control the lending, control the schools; control the schools, control the students

here kid, this one's free.

we just saw a raft of student loan forgiveness run through as yet another goodie room special-interest appeasement to transfer the debt of those who took out loans for educations to those who did not. it’s classic “concentrated benefit, diffuse harm” electioneering.

it’s also a terrible idea as it creates about 900 kinds of perverse incentives, but this positively pales in comparison to what the department of education would like to try next.

not a lot of people seem to know this, but student loans have lots of payment cap provisions in them.

the current rule is that you cannot be required to pay more than 10% of your discretionary income (income above some locally calculated poverty rate that tends to be about $15k for single people, $22k+ for couples more if you have kids) per month over 20 years.

any balance left after a double decade is forgiven.

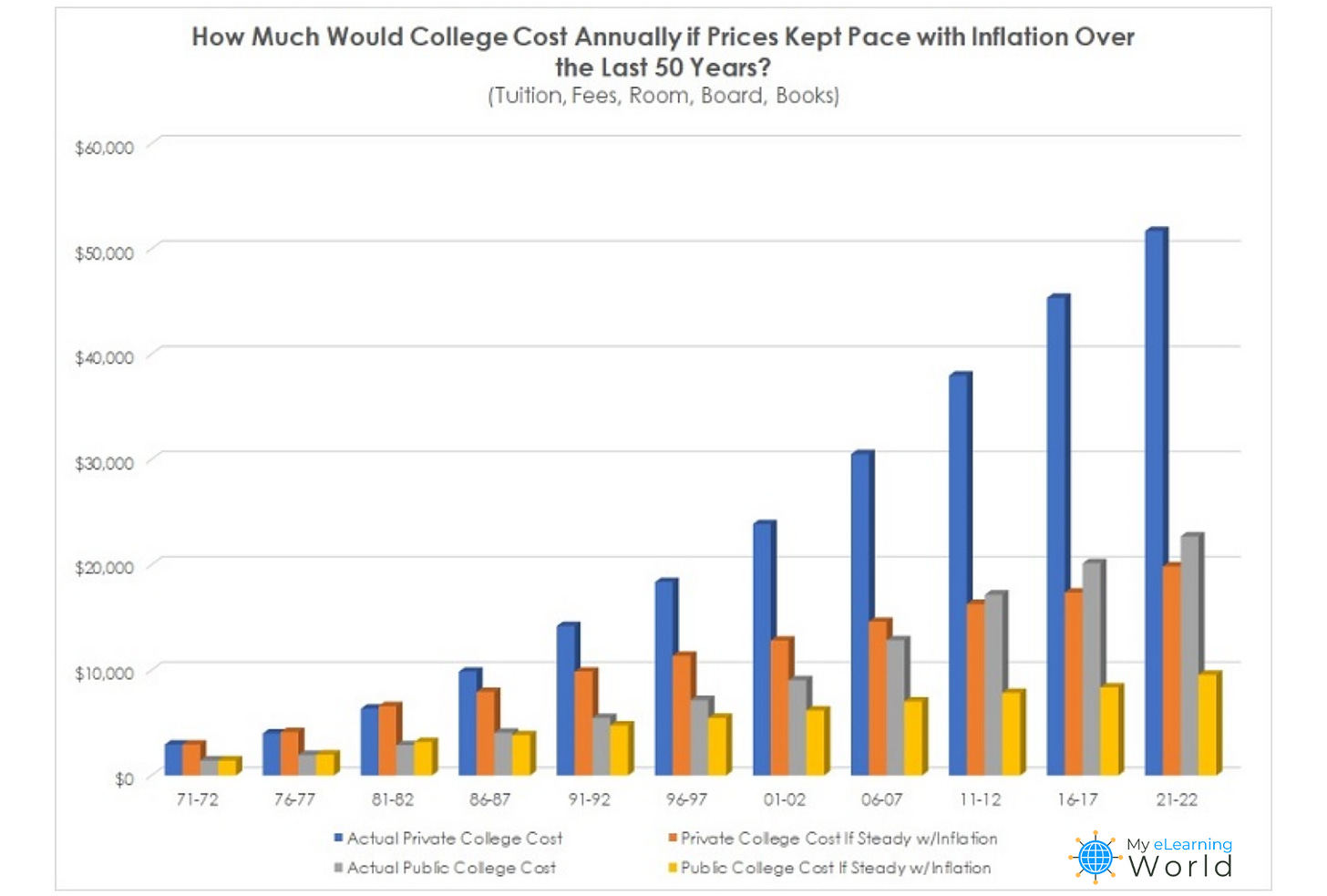

this already creates all manner of bad incentives, especially as most student loans are made without any rigorous consideration on ability to repay. this endless access to debt is what has driven the price of college into the stratosphere.

