getting real about recession

the vise is tightening and the fed and treasury are telling it like it ain't

a 100% contrary indicator is just as useful as a 100% accurate indicator. you just invert the prediction and win.

and so we are fortunate to have ms yellen as our treasury secretary because janet’s ability to basically never, ever be right about anything is justifiably legendary.

and she’s at it again. (and seems to be no longer even trying to make sense)

and so i’d like to introduce the new official meme of yellen predictions (made all the more appropriate by the fact that this was on TV the last time inflation was this high…)

i see little possibility of avoiding recession or of the fabled “soft landing” which has been predicted 147 of the last zero times the FED has managed it.

the fed is the mr magoo of policy and has, over the last 25 years, become the province of a hilarity of modern monetary theorists in all but name. they have missed and wrongfooted every turn because they always look at the wrong things.

easy to say, oh mouthy cat, so if you’re so clever, what should we be looking at? glad you asked.

we should be watching the death cross of consumer spending.

first off, let’s define some terms because many people seem unfamiliar.

nominal terms means “denominated in currency.”

if your salary is $100 and rises to $110, those are nominal terms. you got a 10% raise.

real terms means “adjusted for inflation” so this is a measure of the change in your buying power.

your nominal salary rose 10% but if inflation was also 10%, you had a zero gain in real income.

in periods of high inflation, these can be very different measures and easy to misuse.

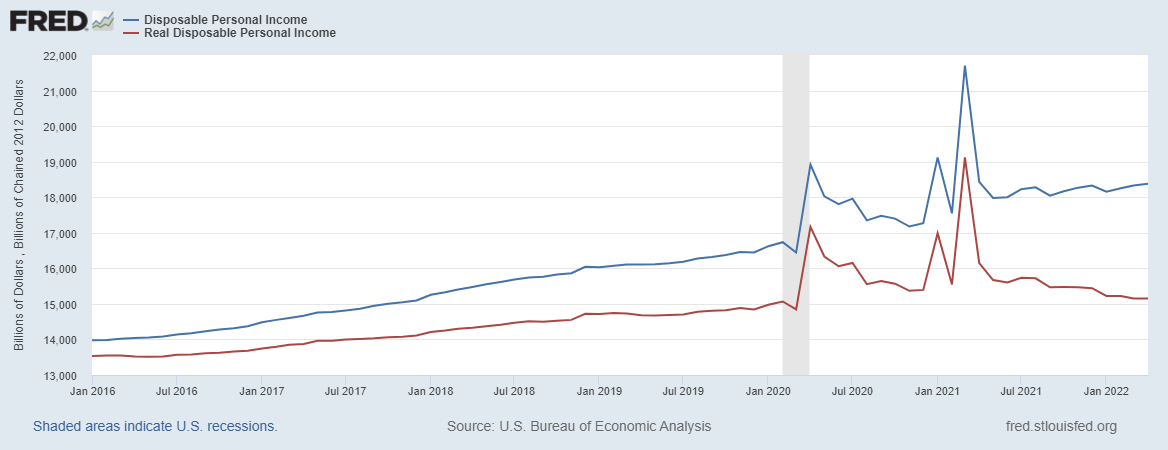

consider this graph of disposable personal income (DPI) which represents income after taxes for americans.

nominal DPI is rising and is 10% higher than feb 2020.

but real DPI is falling and is flat with feb 2020.

all of the rise was eaten by inflation and the real figure is down >6% from a year ago.

