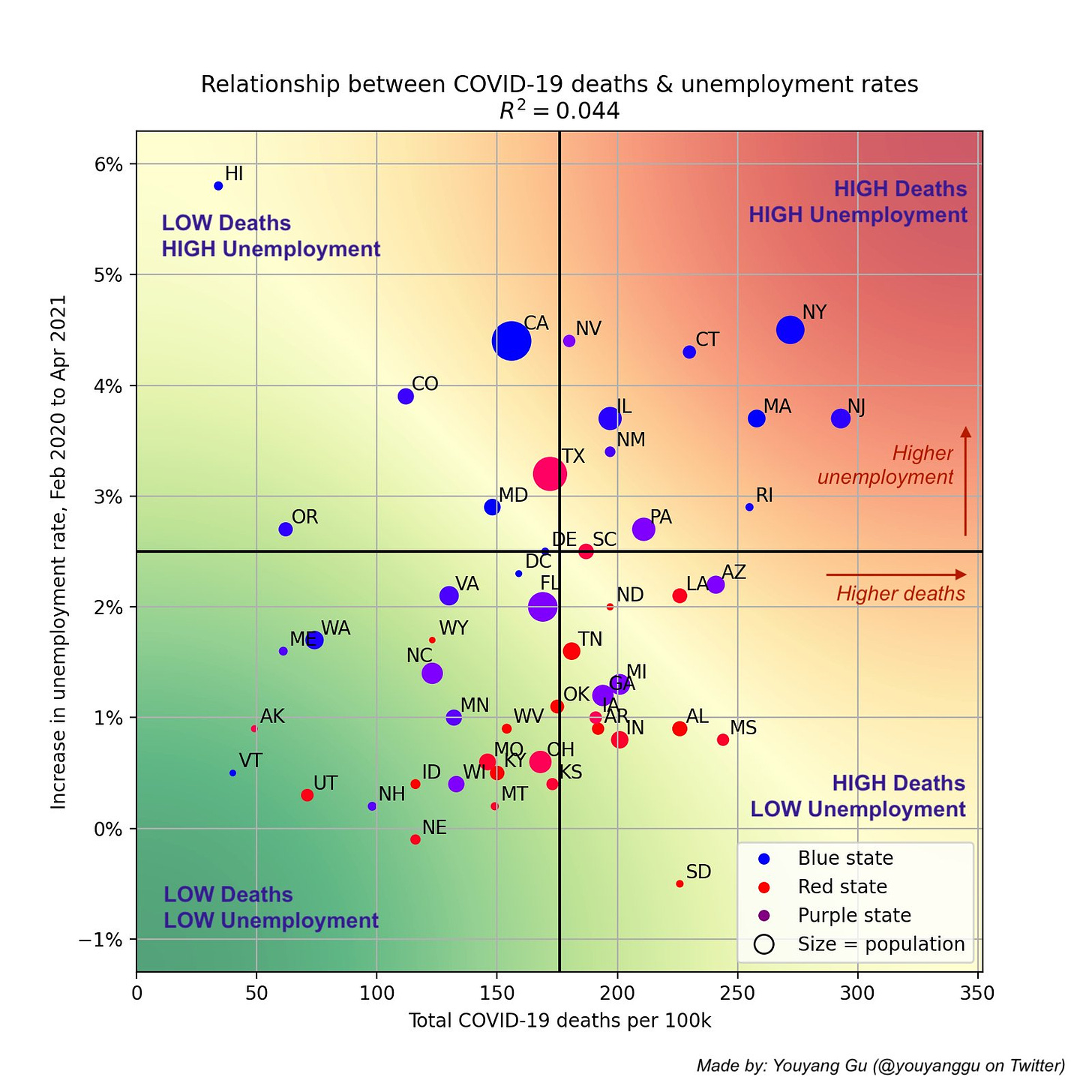

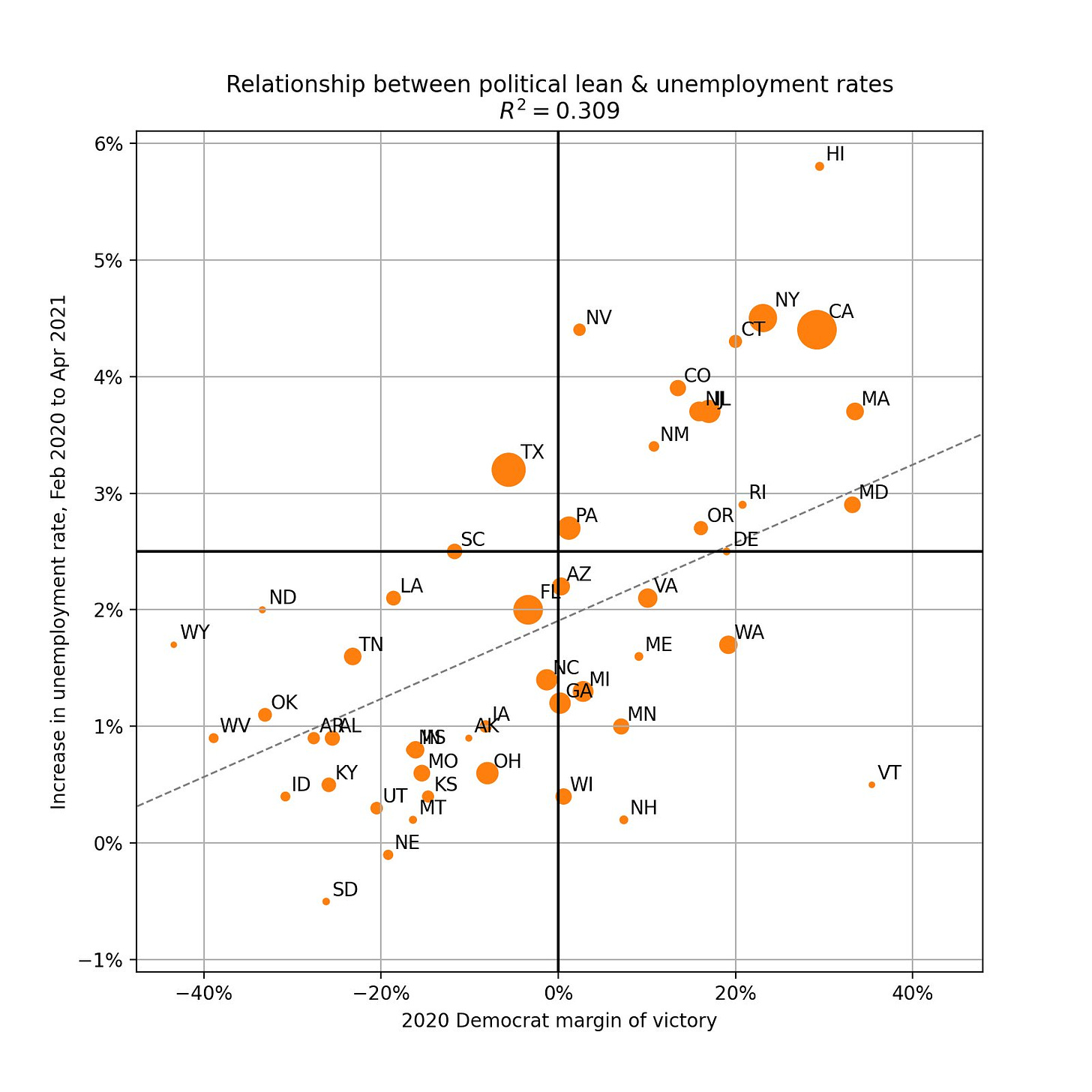

more often than not, they get used to try to fix something the state just broke. and the state just broke A LOT of things and it was policy, not covid that broke them. this excellent visualization by youyang (https://twitter.com/youyanggu) really drives it home:

there is just no relationship between covid deaths and change in unemployment

but look at red vs blue dots: there is vast variation in unemployment spikes based on state governance.

this gives a pretty strong intuition about what caused what.