this happens in any market that gets access to leverage.

based on an emerging markets analysis i did years ago, when mortgages become available in a housing market for the first time, over the next 5-10 years the price of a home generally rises to about 4-5X what it was. what was the price of a home becomes the down payment for one as more and more money chases the same dwellings. we saw this all over the US in the 2002-8 period when mandated loans guaranteed by freddie and fannie came to dominate in the US and the age of the rampant liar loan emerged from the ill advised risk shifting colliding with mandates to lend to subprime borrowers at prime rates.

leverage and credit expansions drive explosive price level changes and student loans are no different. the more you offer them, the more people need them because the more the underlying price of tuition soars. colleges love this and it has led them down a primrose path of wild price expansions. when i graduated in the mid 90’s, my university was ~$22k a year. almost no one took out loans. it’s now $81k, WAY outside of middle class affordability. and now loans, grants, or scholarships are required for most people.

see how this 4-5X multiplier works? this program to “help people afford college” has made college unaffordable.

student loans outstanding have risen from $0.4tn in 2005 to $1.75tn today.

and the new student loan plan proposed by the department of ed is going to be worse. it will pretty much turn university pricing into a farce and require that EVERYONE get loans. it will, in fact, create a system where you’d basically have to be an idiot not to. and i fear this may be by design.

let’s look:

on the surface, this looks like it “helps affordability.” you’re cutting monthly payments, right? but this has not yet looked at what it will do to the price level and how that will affect everyone, especially those who did not previously want loans.

you’re basically doubling the effective leverage in the market. you can expect that to double prices over time. it’s like cutting interest rates in half AND giving out a 50% cut in principal amount on mortgages.

that’s financial dynamite.

