the runaway healthcare buffet

why healthcare costs run so completely out of control and how to fix it

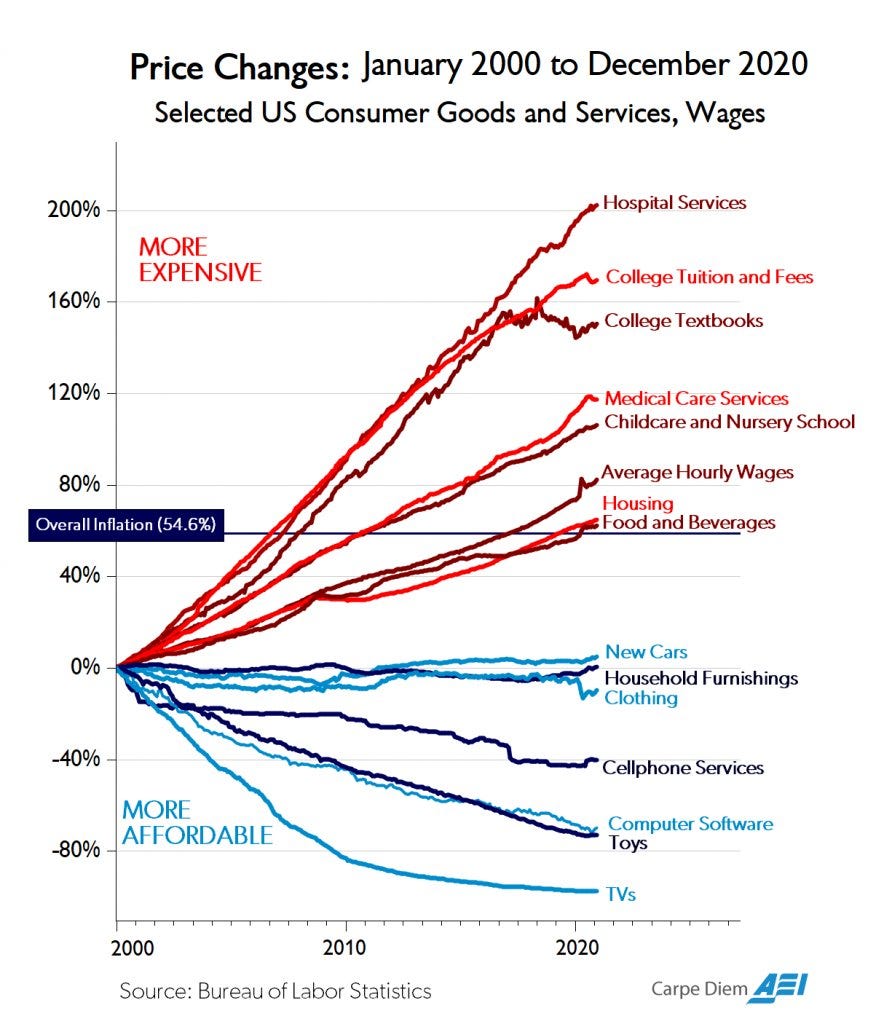

medicine is, at its heart, a technology business with a strong service component. any technology business seeks new and better ways to do things and ways to get more bang for less buck, more benefit for lower cost. and technology businesses are VERY good at this. consumer sovereignty imposes intense disciple and competition breeds competence and pretty soon, TV’s are amazing and cost next to nothing.

so why doesn’t medicine act like these other industries? why does it, year in and year out see pricing soar far in excess of CPI?

this wonderful analysis from longtime friend and gatopal™ mark perry (whose excellent blog carpe diem is a must read) gives us some insight here.

