the last several years have seen a level of federal spending unparalleled in american history.

leaving aside that this was obviously a needless own goal of panicking into shutting down the world to no good end and all bad outcome, the sheer magnitude of it beggars belief and has made the US economic charts all but unreadable by distorting their scales so severely. everything else looks like a flatline.

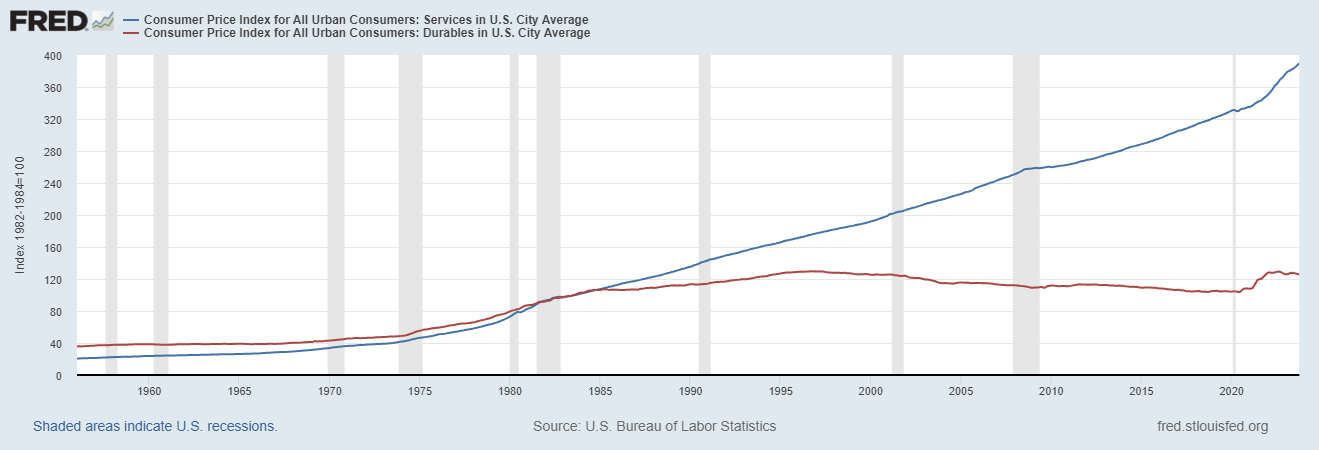

this has exploded US debt from already elevated levels to values that are truly problematic and this issue is being compounded by the historic spike in rates from the artificially suppressed near zero values of recent decades to levels more in keeping with historical norms and make no mistake, these are norms. it was ZIRP that was the aberration and it’s not coming back. rates that low could only persist without setting off massive inflation because of the outlandish overcapacity of china suppressing world prices for consumer and durable goods. so long as they were willing to sell below cost, there was basically no monetary policy rash enough to cause the price of a set of lawn furniture to rise. it kept dropping relentlessly as deflation reigned. it was astonishingly clear in the data as was the divergence from services (which were not affected by this trend).

it’s easy to see durables uncouple from services in the mid 80’s and flip to actual deflation in the mid 90’s as china’s debt-funded, loss-fueled potemkin “economic miracle” started to really get rolling. it was one of the biggest bubbles in history and it caused 25 years of goods deflation.

but that’s over now, reality has returned, and once more interest rate and fiscal irresponsibility come with rapid, obvious effects on the consumer price level instead of just endlessly juicing capital and asset markets.

if we take CPI and compare to M2 (a measure of money supply) 16 months prior by shifting M2, we can see this:

back in the financial crisis of 2008, M2 rose quite a lot and CPI response was muted at best. in the following decade, ~7% growth in money supply was needed to keep CPI tracking in the 1’s. that was china. and it went on for so long that a whole generation of federal budget mavens and central bankers lost the plot. they got used to a world of near zero interest rates, constant asset bubbles, and CPI that simply would not rise no matter how reckless they were or what kinds of deficits they ran.

and now, it’s coming home to roost. it’s easy to run up piles of federal debt when supporting it costs basically nothing. zero interest attracts federal profligacy like unattended french fries attract seagulls.

