the new "not a wealth tax" is a pretext to entrench an aristocracy

and that aristocracy does not have your best interests at heart

you’ve probably noticed the sudden push for a “wealth tax for billionaires.” as is so often the case, much of the media reporting looks a bit wide of the mark, but the actual underpinnings are no less scary. let’s look:

first off, it’s not a “wealth tax” because, of course, that’s almost certainly unconstitutional. so, instead, it’s actually an income tax but on your wealth.

instead of taking, say, 1-2% of the value of held assets (itself an obscene and stupid idea that not only violates basic rights but also does not work to raise revenue) they will simply classify “unrealized gains” on public equity holdings as “income” and then tax it.

this means that if you are, say, elon musk or sergey brin or bill gates where you got most of your stock in the company you founded at what is now basically zero cost basis, you’re going to face the full cap gains rate on your holdings as a one time hit.

only probably it won’t. the obvious solution to this is to exempt past gains and only count “this year” which while seeming generous is actually probably the key to creating a permanent aristocracy in america. the super rich get to stay super rich and nobody else gets to accumulate capital and join them. more on this later

you can hear yellen pitch this in her own words here: (video playable)

and of course, the usual suspects like warren and pelosi are in full throated favor despite their own oddly suspicious and notably large capital wealth accumulations despite never having had real jobs (which i’m sure will be exempt.)

leaving aside how ridiculous this plan is, how grossly unfair, how devastating to founders and their relationships to what they built, pernicious to business and capital formation, how certain this is to tank the market if implemented, its instant end to IPO’s (who would come public if it led to an instant tax bill and loss of 24-35% of your holdings to pay taxes?), and its complete and total unworkability, i’d like to explore 2 other issues here:

is this just a political stunt to get other issues like fauci, empty shelves, and brandon’s plummeting popularity out of the headlines or an extreme “anchor” for the negotiation on raising the cap gains rate akin to a car dealer offering you $10,000 for your maserati?

or might it be something altogether more sinister, a populist gambit to drive in the thin end of a wedge that will never come out?

this could easily be a political stunt, an idea everyone knows cannot work, will not pass, and makes no sense apart from as a stage magicians media cycle flourish while they hide the bunny offstage or the nasty emotional bargaining framing of an issue to make something only “very harmful” look good in comparison. both certainly fit with the general behavior of the brandon administration and the current congress.

this would generally be my base prior.

BUT, and this is a real but, there are reasons to suspect this gang might actually be sincere. honestly, i have come to suspect that they are. this clears too many boards at once and the current congress and presidency are the most radical in america since at least the 1930’s and possibly have aims on exceeding even that.

never have so few taken so much from so many so quickly.

and they want more.

faced with rapidly fading popularity as crisis after crisis mounts and mid term elections loom next year, the strategy seems not to be “hey, let’s fix this” but rather “time to go for broke” and push a full court press on every front.

and make no mistake, this gang DESPERATELY wants what functionally amounts to a wealth tax on the corporate titans of america. this is how you establish control of the business leaders than underpin a top down dictatorial fascist system and how you prevent the emergence of new ones.

and to get that, you play populist. “it’s just the billionaires, why do you even care?”

this is crocodile tears level disingenuous. there is a really good reason you should care. you just may not have read the history you need to provide the perspective.