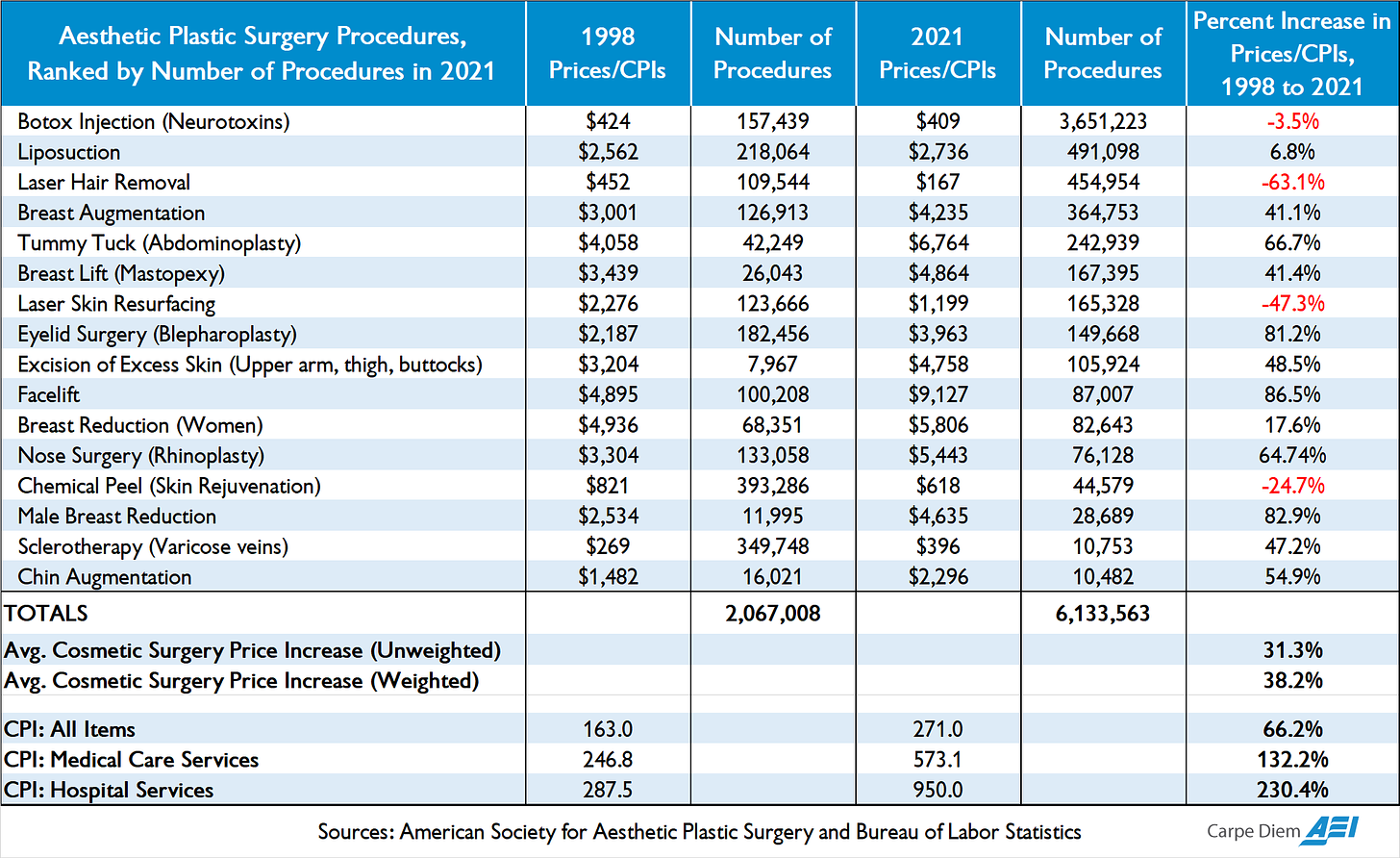

look at the difference in cash pay healthcare like elective surgeries.

they do not explode in cost like other medical procedures. they actually rise less than inflation (and therefore far less than wages). they rose only 38% in nominal price vs 66% CPI and 132% and 230% for medical and hospital services. they do not drop in price like consumer electronics do, but that was probably always too much to expect for a product with such a high skilled labor input component, but still they have become much more affordable over time.

in healthcare, that’s a big deal because, obviously, the rest of it does not.

this was not always so, nor is it so in all places today and when you see a huge change like that and outcomes so at odds with market expectation as to amount to “water flowing uphill” one should always look for “what is distorting this space?”

the answer is, as is true so much of the time, government interference.