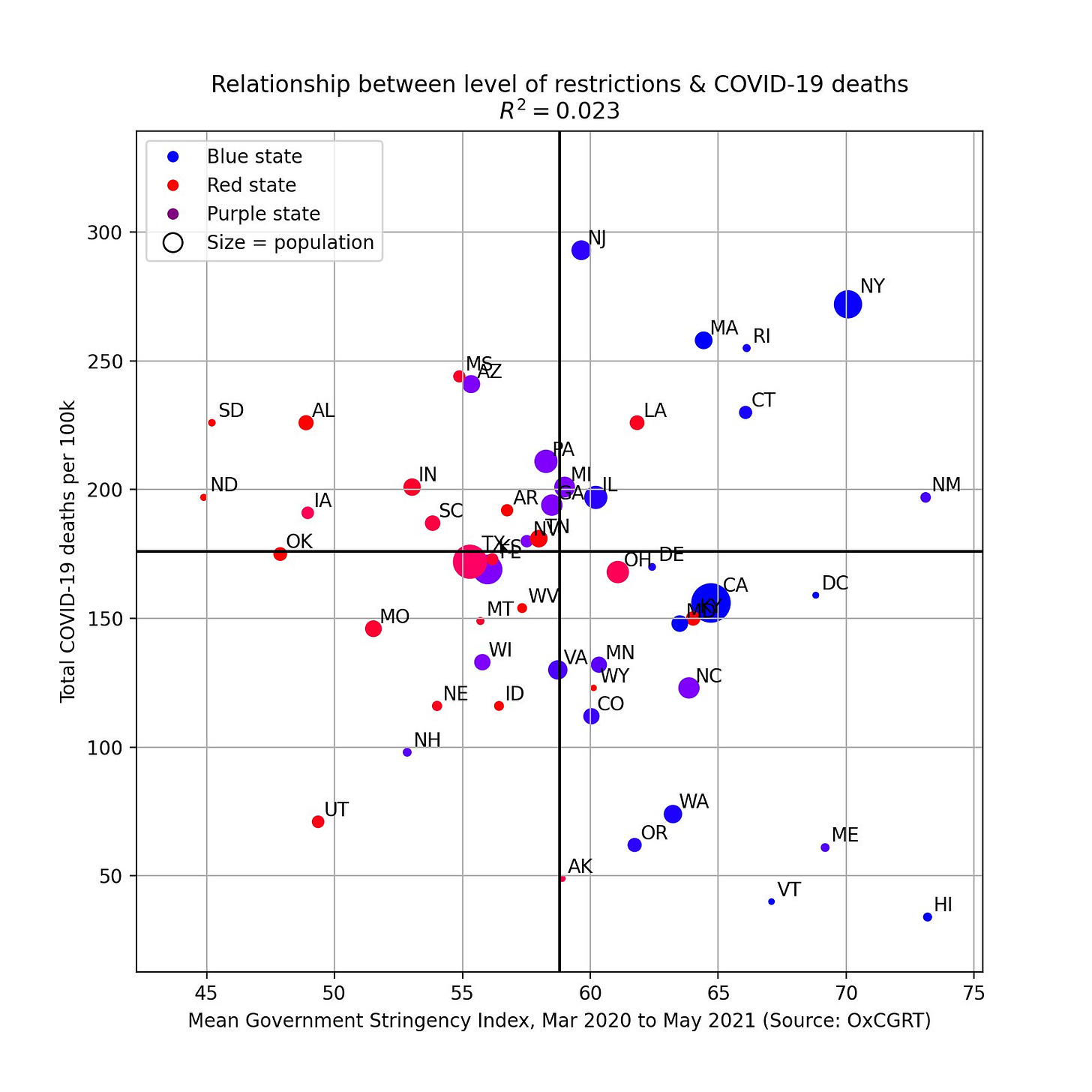

like so many others (internet felines included) he finds no relationship between restrictions like lockdown and masking and covid deaths.

