talking tariffs

because it's time we did

this seems a common current formulation. these are both friends and gatopals™, smart people who i know personally and respect, but i disagree with them on this one.

let’s explore why.

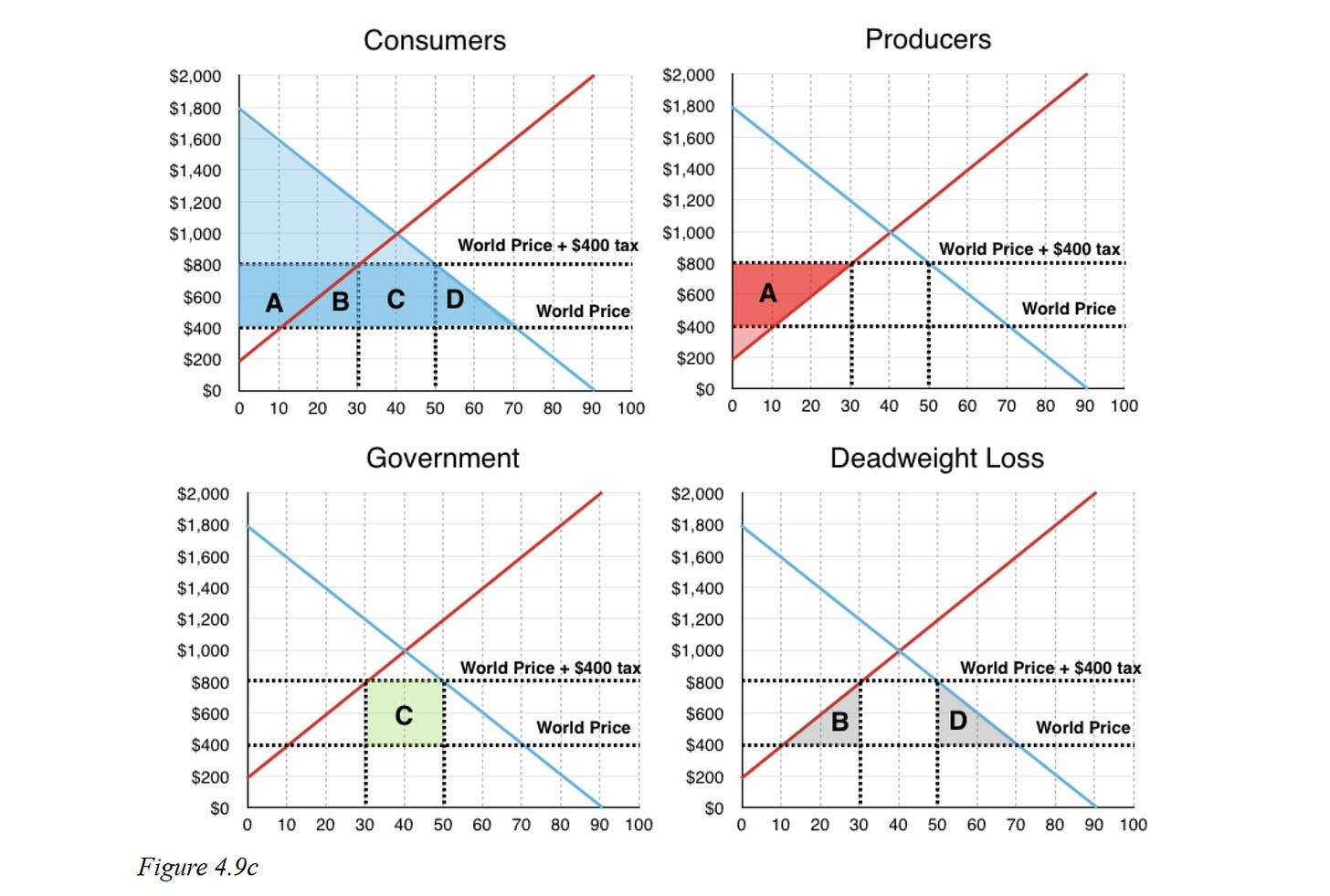

the short answer to this final question would seem to be that all tariffs impose a deadweight loss upon the citizenry of the imposing country.