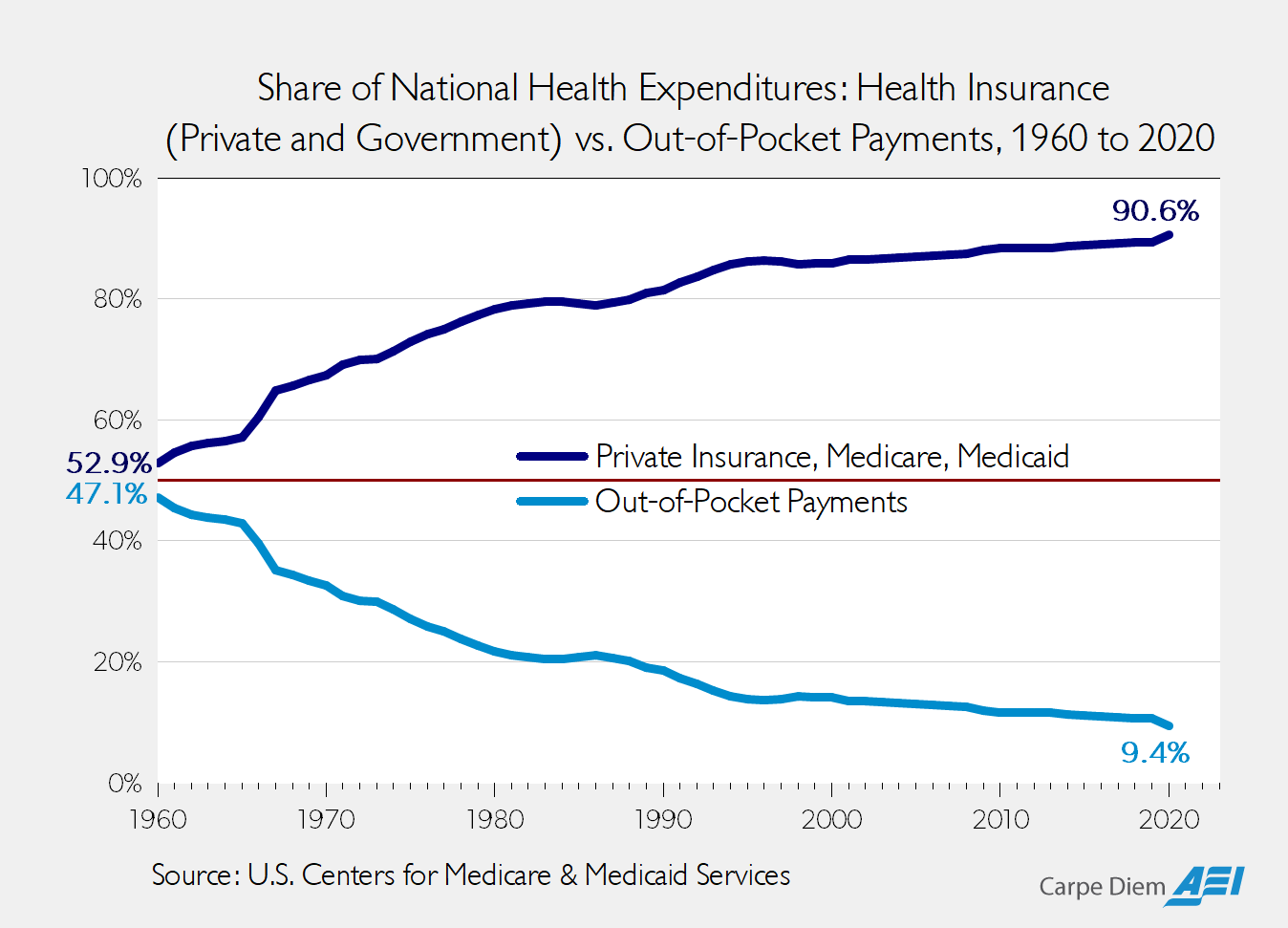

this interference arises in multiple ways. the first is a second order effect of the tax system. the US taxes income paid by employers but it mostly does not tax health insurance provided as a benefit by employers. this creates a tax arbitrage whereby rather than pay you $20k in cash and have you get taxed $6k on it then go buy insurance, your employer can just buy you $20k in insurance. you get a better plan, and it’s a matter of indifference to the company.

add to this a variety of nasty state rules on insurance, limits to pricing, coverage, plan structure etc and it becomes so wildly preferable to get your health insurance from your job that nearly all americans who can, do (and most who do not get if from medicare or medicaid).

over 90% of americans have health insurance.

as this becomes a desirable perk and one on which employers compete with one another, they seek to offer more and more comprehensive (and thus expensive) plans and as regulation and competition intersect they have pushed copays way down especially as federal plans did so and private was forced to follow.

in 1960, roughly half of payments were out of pocket. it’s less that 10% today.

and that changes everything.

the more costs X more coverage equation blows expense into the stratosphere.

welcome to the runaway buffet.

when engaging in pay as you go commerce, people make cost benefit decisions. they ask:

how much do i value this vs other choices i could make?

how much does it cost?

what substitutes or adaptations are available?

what quality levels of service is most suited to my preferences?

but in a buffet system where you pay one price upfront for all you can eat, everything inverts. you not only do not care what things cost, once you have paid, you seek out the expensive ones and you consistently overconsume.

the artificially low price you face for incremental consumption steers you toward taking more than you otherwise would, consumption stacking, and to choose higher quality than you would if you faced the costs of that choice.

if you just paid $90 for the buffet, you are not going to fill up on rolls to save the four seasons money. you’re running right for the prime rib and the lobster tails. you want to recoup your upfront. and you’ll eat until bursting and sure, have a second piece of cake and leave it half eaten. you’d never buy that cake, but because you paid and it incrementally costs nothing, sure go grab it.