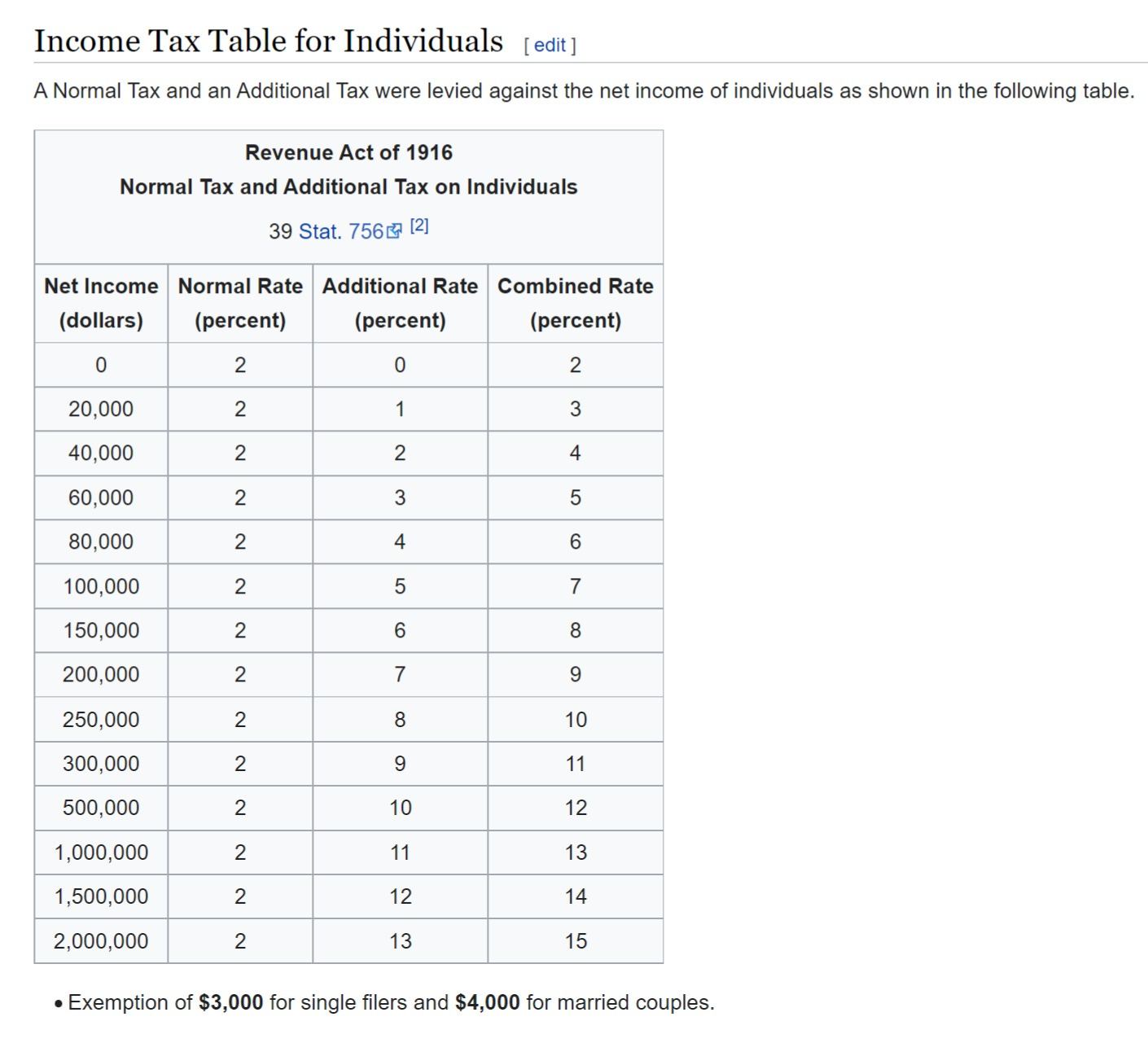

the US income tax started just as a “millionaires tax” too. almost no one paid it to any significant degree. you can see the rates here. note that this is in 1916 dollars. each is the equivalent of a bit over $25 today.

so, individuals had an exemption in today’s terms of $75,000. couples got $100k.

after that, you paid 2% on your income up to $500,000 and 3% on the next 500k up to a million in current money. you can see why so few people found it objectionable. 60-70% paid none and 99%+ paid a fully loaded rate well under 3%.

i presume you do not need me to draw you a map on how THAT worked out in terms of rising rates and increased tax base.

this is not the camel you want to let gets its nose under the tent. do you really think taxing unrealized capital gains will, for long, remain a practice imposed only upon the rich?