this is not optional nor even really debatable. it’s just math and can be shown as certainty. tariffs constitute a really nasty confluence of incentives as domestic producers and government both wind up better off from them. these are concentrated gains, gains that are visible and useful for populist grandstanding, but consumers are made worse off and the size of their loss is greater than the gains to producers and government.

it’s a recipe for crony corporatist favoritism and finger on scale oligopoly.

it’s also a recipe for large aggregate losses of production and consumption.

the economies are not “surviving on this,” they are strangling. europe cannot grow. it’s just that a bunch of key corporate political donors happen to get net benefit out of what is, overall, a net loss.

in essence, industry groups and politicians decide to impose policies that enrich themselves at the expense of the overall welfare of the consumer.

why on earth would we want to mimic that?

mercantilism/protectionism violates basic bastiat who (correctly) admonishes us to:

“Treat all economic questions from the viewpoint of the consumer, for the interests of the consumer are the interests of the human race.”

this is how those with concentrated interests gang up to inflict diffuse harm upon the many, taking $10 each from 300 million people such that they might make an extra $500 million themselves. the fact that this taking cost $3bn is not their concern. that gets swept under the rug. it’s someone else’s problem.

but math is math and this is not a theory that’s in dispute (at least among the economically literate).

there is ALWAYS a net deadweight loss and that loss is difficult to see because it’s diffuse and unpredictable (but also inevitable.) you add a tariff on lumber, and an ice cream parlor goes out of business, perhaps a bowling alley, perhaps a small consulting firm, there’s no way to guess what specific consumption will be forgone to cover the deadweight, only a certainty that somewhere it will be.

this changes the equation dramatically from the idea many seem to hold that “if they do it to us, tit for tat is fair and we should do it back.”

if one frames the question as "if other countries oppress their own consumers, limit their choices, and force deadweight losses upon them, should the US follow suit and do the same?"

the choice here takes on a very different flavor.

punching yourself in the face because your opponent punches himself in the face seems an unwise tactic.

is the answer to this:

“so let’s make it hard for americans to buy a porsche, that’ll show those germans!”?

let’s harm the american consumer because the german consumer is getting screwed?

why? to favor ford? we can hurt porsche, but only by hurting our own consumers. how is this not the same system of subsidy and preference from which we are seeking to extricate ourselves?

it’s the american public paying the price for this policy and the idea of “jobs saved” and “extra US spending” is simply false. however much one may dislike it, the math is egregiously otherwise

