and like some tiresome reprise of “groundhog day” it’s all the same tropes with a slightly different set of riffs.

regulators asleep at the switch and regulating the last crisis (which quite possibly causes the new one), opaque banks holding teetering piles of god knows what, implausible accounting rules that lead to sub-optimal or outright dangerous behavior, monocultures of risk management, and the sudden rediscovery of a variety of kinds of risk from duration mismatch to counterparty non-performance to arbitrary edict by regulators and central bankers that preferences some over others in a manner predictable only by political connection, not some known and knowable rules of commerce and unwinding.

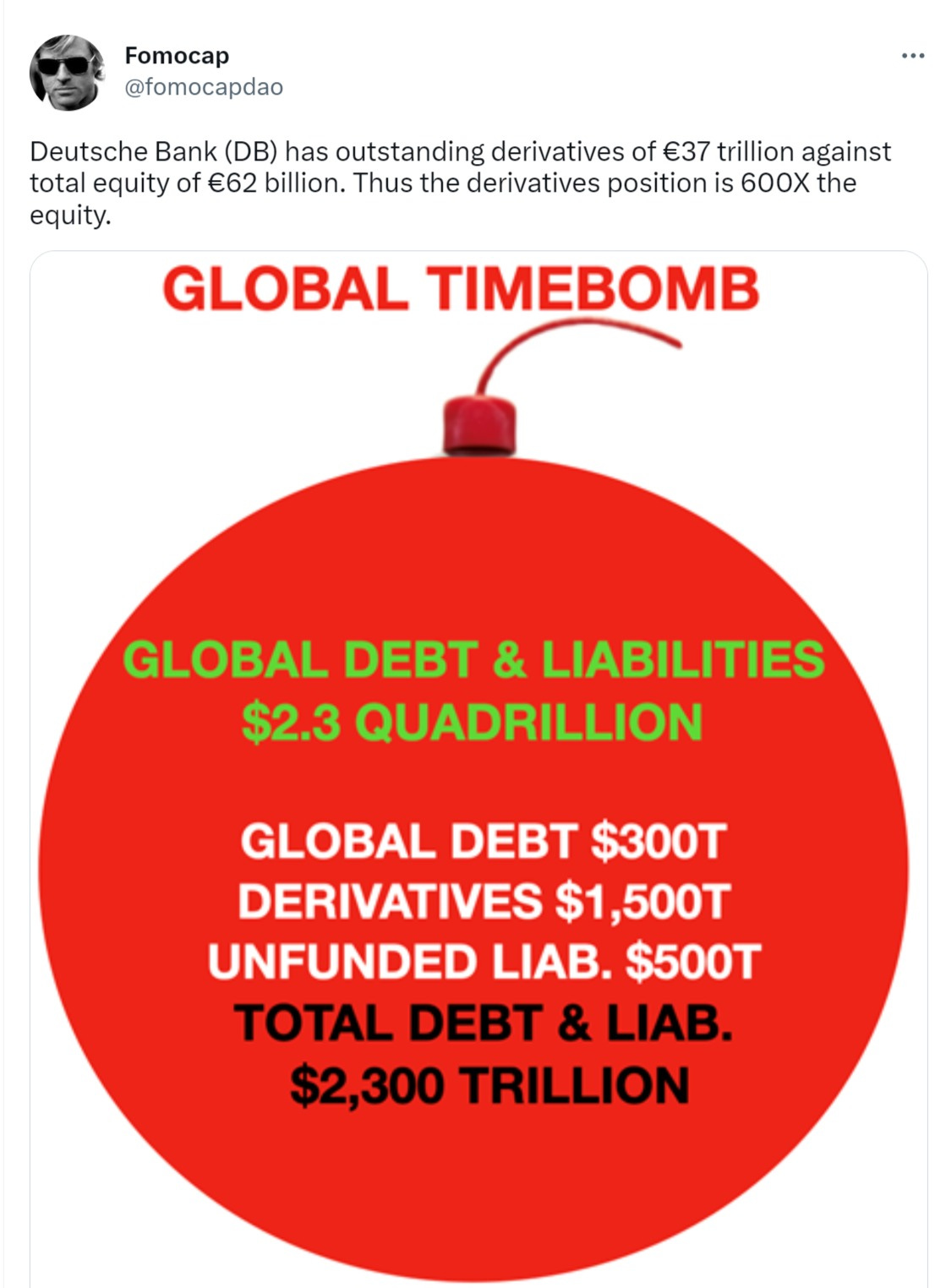

the simple fact is that banking is largely opaque. we could sit down with every piece of public and regulatory data about deutche bank and spend a month going over it and still wind up with what ultimately amounts to a black box bet on the soundness and hedging of a derivatives portfolio nearly 3 orders of magnitude larger than their total equity.

hey, maybe it’s awesome. maybe all this leverage is cunningly laid off and hedged and arbitraged and will produce lovely returns and ongoing modern plenty.

or maybe “wow, if we get this wrong by 0.16% we’re bankrupt” is a level of leverage you do not want your savings or your economy anywhere near.

and as many discovered in 2008, hedged is only hedged if the counterparty you did your hedging with remains solvent and able to perform and markets remain continuous and active.

in theory, an interlinked system of finance can safety carry a larger leverage level than any individual institution because the system can catch temporary imbalances. it’s like 10 people linking arms to stand against a wind vs 10 people alone.

