the road to serfdom is paved with lost perspective

inflation is tax farming and debts and deficits are the road to dictatorship

it’s often said that “inflation is a tax upon savers” but i think that few people really understand what that means. they see the part about “it devalues the money you have in the bank” and sort of nod and say, “yup, that’s a tax on savings alright!” but this is small potatoest acreage of that tax farm.

the bigger game is a bit more subtle.

if you really step back and look at it with fresh eyes, there is so much of "taxation" that does not make any sense.

you buy a house.

you pay property taxes on it for "services" and "safety." this is forced. you cannot opt out. doing so means they take your house even if you own it outright. (this, of course, implies that you cannot really quite own it outright, but that’s a whole other discussion)

then you sell this house 3 years later for more (in nominal terms) than you paid for it. now let’s posit a scenario where the real value of the house has stayed about the same but the value of the dollar has been debased through inflation:

because of this debasement nominal price rose. you now owe tax on the capital gain.

it's quite literally a tax on the government trashing the currency.

and this tax is always with us, even if housing outperforms CPI. some of that gain was debasement of currency and uncle sam and most states get paid for that too.

you even get taxed on real losses.

consider:

you buy a investment property for $1,000,000. 3 years later, it’s worth $1,200,000. but inflation over that period has been 25%. so in real (inflation adjusted) terms, your house has actually lost 4% of its value. you can trade it for less of the overall goods basket than you could have 3 years ago.

but the tax man does not care.

all he sees is “$200k gain” and you get taxed on that.

but what did you actually gain? nothing. in real terms, you lost.

you’re getting nailed with a surcharge for the poor currency stewardship of your government.

they wreck the dollar, you get the bill.

it’s a nasty fork of “hold dollars, lose value; hold assets to offset inflation, pay taxes on the gains.” now, fork 2 is generally superior but that does not make what’s happening there any sort of a priori right or ethical. the incentives are seriously perverse and note that they flow though into other taxes (like property taxes) as well as those taxes are based on the nominal, not the real value of your home and so inflation through money printing stings you again.

this flows through to every capital asset class from gold to stocks to commodities. the only one that does not do this is bonds because high rates and high inflation tank bond prices, but of course “save taxes by buying stuff that goes down” is not generally the best investment plan for long term capital preservation and interest gets taxed as normal income.

so you’re really quite stuck.

the worse job they do with the currency, the less you can afford to hold straight cash but the more they get to tax you by effectively devaluing your real tax basis on any hard assets and jacking up their nominal pricing for tax assessment.

profligacy and ponzi cause monstrous systemic federal deficits, money printer goes BRRRRR, money supply and federal debt explode, and barring special circumstance, inflation follows.

could there be a more perverse incentive set than “turn the dollar into fishwrapping and get more tax revenue?”

unfortunately, there is:

wrecking the fiscal foundations of a government historically leads to bigger, more powerful governments.

consider:

you get some serious inflation kicked up by embracing levels of government spending that would make a drunken sailor blush. this then blows out social security and medicare/medicaid/welfare costs because they are indexed to inflation and at the same time cranks up debt service costs as rates rise at the same time debt level does which widens federal deficits requiring more money to be borrowed and printed which primes us for another trip around this destructive merry go round that keeps building on itself like some sort of positive feedback hurricane convection.

and if there is one thing that never lasts long, it’s positive feedback loops. they cause explosions and take systems down. and whistling past that graveyard does not keep the zombies from eating your brains. you keep getting more and more government as the solution to all the problems caused by overmuch government power.

the worse they do, the more they take, the more power they get, the more damage they do.

lather. rinse. repeat.

we all sort of ignore how utterly mad this is because it's such longstanding practice, but inflation is a form of tax farming and big government is a form of plowing salt into the fields. we wind up with a self-annihilating slash and burn sort of exhaustion agriculture where you keep depleting the land and leaving it worthless and the size and scope of this process starts to increase geometrically. it’s not a sustainable practice. it’s how empires die.

in the great depression, money still had metallic basis, so the federal government could not “inflate out of it” the same way. so we got depression. this time we’re going to go the money printing route because it’s better politics. but doing so is at least as bad for society.

it’s instructive to look back and see how obvious this used to be.

our framers knew it. they did not want an income tax or an IRS or leviathan. they wanted a tiny federal government.

then it got bigger, we passed the 17th amendment, and pretty soon we had the (also very new) income tax ramping up and no “states rights” to stop it. it was supposed to be a small thing, just a few taxes on the very rich. but we all know how THAT goes…

the real damage came in the 1930’s when big statism caused a great depression by trying to fix a recession with big tax and spend programs.