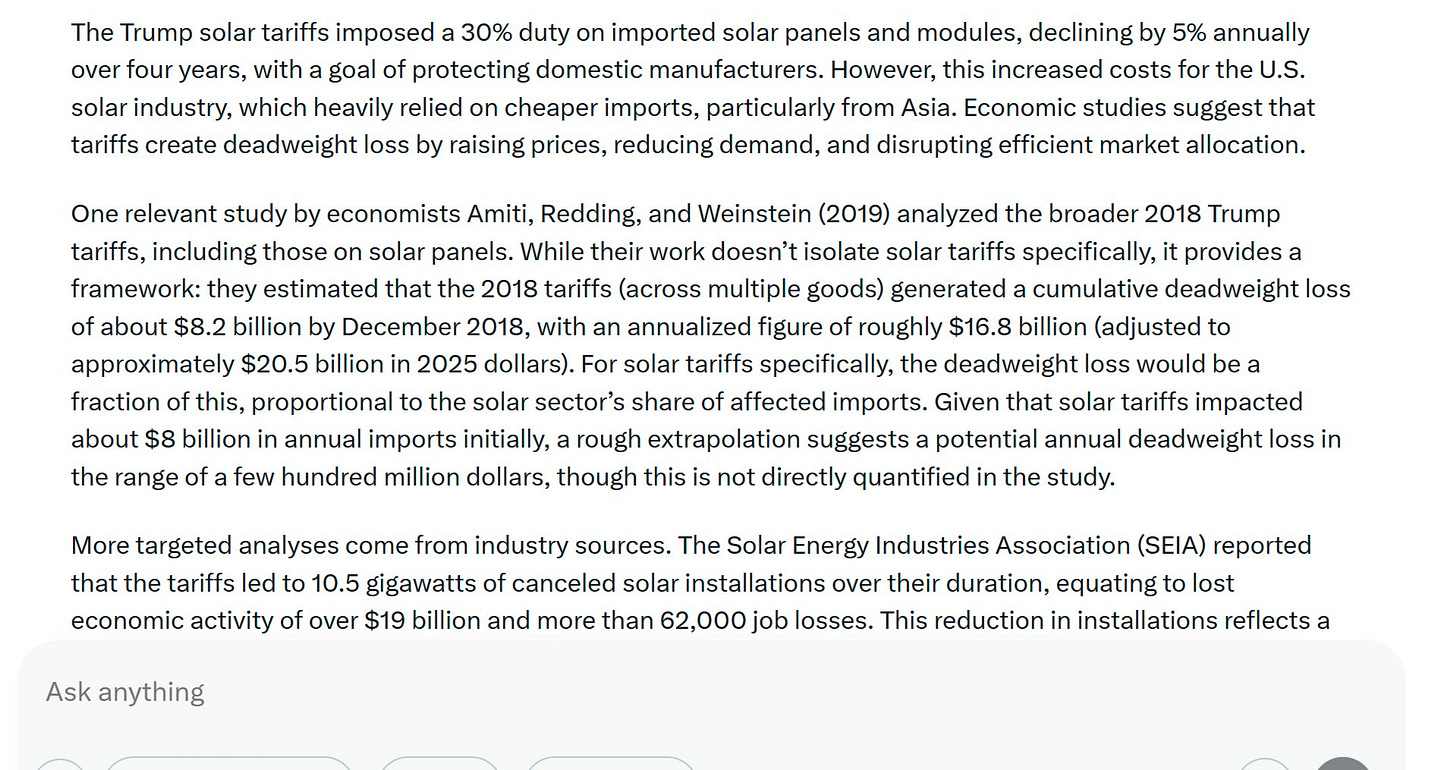

trump’s steel tariffs, for example, cost consumers $900,000 for each job created. washing machine tariffs cost $820,000 per job. this is alarmingly typical.

here’s an analysis of the solar tariffs, an especially stupid example as it was for an end product that probably lacked any actual commercial viability absent regulatory mandate and statist subsidy:

this is where the deadweight loss comes from.

tariffs are fundamentally a form of tyranny upon one's own people, an impediment to free commerce and choice, a breakage of the price signal and of pareto optimality.

the only two potential economic arguments i can see for tariffs are:

1. as a bargaining tool to force others to lower theirs. this is fraught for a couple reasons not least of which is how rarely it seems to work historically. it tends to set off trade wars and higher tariffs. there's also an ethical issue: it's causing the citizens to suffer the consequences of this game of chicken without their consent. (even if 60% vote for it, 40% still did not consent)

2. as a replacement for income tax. there's an argument that a tariff is a less harmful and less distortionary tax than an income tax. there may be some validity to this. the issue is that you're never going to reach parity on tax receipts. to take in what the US does from income tax from tariffs would require 100%+ tariffs on all imported goods. of course, if you did this, demand for imports would plummet so the whole thing becomes impossible.

let’s look at each of these in turn.