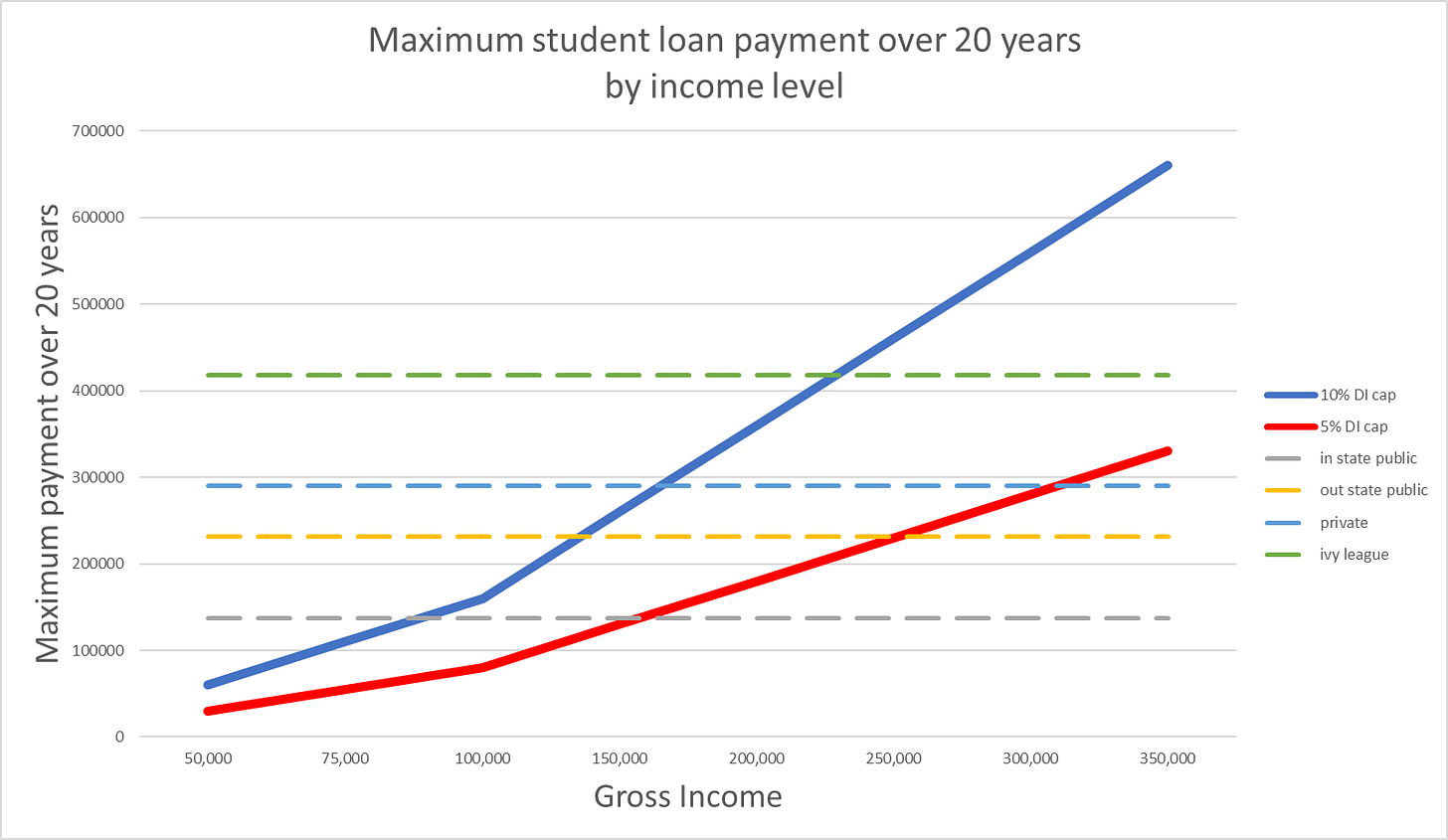

i made this chart to demonstrate.

the blue line is the current 20 year cap on repayment set at 10% of discretionary income.

the red line is the new proposed line.

i then calculated the costs for 4 years of undergrad paid back monthly over 20 years using a 3% fixed interest rate (which is lower than current rates) as a total payback amount using the average cost estimates HERE for most schools and HERE for the ivy league. i used $20k as the DI deduction.

as can be readily seen, not many folks are paying back their full loans now but damn near no one would be paying back their full loans anymore under this new system.