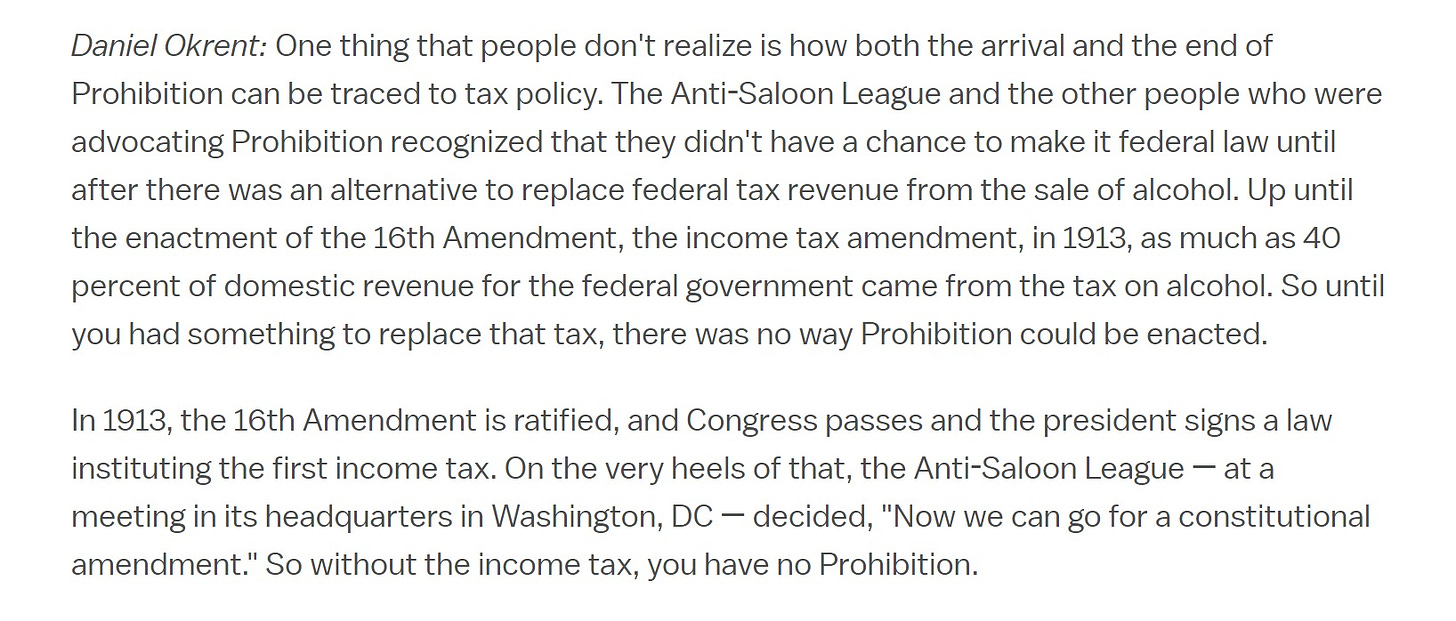

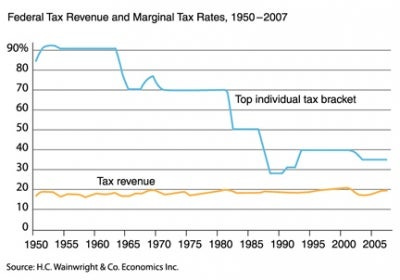

another little discussed aspect of the income tax is that is was seen as a means to another end. for many of its fiercest champions, it was not about fairness or need, it was about finding another source of federal revenue to replace the tax on alcohol which used to be up to 40% of federal tax receipts.

historian and former NYT editor daniel okrent discusses this below:

income tax was the freeing more to enable an aggressive social agenda. that agenda was “prohibition.” we all know how THAT worked out.

it would be difficult to find a more poorly conceived rats nest of stupidity and unintended consequences that does not involve totalitarian socialism.

and obviously, this new revenue source to replace liquor taxes was not ended when liquor taxes returned. instead, it grew in scope and its new potentials to raise revenues led to higher rates, greater reach, a bewildering array of special interest tax treatments, and perhaps most pernicious of all, allowed for the massive growth of leviathan. can anyone seriously argue that the massive (and never reversed) surge in the size of the federal government in the 1930’s would have been possible without this income source?