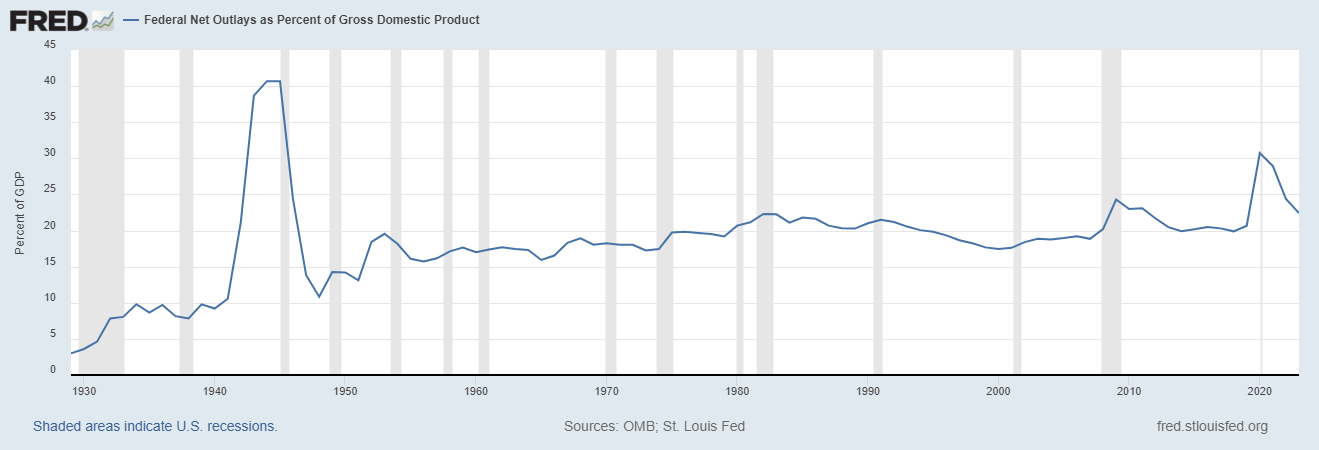

the US federal budget was 2% of GDP under coolidge (truly a great president). under FDR it hit ~10% even before WW2 kicked off (though a lot of the damage was done under hoover). that still sounds low by modern standards, but it’s a 5X jump and it never went back down.

WW2 acculturated people to something entirely new and vastly more intrusive. the mid 1950’s were 16% rising to 22% by 1982 when volcker finally crushed inflation.

we then got 20 years of shrinking government spending as a share of GDP and had the 80’s and 90’s, prosperous happy times in the US.

then the dotcom bust kicked off a new age of activist adventurism in central banking and trends kicked back up. numbers around 20% became normal. covid interventions drove us to 30%.

stop and think about that. the policy around covid was so stupid, so shortsighted, and so damaging that the federal response was to add an amount of spending equal to 10% of total GDP just to keep the recession “minor.” truly, the mind boggles. just that rise alone was percentage equivalent to the entire US federal budget during the great depression.

and you cannot just wreck stuff, splash cash like that, and presume it’s going to be OK.

but they always do. because “we break it means we get more power” is an irresistible siren song for dictators and autocrats.

you leave that incentive set laying around and the question is never “if?” and always “when?” and the answer is usually “right soon.”