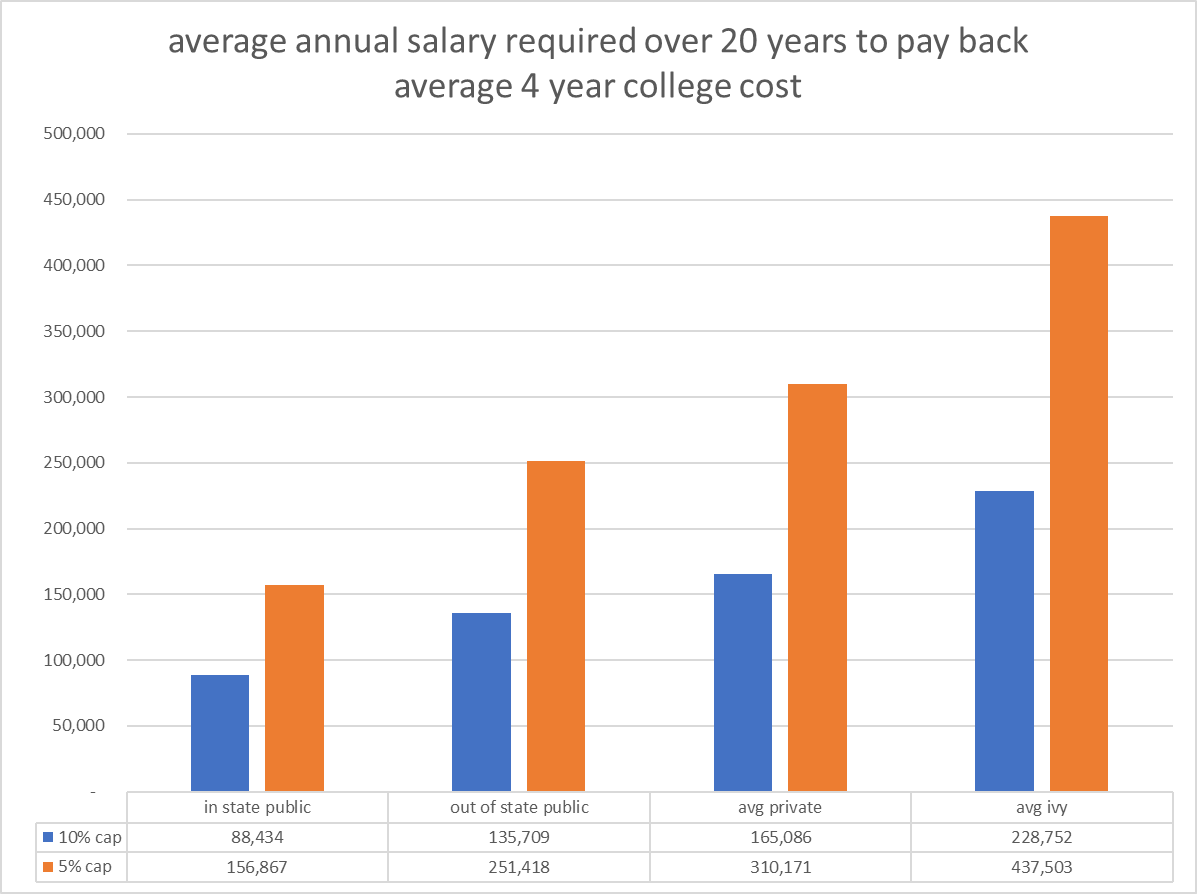

this is what break even looks like under current and proposed systems. it’s the minimum amount of gross income you have to earn as an average over 20 years to make payments that will actually add up to what you borrowed.

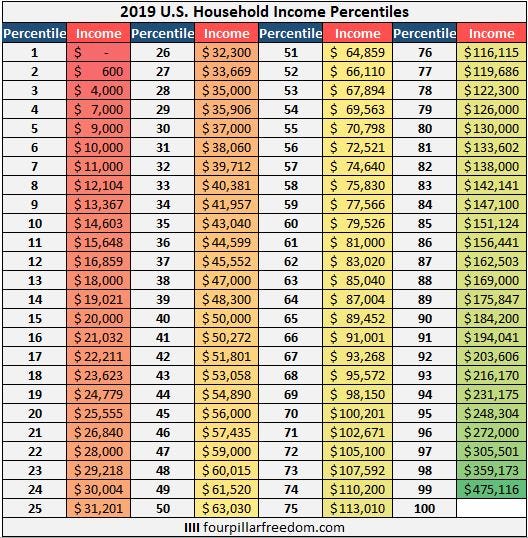

these are some BIG percentile numbers.

under a 5% cap, you need to be 86th percentile to even pay back in state public college.

you need to be 97th percentile to pay back an average private college and 99th to pay back an ivy loan.

even with income growth over time, that’s just not going to happen for nearly everyone.

what you will get instead is trillions of dollars of write downs, maybe 10’s of trillions.

but what you will also get is explosive college price inflation because you’ve turned the whole thing into a buffet where once you pay, you might as well pig out on lobster.

let’s say you plan to go into a nice career with $100k in income. that’s 80k of DI, so your cap on loan payment is $4k per year X 20 years = $80k.

that means that all school costs over $80k are “free” to you. you do not need to care if college costs $20k a year or $100k a year. you will pay the same.

and what do you think THAT will do to your selection process? and what do you think that will do to the prices asked by universities, especially top ones for which competition is fierce?

creating a system where the customer does not care what the price of your good or service is because they do not pay it is a recipe for monstrous over-consumption. we see this all the time in healthcare. once you hit out of pocket max for a year, the buffet is open. go nuts.

this is not a way to allocate education efficiently. it’s a way to hand you uncle sam’s black amex and turn you loose in a miami beach lambo dealer. and trust me, lamborghini is not gonna cut you a sweetheart deal. they’re gonna sell you the anti-rust undercoating.

now think about grad school. yup. pile that one and start demanding a 5% rate there too.

and this problem just gets worse and worse as income drops. if you’re looking at a career that pays $50k you’re capped at a stunningly low $30k full payment over 20 years. that’s getting down into community college prices. you could NEVER justify spending $400k on education to get that job. well, not before. now you can. now you’re not facing the costs.

aventadors for everyone.

clearly, this is a deeply stupid plan. it will grossly misallocate educational investment, drive unaccountable overconsumption of a good that is almost certainly already over-consumed, and shift costs from those who get loans to those who did not. it will also blow prices into the stratosphere. supply of top schools does not really rise. more money chasing the same places can only end one way.

and this will create not only a situation where 98% of americans are priced out of college unless they take out loans (which will, of course, further increase prices) but will create an actual prisoner’s dilemma where you would be a fool not to take out loans because everyone else will and they are sure as sunrise gonna stick you with their bill so you better stick them with yours too. this is how a trillion in loan losses becomes $10 trillion and how every college kid in america gets fastened to the federal teat.

and that NEVER works out well.

leaving aside the investment misallocation and the financial calamity this will drop upon taxpayers (or savers if they just keep inflating it away) this has another really sinister feature: it places the state in total control of universities.