this becomes a strategy. just as when i was young and impecunious, i’d save up hunger then go pillage buffets and eat my body weight in whatever was available (a sushi place in SF actually stopped offering a buffet because of the unspeakable damage my roommate and i were doing to them when we rolled in after the gym). people plan the same way around how to best use their health plans.

out of pocket tends to be front end loaded. then, you hit an “out of pocket max” and everything thereafter is basically free. so people plan “on years” and “off years.” you bunch all your expensive medical consumption together to get it on one year’s out of pocket max. or, if you have an unexpected bill and hit the max, well, then it’s “free play” for the rest of the year and this is really easy to do.

it’s also really easy to lose all price discernment. out of pocket max is often $5-10k. the cost of a single surgery can easily be $50k or more. but not to you. to you it’s always $5k (assuming that’s your OOPM). this is like coming into a car dealer and having them show you a 5 year old ford minivan and a brand new, fully tricked out cadillac escalade and saying “well, it’s the same price, which do you prefer?”

and you know how that’s gonna go.

so doctors become like this:

so people not only over consume on healthcare, they choose severely non-optimal points on the price/performance curve.

paying cash, you’d likely not choose to pay 30% more for 5% better. but if it’s all the same, hell pay double and get 6% better! sky’s the limit!

ironically, this actually makes you feel better about having paid a lot for insurance. of course, the other side of that blade is the double irony that every time you do this, it makes the price of everyone’s insurance, including yours, skyrocket.

over-consumption drives up insurer costs. this drives up policy prices. that drives up the desire to “get your money’s worth by overconsuming” while also shopping for low out of pocket plans because prices seem so high and these get more cost-effectively provided either by employers or the government neither of whom has any idea of or ability to rein in consumption decisions, often by law.

no one in the system has any real control over the outcomes or the costs.