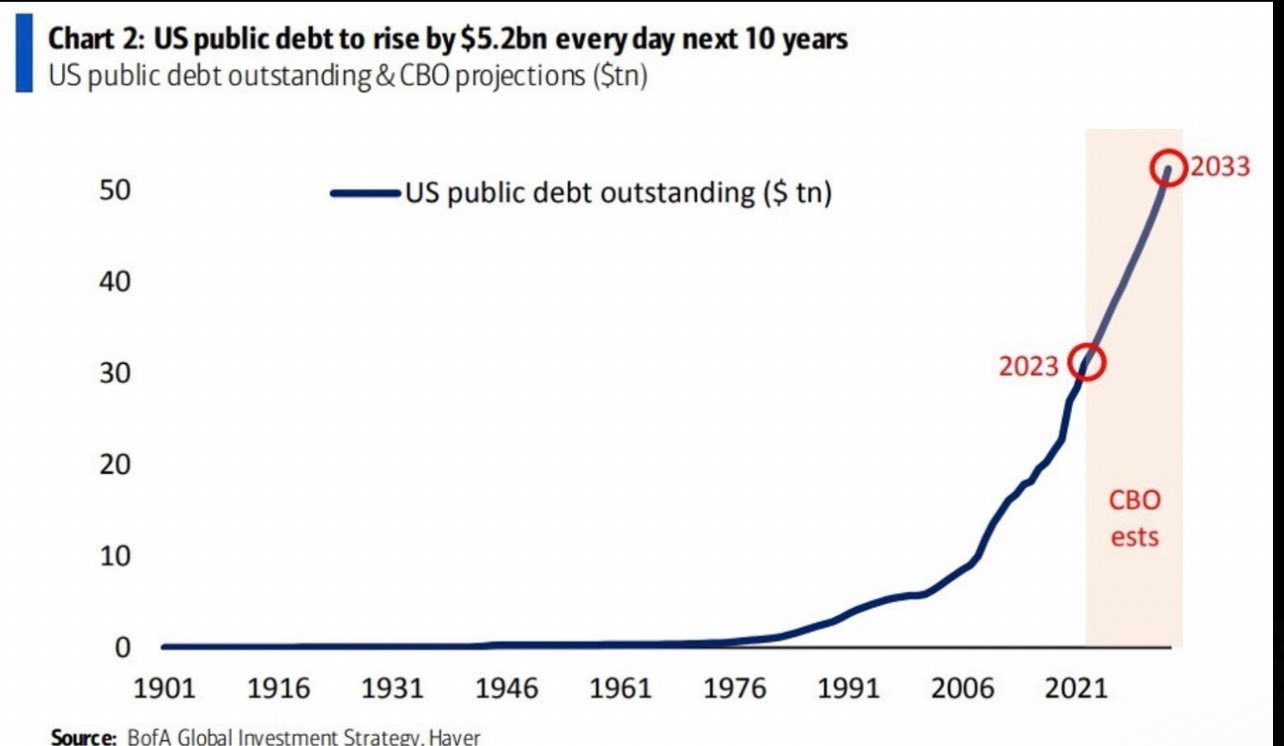

US debt has gone absolutely parabolic. the magnitude of this problem has become so enormous that it starts to look like an inescapable death spiral. this is how democracies die. the demos votes itself infinite largess from the public purse and runs up unstainable debt to do so.

then, one day, there’s just no way to raise more and you either crash-stop, default, and see government and entitlements gutted because there is no way to pay for it when no one will buy your bonds or you start nationalizing the debt by having the central bank buy the bonds (a practice already well underway in the US and a sure sign that the debt addiction is reaching “trainspotting” levels). this latter route tends to go “weimar” or “zimbabwe” and pretty soon, the US currency looks like venezeula’s because in any kind of normal markets for goods and services, printing until the plates melt causes runaway inflation. the trade-off has returned. “print baby, print” now comes with serious side effects that the keynesian/MMT gang has gotten used to claiming “are not really a thing.”