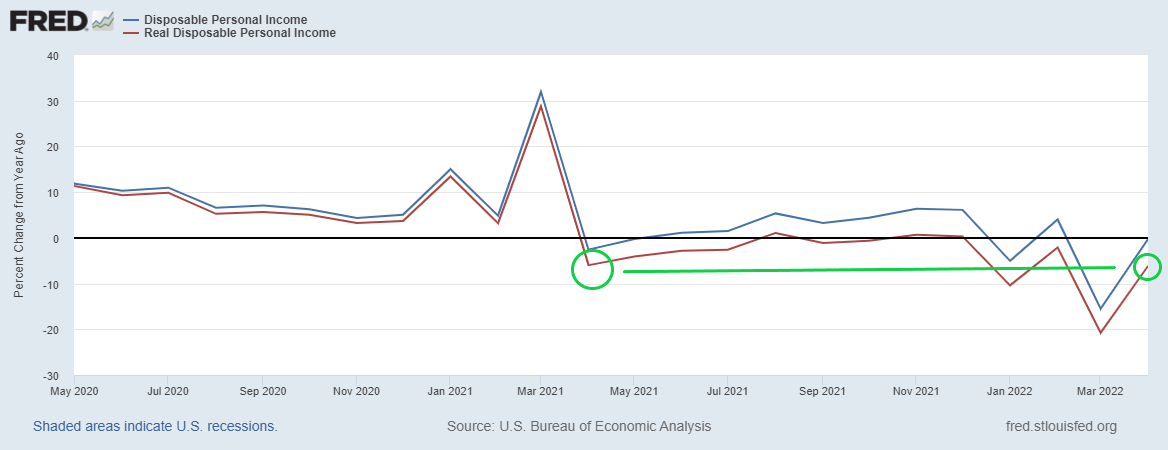

i’ll flip this to % change to make it easy to see:

real DPI is down 6.15% from a year ago. and that matters because while nominal may be what you talk about, real is what you feel. you can afford less and it pops up in your budget and lifestyle and this comp is likely to get worse again. see how this “vs year ago” had an easy comparison post massive stimulus bolus? it rose after that and so the may 2022 comp is harder (and inflation has not been backing off).

people are going to keep feeling this.

now, what’s interesting to me is that they have not yet really adjusted their behavior. they are acting like this is transitory.

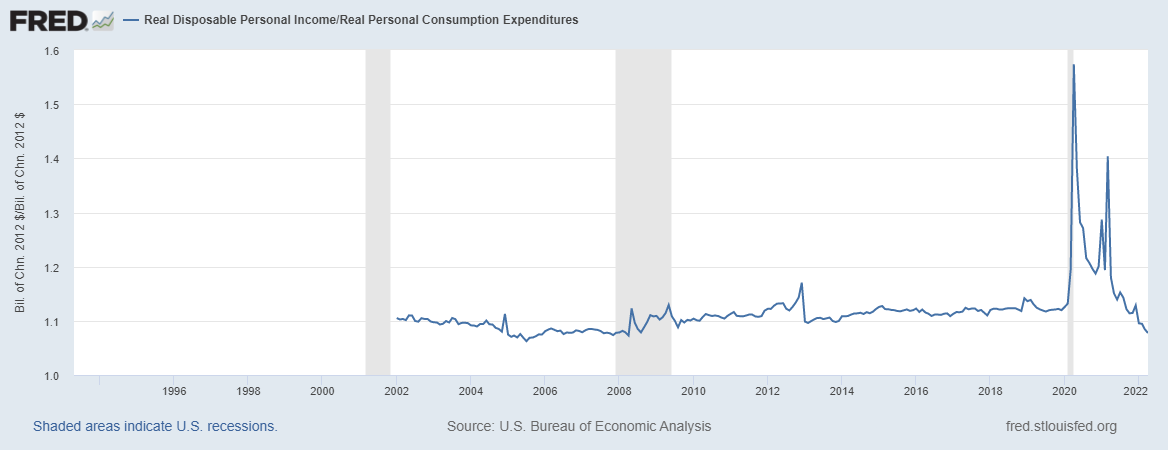

real DPI has been falling for a year. but real personal consumption expenditures, a proxy for consumer spending) has been rising.

this is the “death cross.” you cannot spend more than you earn for long, especially given both US savings rates and the fact that a lot of income is dominated by top earners yet spending slants lower, so a lot of folks are likely already running out of road to sustain consumption.

and when we flip this to % change vs a year ago, which way this looks likely to break becomes clear:

the growth rates in real PCE are positive, but have been dropping as the impulse of the huge covid grants fades. the spending party is over and the reality of morning is setting in. we’re at 2.77% and dropping, meanwhile real income is dropping over 6% and, while volatile as a %, is trending down.

something has to give, and i think it will be spending. if we look at DPI/PCE we can see how this is plummeting. 1.1ish is pretty typical. 1.07 and dropping fast is not. these are also levels similar to the huge credit bubble of 2006-8.