but in practice, this tends to lead to a sort of prisoner’s dilemma of moral hazard where everyone want to be the excess leverage and inevitably some clever boots like AIG decides that “you simply cannot beat a diversified portfolio of being short CDS’s!” and makes some loud public claims about there being “no possible way it could lose money” right before it turns out that assuming that super cheap bond insurance for the whole world is a set of uncorrelated assets is maybe not such a great assumption and they burn a 100 year old insurance giant to the waterline in a week.

in theory, people are supposed to learn from this and smarten up.

in practice, what they learn is how to yell “government!” and “systemic importance” in loud compelling fashion until “too big to fail so you gotta bail!” becomes yet again the market mantra.

in practice, it all always finds some way to go “pete tong” and then you are left with a bunch of scared, incompetent regulators spinning massive and arbitrary solutions to shift a bunch of risk and assets that nobody really understands into a configuration that is not imminently likely to catch fire, collapse, and sink into the swamp (at least until it’s the next guy’s problem).

in practice, you wind up here:

you cannot have confidence in that which is not comprehensible.

and literally none of this is comprehensible.

why are we suddenly so prone to social media driven bank fears and even runs?

because the banks are black boxes and the central banks and treasury departments have become outright chaos agents.

and no one has any idea how to analyze it or predict it.

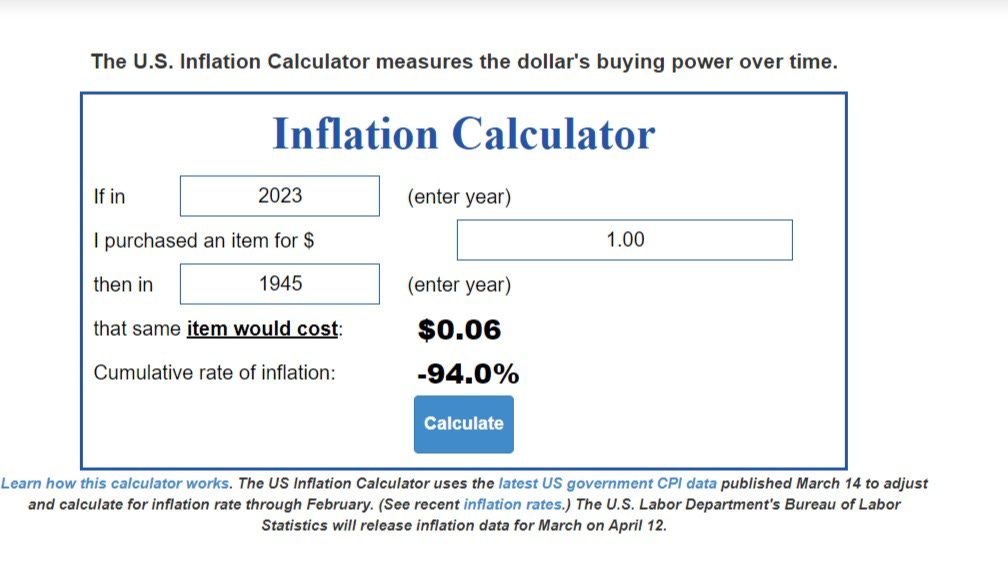

banking is being asked to do 27 different things that banking should not be asked to do by regulators so grossly incompetent and mal-incentivized that the primary asset left in their care (the dollar) has lost 94% of its value since the second world war.