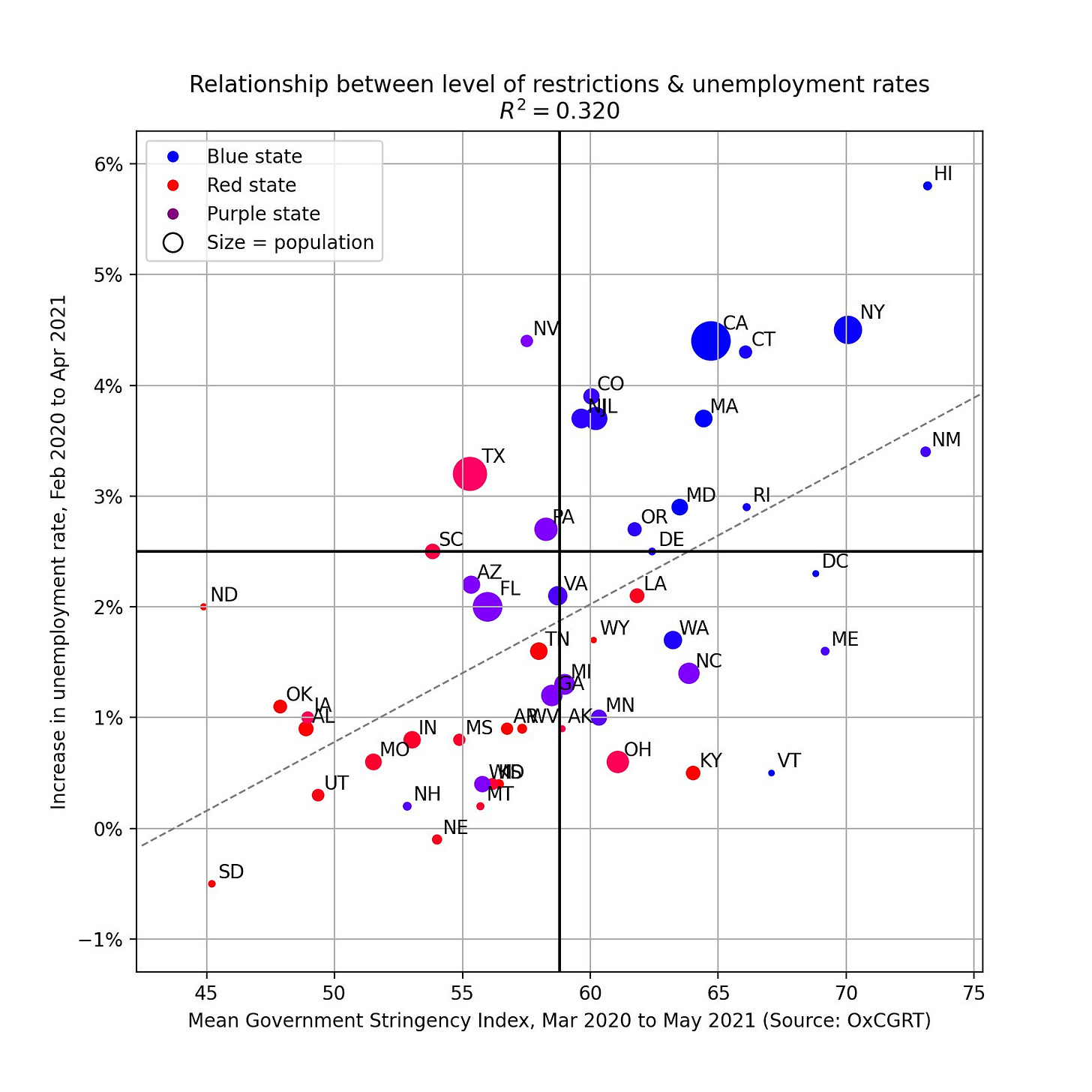

but the relationship between restrictions and rise in unemployment is quite strong:

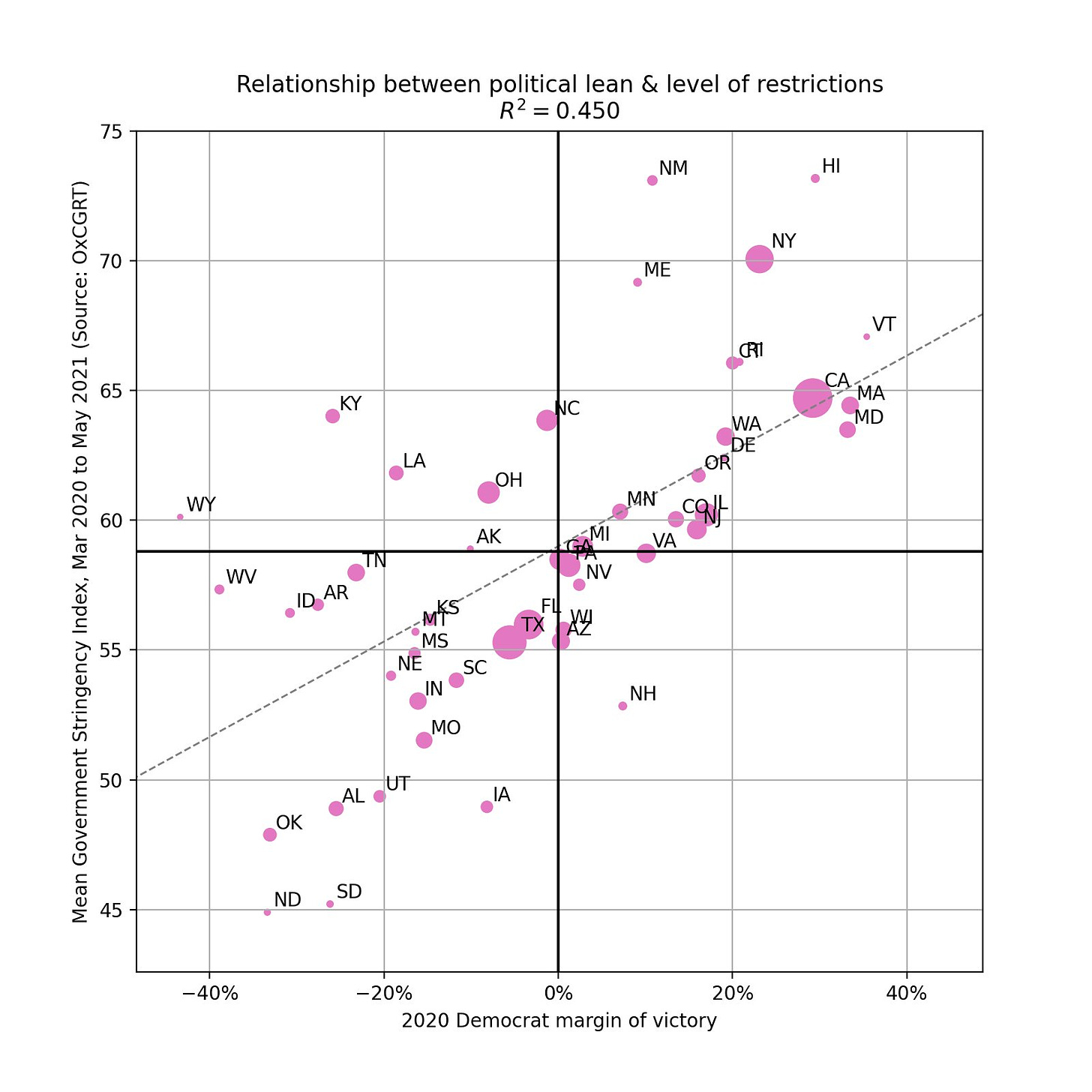

unless you’re going to try to argue that unemployment causes covid restriction (and i’d love to hear that one) then we know this: severity of pandemic does not cause unemployment. severity of lockdown does. and, as i pointed out at least a year ago, politics is what causes lockdown. youyang agrees.

so we get, finally to the simple outcome: politics caused unemployment.

so keep this in mind as the whitewashers of history claim that:

lockdowns worked

lockdowns did not hurt the economy

it was disease not politics that did economic damage

stimulus is going to fix it

none of this is true.

the damage was government doing stupid things and we’ll recover by getting them to stop, not by piling more stupid things on top.

If the question is “do governments or free markets allocate scarce resources more efficiently, in general” it’s hard to see why this is even a matter of doubt any more.

I remember reading an article a few weeks ago which stated that businesses were having trouble finding employees. The reason? Stimuli checks. Why go out and work when one can stay at home and receive the same or more money? Yet another example of government distortion in the economy.

A sad thing is how MSM peddles the narrative that the virus or the pandemic wrecked the economy. Hence, it's quite tough to explain to the average Joe that it was actually government reaction that wrecked the economy.