i presume everyone remembers how that worked out…

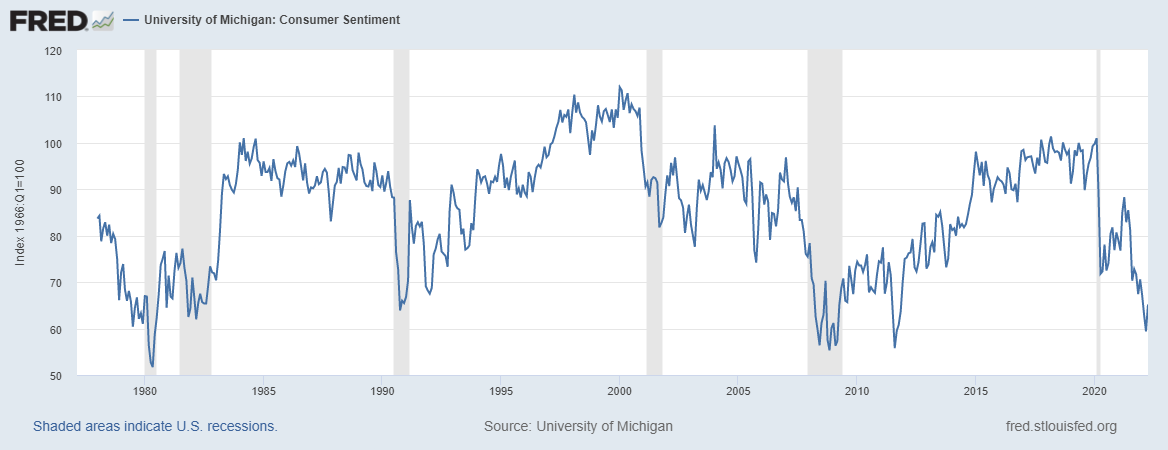

adding more trouble, confidence has collapsed and the repeated attempts to claim the economy is great and that recession is implausible are just making it worse. we’re at levels similar to the lows of the 2008 real estate crisis.

after the last 2 years, being lied to once more by the same people who made this mess is just not passing muster, especially in light of the absurdity of many of the claims. this relentless barrage of “reassurance” is having the opposite of the desired effect because it’s so clearly disingenuous.

this is “subprime is contained” all over again and far too many people realize what a contrary indicator all this rose colored talk is. you do that when you’re terrified, not when things are really going well. when the economy is really strong, no one needs telling. they feel it in their buying power.

and if consumer spending collapses, it’s recession time. honestly, i suspect the only reason we have not already put up 2 q’s of negative GDP growth is the last of the huge boluses of cash from PPP loans and stimmy checks washing through. but that cupboard is just about bare and yet spending continues despite big drops in disposable income.

this is people digging a hole, running down savings, and running up debt, all things that tend to prolong and intensify recessions.

and the FED and the feds are doing everything wrong. half of monetary policy works not because of the bite of rates but the credibility of the central bankers and treasury. but when they lie, they credibility is attenuated. rampant fabulism doe not make anyone feel like “the adults are in charge.”

these same people were just recently telling us that inflation was transitory. now “the economy will not go into recession.” they’re not only eroding confidence, they are making it worse by leading the credulous to conclude they can live beyond their means because it’s all going to be OK in a minute.

i don’t think it is.

at least telling it like it is would earn them some reputational heft and encourage proper planning. you do not do anyone any favors by telling them “smooth sailing ahead” and sending them, spinnaker flying, into a gale.

this is dangerous misbehavior and i would strongly urge adopting the following stance with regard to further prognostications:

The economy is Safe and Effective. So say we all.

I would like to bring up an equally important topic: fuel and food shortages.

This video speaks volumes: https://www.youtube.com/watch?v=P7EFCIOwexg&t=483s

So Blackrock & Vanguard, who largely own and control both the Union Pacific Railway and CF Industries (fertilizer) had UP cut back the shipments of diesel fuel and fertilizer by 25-50% for no real reason.

And both Blackrock and Vanguard are on the board of Schwab's WEF?

This entire thing, including covid, has been entirely engineered. It's time for torches and pitchforks.