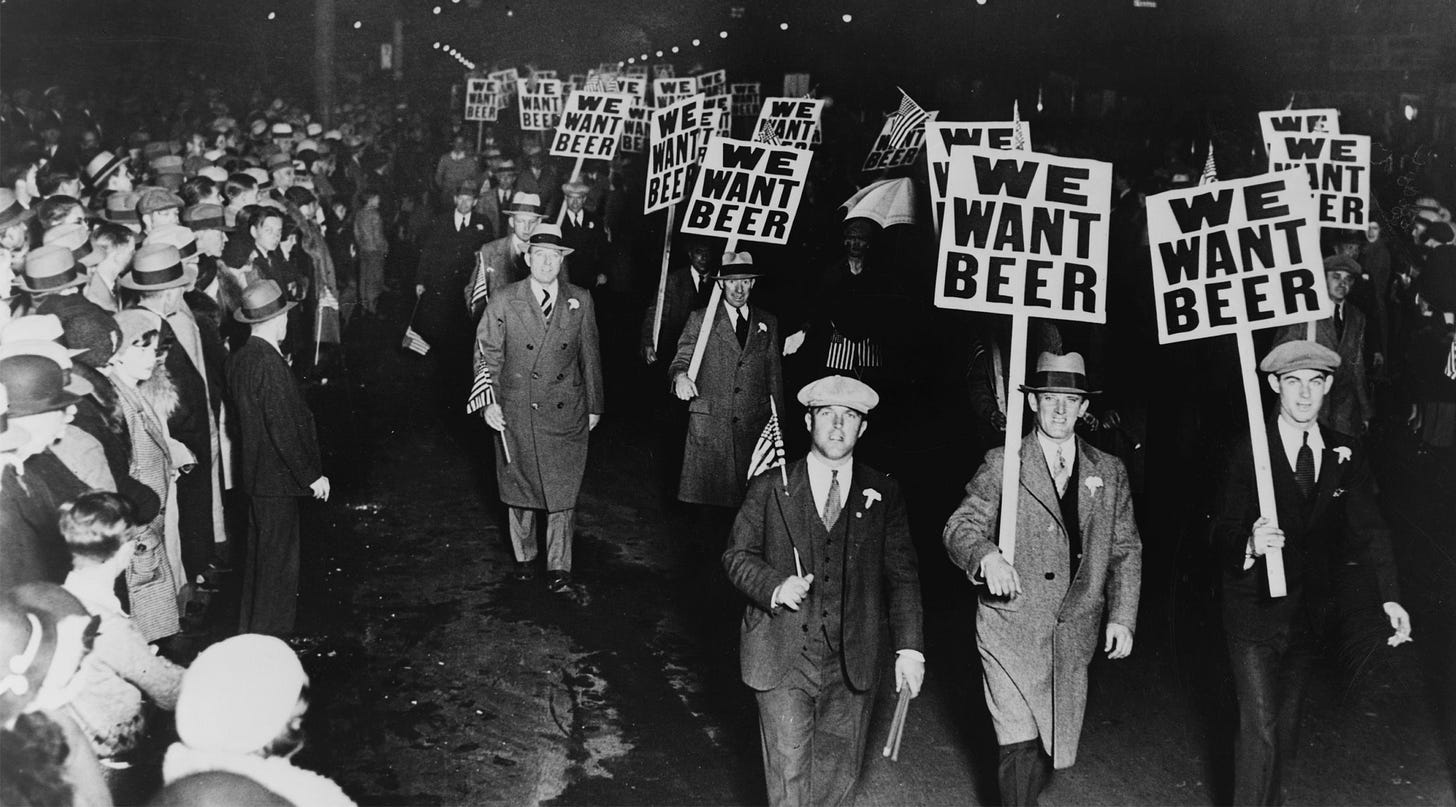

they want a new source now because there is a funny thing about US tax revenues: raising tax rates on the rich does not increase tax revenues as a % of GDP. never has. hauser’s law is not optional. when you crank rates, people shelter income. you don’t get more tax. taxing unrealized gains looks like a way to try to break this relationship and to get tax receipts to rise above the 19.5% of GDP level they cannot be pushed off of under current structures.

and doing it like this will be the single most economically destructive means possible. not only will it take from the most productive and give to the least, but it will destroy the actual engine of capital accumulation. getting taxed on unrealized gains makes a staggering difference in wealth accumulation.

8% market performance on savings over a 40 year career = 21.7X your money

tax that same process at 35% (annual will be ST cap gains, not LT) and it’s 7.6X.

you’d be 3 times richer absent the tax. 65% of your capital accumulation is gone.

pile a 5% state tax on it and now it’s nearly a 70% hit on wealth accumulation. you lose another full doubling of your initial capital.

this will ossify social class in a never before seen manner. it will become incredibly hard to go from middle to upper class and stunningly hard for any new founders to ever ascend to the heights currently inhabited by the the billionaires.

this is likely by design. unlike europe, the american super rich are mostly self made folks. they know how they supplanted the last group of the super wealthy. they do not want company. this is how you pull up the drawbridge now that you are in the castle.

and the price of perpetual position atop the pecking order is joining with the state in it’s totalitarian aims.

history repeats itself:

this new desperation for revenue sources and for the gutting of those who build things is tied to a very specific and draconian social agenda, called in advance. this time they are not even waiting for it to emerge.

you can explore it HERE. it’s near absolute in its reach and is EXACTLY what certain internet felines have been warning of for the last 2 years: the intersection of health, social justice, and climate into a pretext for what amounts to near universal control.