perhaps not the asset manager one would prefer…

these banking crises are caused again and again by governments screwing up banks though ill conceived or outright insane policy.

2008 was the story of the community reinvestment act forcing banks to lend to subprime borrowers as rates akin to prime so that they could buy homes they could not afford. cuz, ESG.

the banks were (understandably) terrified about this but had no choice. fail to do so, lose your charter. so they laid this risk off as fast as they could. the got freddie and fannie (the classic quasi governmental agencies that privatize profits and collectivize risk/losses) to guarantee the loans. these companies basically got to run amok with the federal credit card selling cheap mortgage insurance that took all the risk out of making liar loans (once they changed the rules to allow it).

these guaranteed loans were then packaged, sliced, diced, and derivitived into MBS’s (mortgage backed securities) that spread the risk of US mortgages globally and left uncle sammy on the hook for the impending global whammy.

combined with insanely low rates, this injected insane leverage. it all ended in quite the mess.

and we’ve just done the whole fricking thing again.

instead of learning “banks should lend based on credit quality” the smooth brains up at treasury now want ESG and DEI lending. because that’ll definitely work better this time. swearsies.

and what was the learning from “wow, we sure got hosed guaranteeing all that debt?” let’s grab more power and guarantee even more debt! these agencies are currently acquiring ~2/3 of US mortgage origination.

it’s inflationary and dangerous.

and as our pals over at SVB just learned, the MBS’s made from it sure can drop in value when rates rise. worse, they also suddenly become much longer dated assets because they are not being taken out by refi. you thought you had a 5 year bond. suddenly it’s 15.

that sure does change the “hold to maturity” equation (where you do not have to mark it to market). and that is a terrible mismatch to a huge pool of depositors that are venture funded jet engines of capital destruction masquerading as “new economy growth companies” whose bank balances are a melting iceberg that needs constant top-up from the next round of VC’s looking to immolate a billion or two.