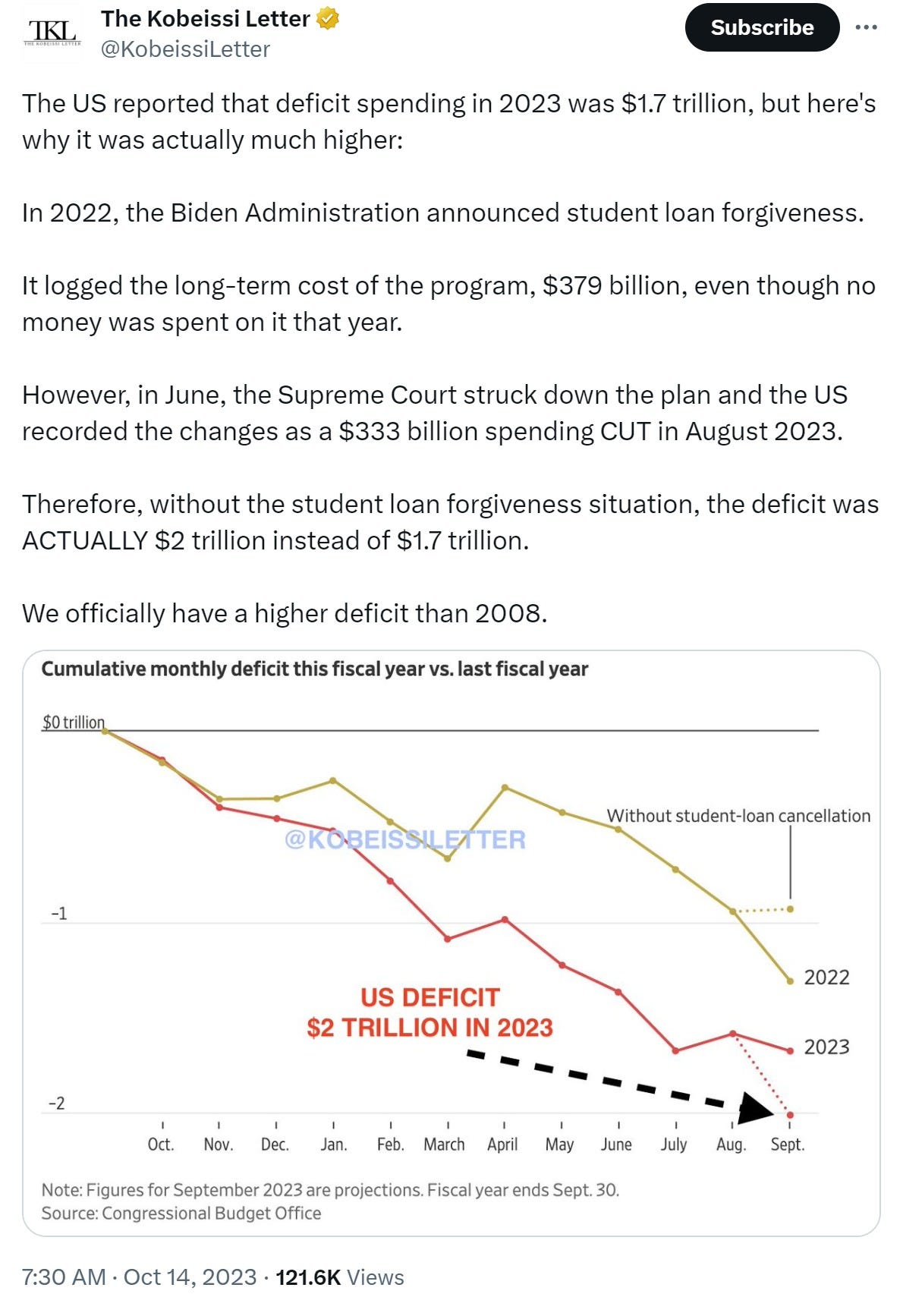

US debt was $5tn in 2007. it’s $33.75tn today. the CBO estimates we’ll be adding ~$20tn over the next 10 years. this seems optimistic. their “$5.2bn/day” estimate has been multiples low since the debt ceiling limit was raised. the real number has been $30bn/day, ~$1tn a month. $2tn a year on deficits seems low even if we don’t have any more crises, esp if debt service alone exceeds $1tn/yr. add a crisis and that number could be $70-80tn, not 50.