and there is a ZERO percent chance this tax can pay for even a fraction of it. it’s not even supposed to. so the tax will grow. but it won’t help pay for this. it will just keep you in your place and they in theirs.

lest you think i exaggerate on scope, please read this plan in its own words:

these principles cover literally everything. they want to “build it back better” a phrase that seems to crop up everywhere you look like some sort of demonic whack a mole.

we must control everything so that we can make everything equal. that’s command and control dictatorial socialism you smell, amigos. take a good whiff.

hell, some of what these people are discussing sounds like HARRISON BERGERON. imagine reading that and mistaking dianna moon glompers for the hero. because that’s what’s happening.

(if you have never read this short story, read the link. it’s a 5 minute read and represents some of vonnegut’s best work. i have loved it since i first read it in high school.)

all this profession of wanting to “build back better” that which you have just spent two years wrecking rings terrifyingly false. these are liar’s words to make it seem like the global disruption was something that just happened and not a set of barking mad policy choices that cast aside 100 years of evidence based pandemic guidelines and 1000 years of social order to drive the world into a ditch because that’s how you get compliance and control.

these are not the people you want deciding what “better” is when you build back.

and the bum rush to do this is grabbing for all the commanding heights. look who brandon wants to run the banking system: saule omarova, born and raised in soviet khazakstan.

this is not a woman who fled communism. it’s a woman who loved it but had her communist horse die out from under her while studying in america, she is now seeking to saddle up in the US. she’s still a true believer.

“Ms. Omarova wants to put an “‘end to banking’ as we know it”—again, her words—and transfer private banking functions to the Federal Reserve, where accounts would “fully replace” private bank deposits. The Fed would control “systemically important prices” for fuel, food, raw materials, metals, natural resources, home prices and wages.