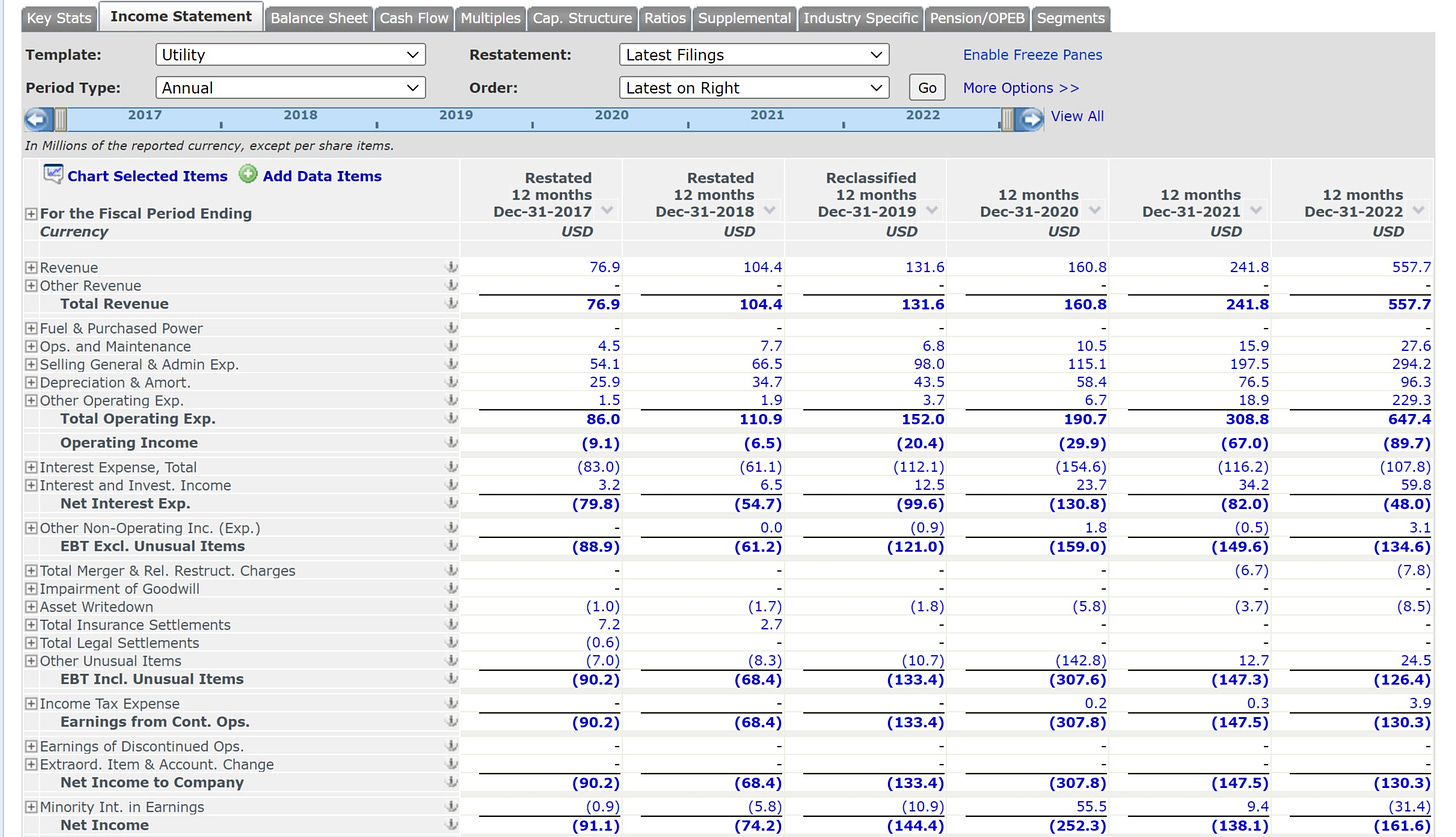

here’s a typical depositor. it doesn’t matter who they are or what they do. their primary business is selling dollars for 80 cents. and these companies are currently legion. because if you make money basically free, folks are going to take you up on it.

this company has over $5billion in debt and keeps $360 million of cash on hand.

they have no plans nor ability to make money they had cash flow from ops of negative $330 million last year.

who on earth would take on long term bonds held to maturity while using these guy’s deposits as a source of capital?

yeah, that was always gonna work out delightfully.

and why would anyone keep large uninsured deposits at a bank that does this?

you do it because you believe they (or perhaps more importantly, the other depositors) are sufficiently connected that it will not be allowed to fail and that you will be made money good. and, assuming you get your politics right, this generally winds up being a sound bet. it certainly did here.

once the federales and the FDIC stepped in and said “it’s all covered” the companies that pulled money and caused the bank run came flooding back. it was easier than getting a new bank and the literal canon in the valley became “this is now the safest bank in the US.”

and it’s probably true.

but this is also a serious problem because the moral hazard you create with this sort of backstop (explicit or otherwise) is grievous and it lets people do dumb things (like trusting black box banks with wicked leverage ratios and far flung exposures) with impunity.

and there is basically no practice on earth more assured of ending in tears than letting people do dumb things with impunity.

and it does not have to be like this.

we can do much, much better but to do so requires dismantling centuries of government prerogative and privilege and bankster oligopoly and creating an actual market for banking and for money.

there is nothing remotely difficult about doing it. there is no meaningful technical or systemic hurdle. it’s just vested interest.