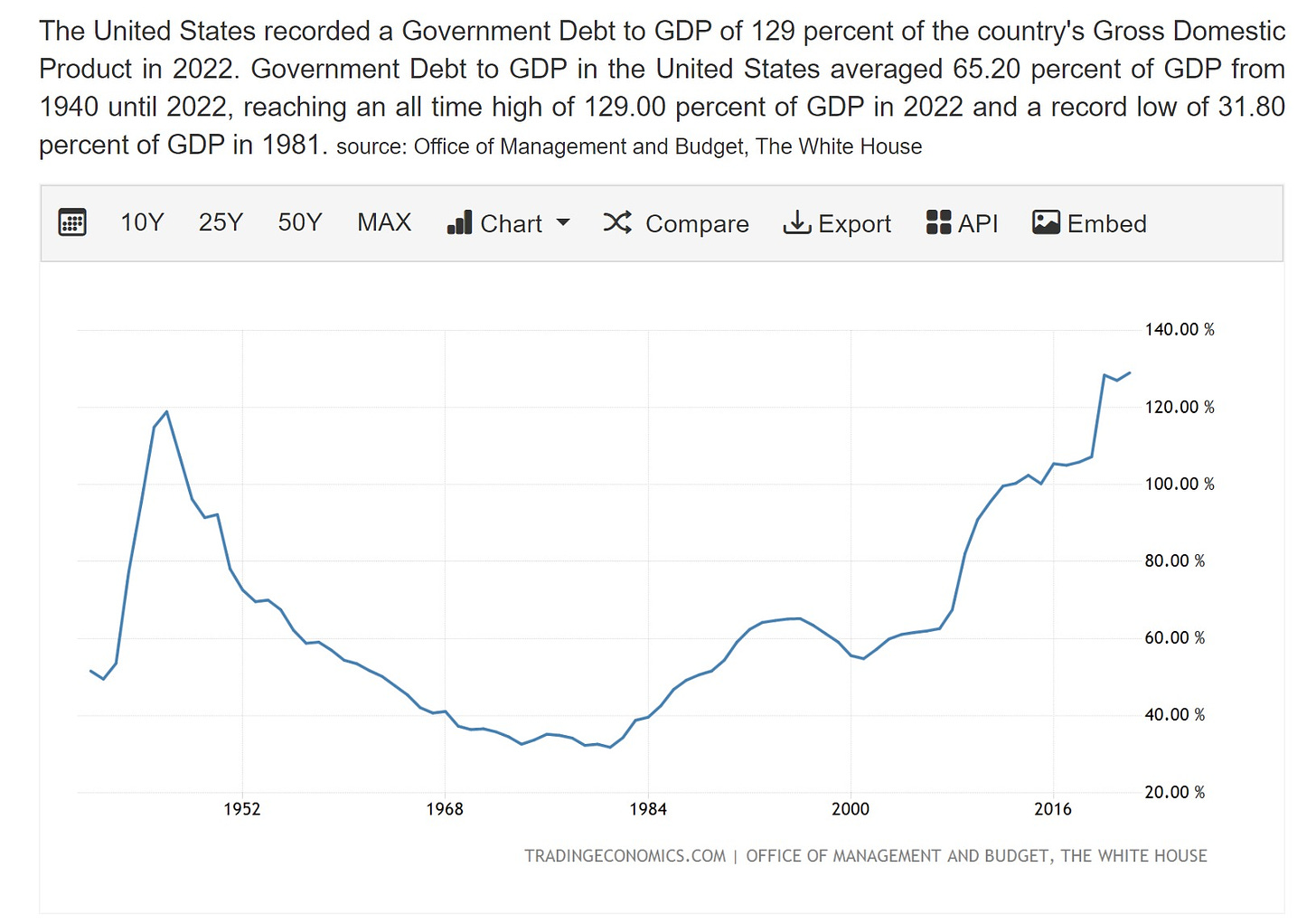

when it exceeds 90-100% of GDP, federal debt really starts to hamstring economies. it’s a well studied phenomenon. and once you cross this rubicon, the death spiral tends to come fast, far faster than people imagine.

deficits become a way of life, they become a trap. they become needed to keep fending off the effects of the last one and to prevent the recession that comes from stopping stimulus. you have to keep growing them just to offset the growth drag of high debt levels. all the thinking goes short term and gimmicks get trotted out to try to make the facts look better than they are. but this is what circling the drain looks like.

we are not growing out from under this, we’re being buried beneath it.

the US hit 100% debt/GDP in 2013 (up from 60% in 2007) after the massive surge from cleaning up the 2008 mortgage bubble (itself a mess created by federal policies).

we caught our breath for a minute afterwards and had drifted up to about 107% by 2019, then covid hit and all bets were off.

we hit 129% in 2022.

next recession may well push us to 140-150%.

that’s deep into the “doing damage” and quite possibly unrecoverable. i’m not sure any country in history has gotten debt back down to manageable levels after hitting this point, especially when entitlements are creating a structural budget hole that (in combination with debt service) now exceeds overall tax receipts.

this could be ignored when rates were near zero because the costs were hidden. but now they are not. rates rose from 0.1% to well over 5%. and the US debt is quite short in terms of duration. $7.6 trillion of US debt matures over the next 12 months. (~31% of all debt outstanding) add to that the deficits and we likely need to sell $9-$9.5tn in debt in 2024. doopsie. and our policy makers seem to be either in severe denial about what’s going on or simply willing to lie bald-faced about it for political purpose. neither instills confidence.