all the incentives are wrong.

and thus commences the convection that culminates in the cost hurricane.

and everybody gets on board.

pretty soon, no one even knows the price of anything in medicine. seriously, they don’t. i have been self-insured for quite some time and so i know. i go looking for prices. and they are REALLY hard to get. what does this blood test cost? no one can tell you. doctors just prescribe them willy nilly and assume it’s fine. and we are over tested and over paneled to the point of absurdity.

several years back, it took me a week to get a cash price for an MRI. amusingly, once you i did, it was about 70% below the “insurance rack rate.” hospitals LOVE cash pay because insurance is so deliberately slow and annoying, but so few ever ask the “pay now” price that providers are just not prepared for the request. it’s outright bizarre that they chose not to lead with cash discounts. i suspect it’s because doing so would infuriate insurers and the insured alike and in a country where over 90% have health insurance, it’s just not much of an addressable market.

a stunning number of my peers love their high price high coverage platinum-plated health plans even though they could easily self-insure as i do. they know they are getting gouged and that the insurer must price above cost. they do it anyway.

mostly, i think they just want to not think about it and the nature of the system encourages that.

pricing most surgery is like trying to get an estimate to build a space shuttle. and no one has any idea if the quote is complete or is willing to guarantee a price or a max.

it is so hard to shop for price performance that few even try.

gee, i wonder why this market is so completely out of control?

if you want to get a boob-job, you can get pricelists for the asking and they will be accurate, complete, and attached to testimonials and info that help you assess quality.

try the same for rotator cuff surgery. you’ll be lost. the vanishingly few places with real cash practices tend to have wait lists so long they have to be written on mobuis strips because they cater to a serious high end which is the only way you can get away with not taking insurance. this puts you in line behind people with triple digit fastballs and that’s a tough gang to get cutsies from.

the simple fact is this:

the reason that healthcare in the US is so expensive is NOT because more people need insurance or more inclusive insurance coverage

healthcare in the US is expensive because TOO MANY people have insurance and the structure of that insurance sucks.

the whole system is set up to prevent discernment. what was a tax optimization and a set of perhaps well intentioned copay and out of pocket max rules imposed to “protect people” have become the source of an outlandish, self perpetuating price spiral.

apart from the guild systems that keep supply low, there is nothing special about healthcare that demands that this be so and clearly even that issue can be overcome if you simply move to cash pay because a cash pay system has price transparency and prices are the most potent magic in markets. they are the signal that invites supply and inhibits overconsumption.

all goods and services are limited and scarce. all will be allocated in one manner or another. prices are the only thing that can do it rationally and when you break that signal and divorce consumption decisions from costs, it runs out of control.

(note the other high flyers on the first chart: schooling and textbooks, the other space the government regulates like hell and pours money into and where so few pay actual full price (and get access to piles of state sponsored debt in egregious amounts when they do) that the signal gets distorted and the price spiral explodes.)

if you want to fix medical costs in the US, more insurance, more comprehensive insurance, and lower out of pocket is the wrong way to go.

that, quite literally, IS the problem.

people love to point to singapore as a country with great healthcare access and outcomes and low spending as a % of GDP.

what they miss is that it’s mostly cash pay. insurance there works like actual insurance. it’s for emergencies and only kicks in above fairly high levels. the rest of the system is set up for price shopping, quality assessment, and puts the cost of choices squarely onto the decisionmaker. there is no buffet and so pricing is rational and medicine acts like a technology good.

good, fast, cheap. (pick 2)

that’s the classic trade off.

for healthcare, the US has good and fast.

canada has good and cheap. (though with quite a lot less selection)

they ration care with time, not money. want to see a specialist or get an MRI? it can take months on wait lists. this is unimaginable in the US. it gets so bad that people get caught sneaking into veterinarians to use their imaging equipment.

but lots of true technology goods can get you good, fast, AND cheap.

and we see hints of it in the US cash pay market and in places like singapore.