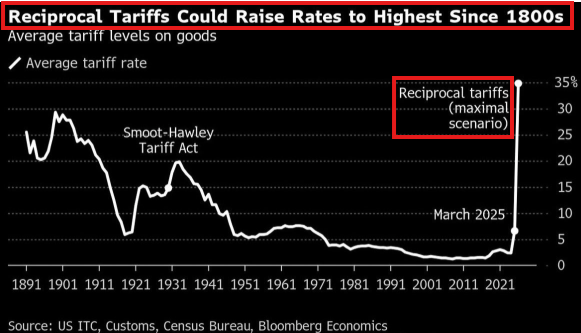

firstly, the whole manner in which trump imposed these “reciprocal” tariffs is fundamentally unsound.

firstly, it was based only upon goods and not upon services, so right there, you’re already in weird water, but far worse, it’s based in the sort of populist economic illiteracy on trade balances that makes no sense. it took the amount of a nation’s 2024 goods-trade imbalance with the US then divided that by the value of the goods america imports from that nation. it’s a meaningless figure indicative of nothing of any real substance apart from “we think unilateral trade balances need to be fixed.”

“Drop your trade barriers…and start buying tens of billions of dollars of American goods,” Trump said Wednesday.

this is a bad look, at once fascist in the sense of command and control nation state level diktat on commerce and dangerously economically illiterate.

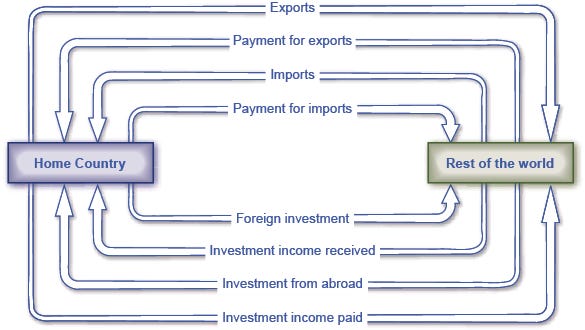

a trade imbalance is not an inherently bad thing. it can be a very good thing, a beneficial thing. this idea that if we buy $50bn more goods from kermeowistan every year than they buy from us that it implies that they are somehow “taking advantage” or this this is “unstainable” or negative is flatly false. it’s actually ridiculous. it ignores complex trade flows and balancing factors like “capital flows.”

people really seem to struggle with this, but it’s not that difficult. you’ll will have a large lifetime trade deficit with the grocery store. you will buy much from them. they will buy nothing from you. is this a problem for you? is it unsustainable? most people seem to sustain this beneficial grocery trade their whole lives.

why is it any different if it crosses a border or gets aggregated by nation? (spoiler alert, it’s not)

you’ll likely run a lifetime trade deficit with many countries too. you buy a BMW. that’s a deficit to germany. you run a restaurant in toledo. you have no german customers. does this fact harm you in some way? did germany take advantage of you? would it be better for you if we imposed a tax that made that BMW 25% more expensive? no, and if we do, it might create automotive jobs in the US, but the cost to do so is YOUR choice and your budget.

this is the key point:

those “created jobs” will come at many times the cost of the value they provide. so someone is losing somewhere, they’re just hard to see because “money that was never spent on ice cream” is impossible to track or attribute in terms of root cause. but it has to happen somewhere. that’s how deadweight losses work.

in the simplest terms, perhaps the US buys from germany, germany buys from france, and france buys from the US. trade balances but in a triangle. more likely, this has 100 parties to the chain. also more likely, trade does not balance. what winds up balancing it is capital flows, generally into bonds, stocks, and corporate or asset investment. so we buy german cars, the germans who get these dollars either trade them to someone or invest them themselves, and the money winds up in the S+P 500 or financing US federal budget deficits by buying treasuries. there’s nothing inherently bad about this. it provides a better cost of capital for US companies, lets them grow, makes them more competitive, enriches shareholders and underpins pension plans and endowments. that shuts off if you force trade to balance.

trump loves this because he loves making deals. you buy from caterpillar and i’ll drop the tariffs. but the desirability or justice of this is severely lacking. it forces commerce. this breaks the efficiency and pareto optimality of trade systems and the validity of the price mechanism. it’s also “the US consumer gets screwed so i can play to special corporate interests.” great for CAT and the few folks who get new jobs, but what about everyone else caught up in the trade war? who makes it up to them? a net overall loss is still a net overall loss and this idea that we’re going to arrive at free trade for all looks fraught.