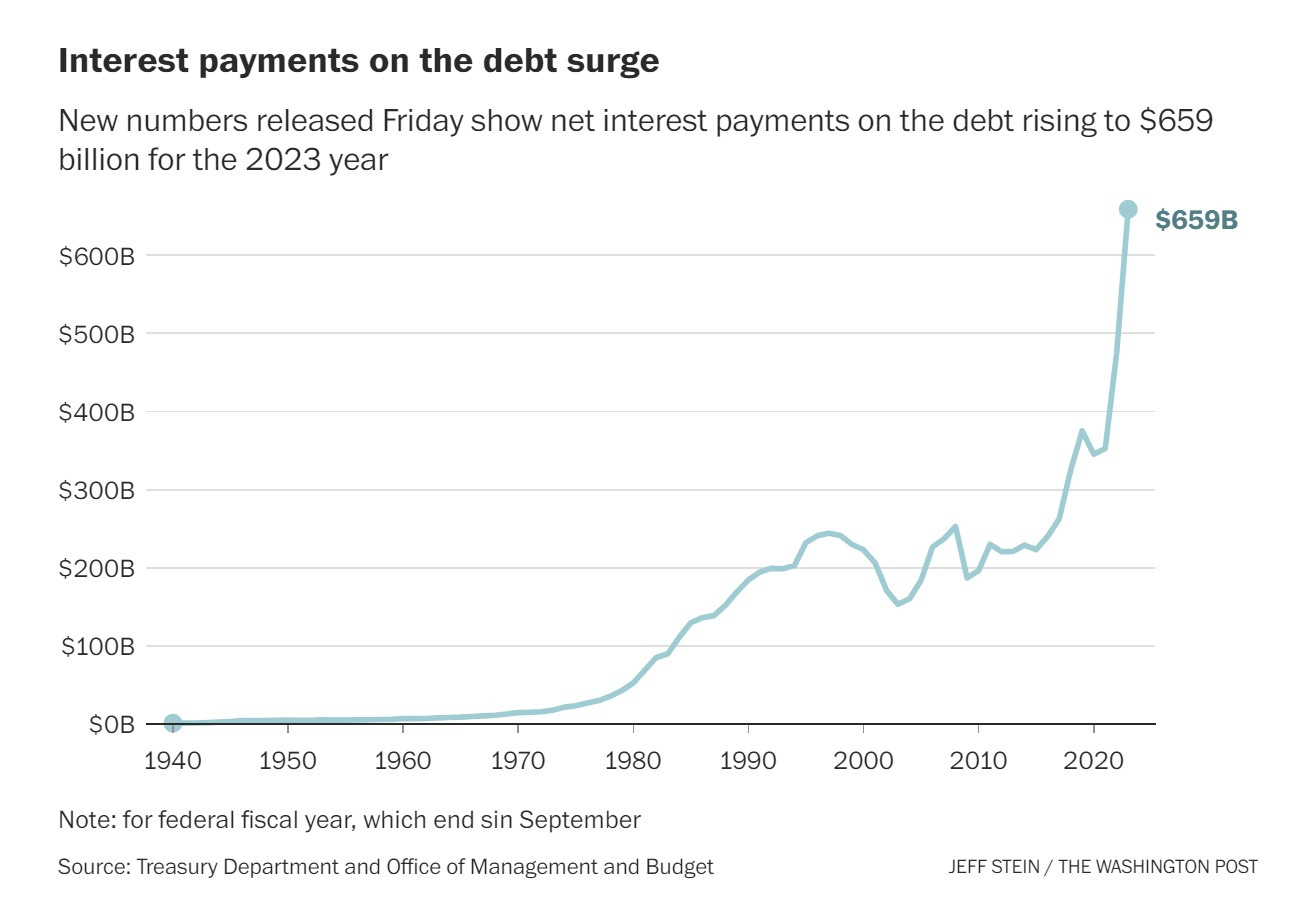

here’s the chart that starts to get outlandish:

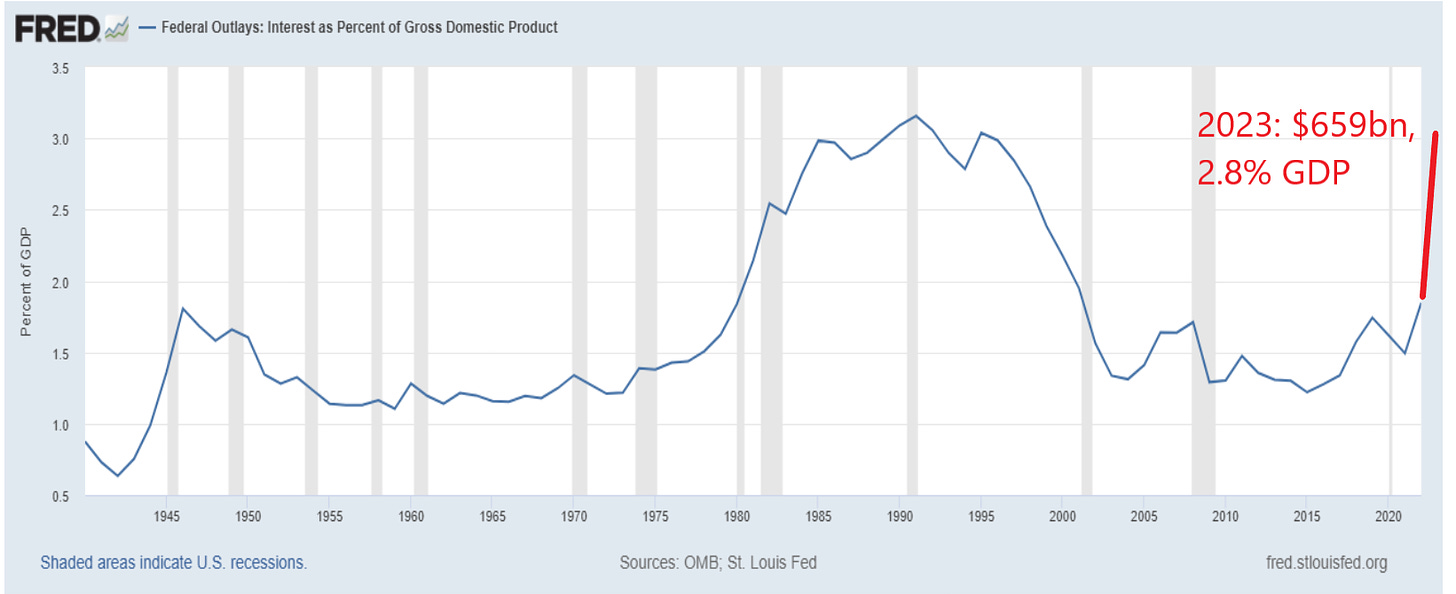

and this is not even bad yet. this is a cost of capital in the low 2%’s. as this rate rises toward 4 or 5%, this is going to double just on our existing debt. you can see it here as a % of GDP. at 4-5% rates, this would be 6 or 7% of GDP.

now apply that to $50 or $70 bn of debt. it’s easy to get into double digits for federal debt service as a % of GDP. that starts to be half of all collected taxes spent on debt service. so deficits blow out further and pretty soon, you’re borrowing to fund the interest on your borrowing.

lights out, game over.

there is no way bond markets are going to support this. we’ve already seen revolt and iffy auctions.

this is all going to go on the fed’s balance sheet and that’s going to cause a wild inflationary spiral which is the only real way for government to get out from under situations like this. it devalues the debt they have already run up. if you drop a zero off the real value of your currency, suddenly $50tn of debt feels like 5. of course, this makes market rates of interest explode and debt service with it which is when regimes go truly darkside and fix markets with “rate caps” and then sell it all to the central bank at some wildly non-market price in hallucinatory games of “extend and pretend.”

this is how you get weimar, zimbabwe, argentina, venezeula, etc. and make no mistake, it CAN happen here. it IS happening here. the kinds of structural deficits the US is running are unsustainable and 123% debt to GDP is a serious threat to national solvency. this is not a hypothetical. this is the road we’re on right now and its inevitable destination.

absent immediate and radical change in the way our federal government spends money, they’re about to take the american republic down. there is basically no other issue of import at the moment. this is not a 30 years from now problem. it’s 10. it might be 5. the math is just the math and compound interest is a helluva thing to try to fight.

it’s astonishing to me that there is basically zero foregrounding of this in DC. who is even running on a policy of “we need to balance the budget”? it seems the best we can muster is kabuki debate about whether we should ride the rails to ruin quickly or a little more slowly.

america needs to start electing serious people or we’re going to get the very serious times that electing weak fools and liars brings. no one wants to point at this buck naked emperor and say “irresponsible, reckless profligacy and reality denial” but we’d better start. it’s not going away by itself.

I like to make fun of politicians for sticking their head in the sand and pretending this isn’t happening, but then I always catch myself doing the exact same thing when I read articles like this because it’s so overwhelming and scares the crap out of me.

Democracies always fail and they fail when the public realizes it can vote goodies for itself. And then after the collapse comes tyranny. It’s exactly what happened in Germany and Venezuela and there’s no reason why it won’t happen here. The vast majority of people who vote have no idea how any of this works and they think all government money is free… so they vote for people who put that into practice, whether they know it themselves or not. Our politicians are either stupid or cynical, but neither will avoid the collapse.

"If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered.... I believe that banking institutions are more dangerous to our liberties than standing armies.... The issuing power should be taken from the banks and restored to the people, to whom it properly belongs."

Seems like Thomas Jefferson was on to something.