as this election cycle approaches, the populist grandstanding about “making healthcare affordable” will kick off. but the solutions are going to be desperately wrong tripling downs on the process that made this mess.

the real answer is:

fewer insurance mandates

more cash pay with price transparency

ends to artificial supply constraints like certificates of need

alignment of facing costs and getting benefits at the consumer level

if you’re really going to insist on government subsidized healthcare (iffy idea, but one that many seem so wedded to that it’ll be hard to abandon outright), single payor or more subsidy or mandate of existing practice is not the answer.

health savings accounts are.

give people money, not buffet tickets. let them save and keep what they do not use and build it up when they are young and healthy and spend it when they are old. let them shop by price and preference and let the medical industry respond by seeking to provide better outcomes for less money and clear cost/benefit information. it would be easy and actuarially manageable to layer high deductible insurance for “actual emergencies” on top of this at low cost.

note that this also solves the endlessly prickly “death panels” issue. you have X dollars. if a $500k course of chemo for your terminal cancer worth it to get 2 more months of low quality life? or would you rather leave the money to your kids?

perhaps the better question is “if people had to pay for it with their own money and not the buffet’s, could anyone charge $500k for that treatment?” or “would so many companies spend so much research time and capital on products that offer so little?” i suspect the whole space would rationalize enormously if exposed to price discernment and that’s an “everyone wins” outcome.

no allocation system can work if those making choices and getting benefits do not face the costs or can shunt them to others. the buffet system is a million sided prisoner’s dilemma governing a tragedy of the commons. that’s a disastrous structure that cannot possible reach a good equilibrium.

it’s a death spiral but one that’s easy to stop if we simply make this a real market again.

if cars worked like healthcare, we’d all have to pay $50k a year for them because we’d all be getting a new 911 every 36 months and throwing it away at the end.

the more we try to call a scarce good or service a right, the more unattainable it will become. it’s a great populist pitch, but it’s utterly divorced from reality.

healthcare is not too important to be left to free markets. it’s too important not to be.

Great post! You briefly touched on the way the existing guild artificially restricts supply, and that's a HUGE deal. (In the 80s the 'experts' were saying there would be a doctor glut and government must step in to protect doctors' salaries)

Certificate of Need laws also need to go. Imagine Burger King needing to get McDonald's permission before opening a new restaurant!

And finally, all the layers between the doctor and patient need to go, as they drive up price and don't actually contribute to healthcare. Going to the doctor should be like going to a fast food place: You walk in, see the price for everything right on the wall, get what you need, and pay for it yourself.

Edit: Relevant link

https://time.com/4649914/why-the-doctor-takes-only-cash/

In arriving at their price list, Smith and Lantier did an end run around the whole system. They asked their fellow doctors how much compensation was expected per procedure, factored in necessary expenses like surgical equipment and medical implants, then tacked on a 10% to 15% profit margin. Since their surgery center does not employ the army of administrators that is often required to haggle with insurers and follow up on Medicare reimbursements, their overhead is smaller. The whole operation is 41 people. “Finding an average price doesn’t require complicated math,” Smith says. “It’s arithmetic.” Since posting the price list eight years ago, they’ve adjusted it twice, both times to lower rates.

"more cash pay with price transparency"

This is a huge part of the problem in the US--if you ask a hospital or other provider about the cost of a certain procedure, the answer is--What type of insurance do you have? Why should that matter? Why do different people get to pay different prices? Why does it matter where your provider is located? It's all so ridiculously opaque--and if other industries practiced this way, people would go to prison. Yet everyone accepts this nonsense. It bothers me when politicians talk about healthcare costs but they're always referring to insurance costs. Health insurance is the financing mechanism for healthcare. The whole system is a jacked up mess which makes insurance premiums high. This area is like so many others, where lots of politicians gain favor or push agendas by pretending to do something--usually making the problem worse--like the affordable care act. I'm certainly no expert but this illustrates perfectly the havoc that can be achieved through government meddling and regulation versus letting the market do what it does on its own.