governments have always coveted the ability to control the money. once, they just took a % of all the gold and silver and copper they struck into coins for you. in a fiat system, they just print more money and devalue the cash everyone is holding. this creates massive sort term profits that accrue to those closest to the money printer when it goes BRRRRRRR! this is called the cantillion effect. (named in 1600’s france, so hardly a new idea)

new money is inflationary, but not right away. the first person to spend one of these new dollars gets the old market price. but as more and more new dollars are spent and re-spent it drives price levels higher. maybe the second and third guys still get some benefit if they move fast enough. but at some point, far enough from the wellspring of made up money, this flips and you become a bagholder who is losing wealth. and this cycle rapidly accelerates as people get used to it. you wanna get that cash out of your hot little hands as fast as you can before someone else inflates it away. it’s a race to the bottom.

but government ALWAYS goes first. and money center banks pretty much always go next. so the same small gang is always benefiting from this. and that is why they do not want it to change.

but as seems plain from the drunken monkey bumper cars in a minefield currently DBA “the global banking system” it has to change.

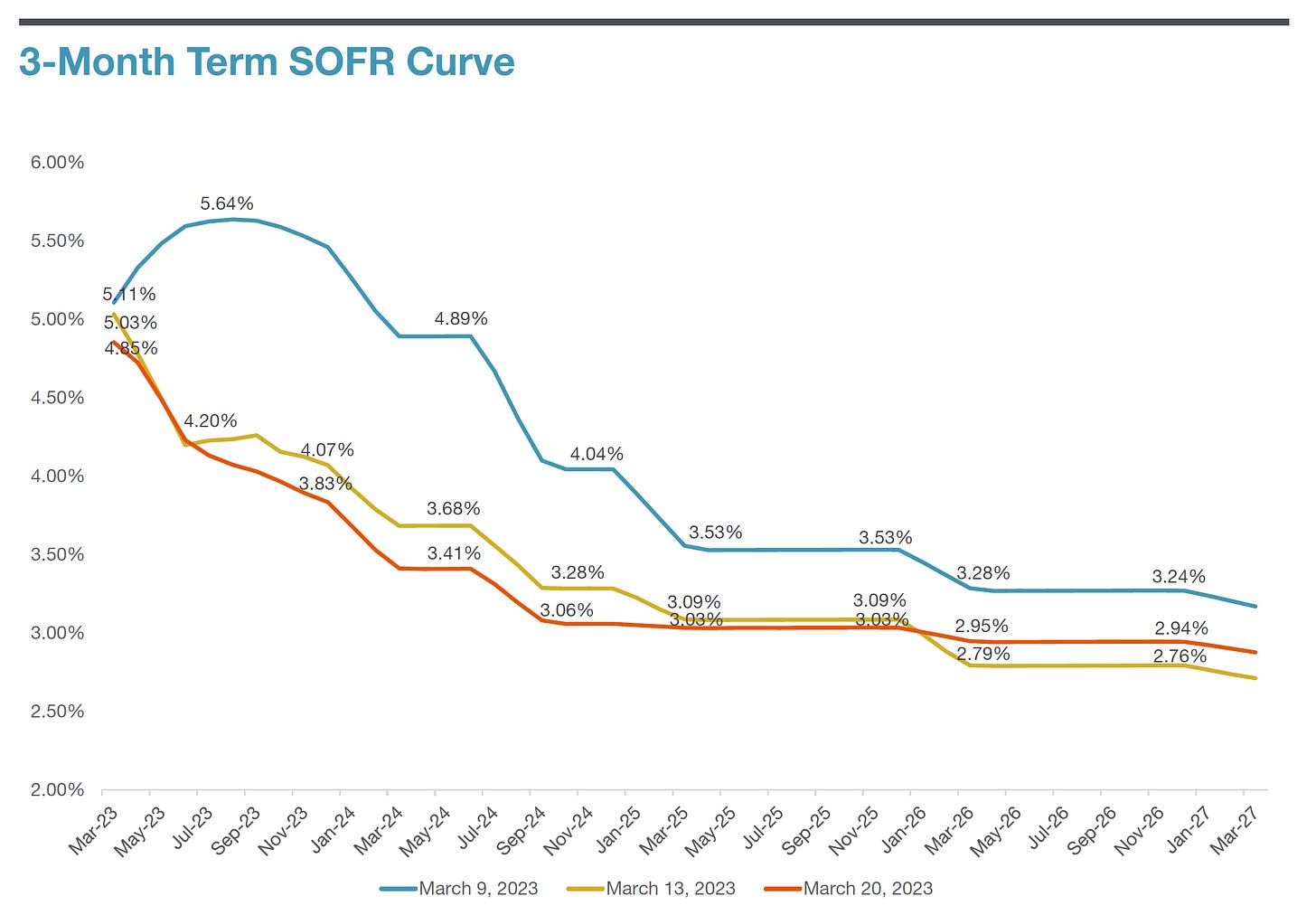

because this is not working. this afternoon, the FOMC at the fed is going to give is rate news. and they are, because they were shortsighted and stupid for decades, trapped between a rock and a hard asset. pretty much every credit market on earth is pricing in a fed pivot. the SVB blow up dramatically changed the forward pricing curves on short term borrowing. (SOFR = secured overnight funding rate, the cost to borrow cash with US treasuries as collateral. it’s commonly used now instead of LIBOR)

are the markets right? who knows. the “powell pivot” has been the woodchipper trade of the last 12 months. but the assumption of where this rate would be come summer dropped from 5.6% to 4.2% in a couple days. that’s an INSANE swing. generally is the 2 year bond moves a couple basis points (100th’s of a %) it’s a busy day. watching it swing 50bp intraday is phantasmagoric.

but consider the position in which this puts markets:

if powell hikes, it’s going to be carnage. these curves flip back up. losses on bonds will be savage. the equity markets are going to go bid wanted. it will be a serious mess and a serious stressor for banks as their bond portfolios tank.

if powell pauses or cuts, it’s a 140 decibel ringing of the moral hazard dinner bell on backing, speculation, and inflation. we’re once more heading for “print and pray” esp with a $6.8tn biden budget on the table that will bleed arterial red ink in excess of the GDP of 95% of countries on earth.