She says the Fed should be remade into what she calls “The People’s Ledger.” By “the people” she means progressive elites like her. She calls for “reimagining” the role of central banks “as the ultimate public platform for generating, modulating, and allocating financial resources in a modern economy.””

this is literally the current nominee for comptroller of the currency of the united states of america. none of this is funny anymore.

and half the media loves her:

“A Washington Post columnist hails her as a “trenchant and informed critic of the current financial system” and praises her “innovative ideas about how to reform banking” and “tough approach to banking regulation.” “

(but i’m sure it’s a coincidence that rags owned by the very billionaires this plan will protect in perpetuity as top of the pile are playing populist to support it. pro-tip: when billionaire start spouting populist platitudes, look for the razor blade in the cotton candy. 99.99 times in 100, it’s there.)

me, i’m with the WSJ editorial board:

“Her ideas were innovative—circa Moscow, 1918.”

and we can 100% expect the “right” billionaires to be all for all of this. is there is one thing they understand for certain, it’s that staying atop the greasy pole of free market competition in digital industries is HARD. creative destruction is the law of the jungle and disruption and displacement its norm.

this is why big business does not like free markets. it wants things it can control. and the best way to do that is to enter into a totalitarian/fascist partnership with the state. you help control the information and the flow of commerce and they keep anyone from knocking you off your perch.

one hand washes the other and we the people get the filth all over us.

so do not listen to a word these anxious eichmans of industry say about “oh, good idea! let’s regulate industry, make it safe, prevent disinformation, seek truth, and pretend to pay taxes.”

it’s all just a smokescreen for “we’re part of the ruling class now and nobody gets to disrupt us.”

the “wrong” billionaires who refuse to get in line will get gutted like trout, taxed out of control positions, and regulated to ruin. they will not get a say. and neither will you.

next they will come for the 100 millionaires. and soon the millionaires. and then everyone. you didn’t build that because we took it.

this is the road to stagnant penury and ashes.

these would be wardens of the economy do not want the consumer sovereignty of markets, they want sovereignty OVER consumers through a public/private partnership.

“@jack” to “@jackboots” in one business cycle.

because the goal is to stop the cycle while you are on top. and that takes coercion.

and it’s coming hard and fast now from every angle. we’re being bum-rushed before the mid-terms flip the power structure. note that they even added “democracy” to their list.

brace for broadsides of how in person voting, voter accountability, election supervision, and requiring ID or even citizenship to vote is racist/sexist/anti-trans/cruel to sunshine and lollipops from the same people who claim that requiring proof of vaccination to go shopping is a moral imperative.

they are hypocrites to the bone and morally bereft. this is not about principles and never was. it’s about pretext to grab and wield power and to make damn sure that power stays with them and theirs. it’s all the ever wanted.

whether this process is a pendulum to be swung back or a snowball that is gaining mass and will crush the town below seems like the question of our times.

and the answer depends on us.

everyone is exhausted after the last 2 years. they are counting on the exhaustion. it’s why now is the time for them to make their move. this is the 4th quarter defense where it’s just getting hard to run anymore and harder to hold the line. but if you want to get out of this game with your freedom, buckle down, because we damn well better.

it’s clear from the disaster squirting out of ever side where ideas like this are going to take us. the past is replete with cautionary tales and devoid of counterexamples. if ever you cared about your future freedom, now is the time to stop this.

you’re being sold your own serfdom as though it’s a vacation package.

history is not kind to those who fall for that one.

find something that touches you and push back. push back everywhere.

the society you save may be your own.

do not underestimate the evil that was unleashed in the early hours of 4 nov 2020.

these totalitarian progressives think their mass printed ballots and hacked counting machines give them a mandate.....

make no mistake they have the fix for 2022.

Absolutely brilliant essay.

After watching in person as Antifa and BLM burned and wrecked the city I live in while being told it was all in the name of equality, I became radicalized. I used to never give a rip about politics. Then I watched a Presidential election stolen. We can never go back. We can only go forward. And forward means battle.

Are you prepared? Because I sure am!