trying to balance all bilateral (or even aggregate) trade is a fool’s errand and the very quintessence of a stupid game from which one will win stupid prizes from playing.

the big question that emerges is how much of this is sincere and how much is just high stress posturing for negotiation. i’m not sure anyone really knows, including trump.

dealmaker don has, honestly, outperformed what i would have expected on driving some others to (at least signal) a willingness to engage in reciprocal dropping of all tariffs bilaterally. this (as opposed to trying to force balance bilateral trade) is, at least, a clearly good outcome. and the US had some clearly very strong cards to play.

the US position here is far stronger than many of our key trading partners. “exports to US are 76% of canadian exports and 78% of mexican, 19% and 37% of respective GDP’s.

the US only imports 14% of GDP overall, 4% of total is from canada and mexico (combined). if such is the inclination, it’s a strong hand to inflict pain in order to drive a free trade deal.” indeed, within hours of Trump’s press conference, it appears that canada is already putting “we’ll drop all of our tariffs on you if you drop all yours on us” on the table, though the signals are far from clear and the deals far from done. this would be a big win for trump and for the US consumer (though the thorny issue of non-tariff barriers remains).

others will start to fall. it looks like mexico, viet nam, india, argentina, and israel already have and while the last 2 have immaterial trade with us, the others are significant. this is ~1/3 of all US imports moving to a “free trade no tariff system.”

it’s also about 28% of US exports so this is a win on both sides and should provide some benefits to US exporters.

it’s good news, but it’s also likely not nearly enough to offset the bad, at least not in any sort of short term timeframe.

the argument that it’s basically global trade oncology to kill the cancer of protectionism and open up a new order once the course of treatment is done is a possible outcome, but it’s an expensive one to reach and far from certain.

china and the EU are not our friends on this and their business interests have plenty of sway to keep their ill gotten mercantilist preferencing. they’re going to fight.

and “Trump has said that he will not make a deal with China unless the trade deficit is solved." which is both pointless and improbable so this likely has some legs to it.

i have a nasty suspicion that deep down, don is pretty mired in long debunked 1700’s level economic theory and the sheer magnitude here could be historic (though i suspect the maximalist case is off the table).