and this kind of action is all in the hands of an opaque cabal of possibly qualified (but probably not) regulators that have painted themselves into an epic no win corner where raising rates will threaten the banking system and cutting them will just add fuel to fires yet to come.

being in this position at all means that policy has already failed in ruinous fashion.

trying to invest or plan around this is not economics or even finance. it’s kremlinology.

just what is the purpose of a system like this? it seems capricious, unstable, and ill suited to the sound function of currency, economy, and savings.

it even debases the real economy by flooding it with money losing companies that can be created in infinite numbers if money is free.

this is the stupidest of games with even stupider prizes and we’re all being made to play with our economies and savings.

and we DESPERATELY need to find a better way.

because this is not the sort of game you want to lose…

in 2000 US federal debt was 54% of GDP and dropping. today it’s 122% and heading for earth escape trajectory. we have ~$100tn (another 300% of the economy) laying around in unfunded liabilities that have eaten all of US tax revenue and then some.

the kind of debt accumulation we have seen in the west in recent years combined with the vast unfunded liabilities of ponzi welfare state system funding comes unglued in one of 2 basic fashions. there is no third way.

eventually you reach the point where the can can be kicked no further down the road. we can argue about when that is, but there is always a point and at that point you get either:

hyperinflation

or

depression

and that’s the list. they either print until the whole idea of money is debased and you need a wheelbarrow of currency to buy a bagel or you get widespread defaults, failures to pay, massive cuts in welfare, medicare, medicaid, and social security, and widespread bankruptcy.

we took an equity bubble in 2000 and turned it into an equity AND an real state bubble then turned that into an equity, real estate, and a government debt bubble. once you hit “everything bubble” it gets awfully hard to find anywhere new to kick this can and this likely helps explain the vast exodus of boomer oldsters in government fleeing like rats off a ship they know damn well they have finally sunk.

finding a new plan is going to become vital.

doing the same thing over and over with the same bad incentives and expecting a better outcome is hallucinatory madness and reality denial not a basis for systems of human flourishing.

i have some very concrete ideas about what that might look like that i will publish soon in a companion piece to this one as soon as i get the time to write it.

stay tuned.

Everyone needs to educate their family and friends:

During the plandemic, the reserve requirement for banking institutions was 0%. Yes, it is still 0%.

No bank could survive 0.5% of its depositors pulling their money out.

This is insane.

meltdown = CBDC