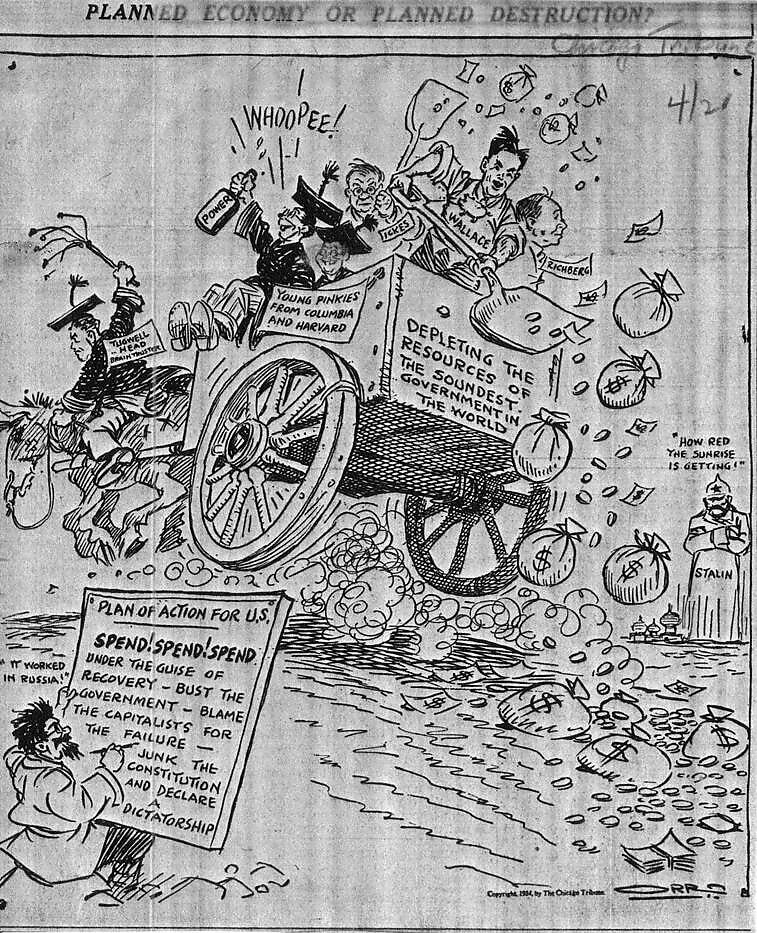

wanna see some real prescience? this is a cartoon from the chicago tribune in april of 1934.

there are so many gems in this it’s hard to even know where to start admiring it.

tugwell drives. this was a man such a communist that he was too embarrassing for even the FDR administration so they sent him to govern poor puerto rico who has never recovered from his “reforms” that make business here a nightmare to this day.

drunk on power are “young pinkies from columbia and harvard.”

natch.

wallace et all “deplete the resources of the soundest government in the world.”

hey, wait a minute…

stalin watches happily as “the sunrise gets red.”

swap in xi and you’re still right on target.

but perhaps the best is this:

does this remind anyone of anything?

perhaps a certain reckless shuttering of the world followed by record deficits, debts, and debasement?

this is not even history rhyming; this is flat out plagiarism.

and this trick was once widely known because people had just seen it done.

but somehow we forgot.

so here comes the sequel.

“it worked in russia” is not a reference to the economy working, it’s a reference to the bolshevik revolution working and ultimately leading to dictatorial horrors like stalin taking power. it’s the marxist playbook. has been for over 100 years. it still is because it works.

you break the economy, you run expenses out of control, and you ruin the currency.

you make the streets and political dissent unsafe all while accusing the victims of your depredations and purges of causing the very harm you inflict upon them.

you break culture.

you break family.

you turn group upon group.

then you take the guns.

and finally, you take the society as desperate people seek desperate solutions.

this is an old trick and is has not gotten better with age.

you do not want to go any further down this road.

this is the road to serfdom.

and denial is not a plan.

there is no world in which debt and deficit like this works out.

the road we are on does not lead anywhere you want to go.

and it’s time to make the hard choices.

they only get harder from here.

Too many people now make their living from govt largesse. Every city depends on it. Every politician gets elected with it. I fear It’s only going to stop now when the gravy train crashes and burns

“That was precisely the reason the System was created at Jekyll Island: to manufacture whatever amount of money might be necessary to cover the losses of the cartel. The scam could never work unless the Fed was able to create money out of nothing and pump it into the banks along with ‘credit’ and ‘liquidity’ guarantees. Which means, if the loans go sour, the money is eventually extracted from the American people through the hidden tax called inflation.”

—G. Edward Griffin, “The Creature from Jekyll Island: A Second Look at the Federal Reserve”

Additional relevant excerpts:

“The damage done by the banking cartel is made possible by the fact that money can be created out of nothing. It also destroys our purchasing power through the hidden tax called inflation.”

“The savings and loan industry, is really a cartel within a cartel. It could not function without Congress standing by to push unlimited amounts of money into it. And Congress could not do that without the banking cartel called the Federal Reserve System standing by as the ‘lender of last resort’ to create money out of nothing for Congress to borrow. This comfortable arrangement between political scientists and monetary scientists permits Congress to vote for any scheme it wants, regardless of the cost. If politicians tried to raise that money through taxes, they would be thrown out of office. But being able to ‘borrow’ it from the Federal Reserve System upon demand, allows them to collect it through the hidden mechanism of inflation, and not one voter in a hundred will complain.”

“Warburg’s revolutionary plan to get American Society to go to work for Wall Street was astonishingly simple. Even today, academic theoreticians cover their blackboards with meaningless equations, and the general public struggles in bewildered confusion with inflation and the coming credit collapse, while the quite simple explanation of the problem goes undiscussed and almost entirely uncomprehended. The Federal Reserve System is a legal private monopoly of the money supply operated for the benefit of the few under the guise of protecting and promoting the public interest.”

—Anthony Sutton, former Research Fellow at the Hoover Institution for War, Revolution, & Peace, quoted in “The Creature”