if you need to get loans to go to college and pretty much every loan comes from the government (or has their express backing) then they are now paying ALL the pipers.

guess who gets to call all the tunes?

this will make title IX and the tax break addictions look like mild suggestions of influence. this will make it total. once they get schools hooked, if the feds make them ineligible for these loans: it’s over.

this will be the defacto ceding of control to the state.

it will also form the basis of a social credit system. if we don’t like the things you say in high school or college: no loan for you. you’re out in the cold.

yeah, your parents too.

probably your siblings as well.

oh, and your friends of course. mustn’t follow dissidents on twitbook.

everybody around you better be good or no college for you.

if this sounds far fetched, it’s already happening in china. they are using exactly this sort of peer and family linked web of social credit. the social scores of your friends affect your own. it’s the kind of plan the WEF loves. and believe you me: it CAN happen here.

this is the thin end of a wedge that you’ll never get out.

control the systems of education, what they teach, and who gets access to them.

require and advance them as critical credentials for success in state and private jobs.

this is how you dominate a whole system. it’s the fascist/socialist/authoritarian playbook, chapter 1.

you’ll need to obey and compete to get access to the lending that you need to buy your future and leviathan will have a monopoly on funding you by deliberately mispricing a market and endlessly forgiving loans. pile on some ESG, DEI, and special loan jubilees for “people that take X kind of job” and now you’re shaping a whole society and workforce.

it’s not about efficient allocation or fairness.

it’s about buying dominance.

it’s also a nasty object lesson in leaving unchecked power lying around.

“just where in hell do they get the right to do this?” many have asked.

the answer, like so many other outrage origins of late finds its genesis in the realm of the patriot act and other such post 9/11 hysteria that abrogated so many rights “because crisis.”

this current action claims authority under the “heroes act” which was intended to to cover disruption from the attacks and wars that followed.

note how terrifyingly broad this is.

it’s a classic trojan framing for a popular cause that then gets re-used for other purposes later.

the patriot act and its little siblings like this one really drove a stake into the heart of the american republic. they basically tossed the idea of limited and enumerated powers out the window in “emergencies.”

and if you grant near unlimited authority during emergencies, well, you can then expect near unlimited emergencies, can’t you?

because some things never change.

they just keep taking you mile after mile because you ceded the first inch and invited the vampire in.

and it’s going to keep grabbing.

i don’t know if these powers can be used to cut the income cap in half or if that takes actual legislation, but given the broadness of the power grant it sure seems like it could and the inclination to use executive fiat to push vast transformative agendas that cannot pass legislative muster certainly seems present.

we’ve spoken much here about eliminating the regulatory state, but the lending state is just as dangerous, perhaps more so. from farm loans to housing this has been a debacle. everything this firehose of cash has touched has boomed, bust, and wound up with 3 times the federal interference it had before. whole spaces are never the same.

the federal government now backs well over 50% of us mortgages.

the fed now owns $2.6 trillion of mortgage backed securities, roughly 1/3 of the total market. this is up from zero in 2009. see how fast that goes?

and see how vulnerable it makes any market under such thrall to domination by politicians and their pet peccadillos?

once the government needle goes in, it never comes out of these markets.

it creates desperate debt supplicants and serfs while breaking markets and misallocating investment and risk.

this is another activity from which we must remove the state. there should be no government lending. none. it almost never serves any useful purpose and winds up devastating those it sought to aid. it creates dependence and crowds out the development of systems that align incentives and generate sound choices by associating return to risk and demanding return on capital.

control of capital allocation and access to credit is control of a people.

this is not a friendly loan. it’s the worst kind of loan sharking, and the true vig is your agency and your liberty.

On the other hand, should a populist regain control of the executive, the baleful eye of the state could prove rather bad for the universities.

Want those federal student loans and research grants? Better keep administrative costs down to 5% of budget. Oh, that means you have to fire 90% of administrators? Guess those vice-deanlets of DIE have to go then, sorry.

Yeah, yeah, I'm LARPing. Under the current regime that won't happen. A guy can dream though.

In the meantime, the universities are beclowning themselves so badly that a degree is increasingly seen as a black mark in many circles. And what happens if the USD loses global reserve currency status? The ability of the feds to distort markets and enforce social engineering policies is predicated on the ability of the Fed to print unlimited money that people treat as money.

Universities are nothing more than a multi level marketing scam. The system attracts professors and administrators of the same ilk as hucksters.

2nd biggest grift in history next to the Scamdemic.