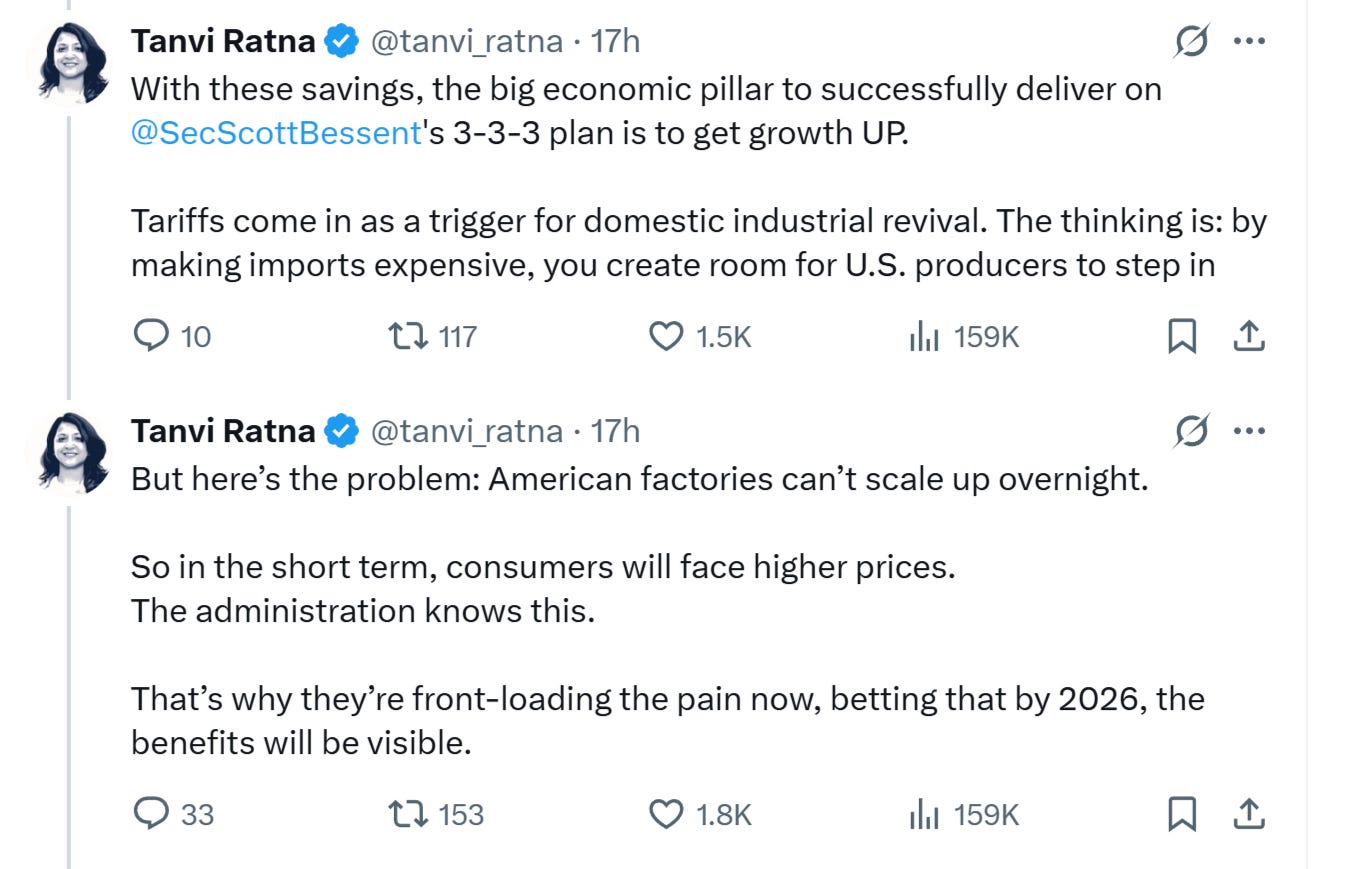

for those that want to read a counterpoint to my take (and people should always make sure they understand the other case) this seems to be a good example

where i really find fault with it is here:

this assumes that mercantilism is a positive sum strategy, one that drives onshoring and net growth over time. but it’s not. it’s a repudiation of the ricardian benefits of comparative advantage to increase overall production and consumption frontiers. mercantilism is a negative sum form of crony capitalism. if it weren’t, we’d all long since have devolved into autarky economies as an optimal state.

you cannot protectionism your way to greater prosperity. it’s just needless (but unavoidable) opportunity cost.

and that leaves us here:

essentially, this is a highly levered bet that we can drive enough free trade to swamp the damage of trade war.

as we saw above, that’s a pretty iffy proposition and one unlikely to pay off especially as resource constraints bite in the US. you cannot just scale up to produce mass exports without using resources (especially labor) that would have been used for other things. higher wages without higher productivity = higher prices and the loss of the benefits of specialization and trade are large.

the other line of argument here seems to be that “well sure, tariffs are disruptive and non-optimal, but not compared to an income tax so swapping them out is good.” in fairness, this may well be so. i can certainly see how one would make this argument, especially around the higher growth rates from lower income tax (esp cap gains) and the hideous distortions it produces when used to fund a welfare state. taxing success and subsidizing failure is about as non-optimal as one can get for economic growth.

before we can even assess “is this a good trade?” we need to ask “is this possible?” and the problem would seem to be that “no, it’s not.”

here’s the math:

trump’s ideas about replacing the income tax with tariffs seem mathematically unworkable. tax receipts in 2024 were $2.4tn for income taxes, $1.6tn for FICA, $250bn or so from cap gains, and $420bn from corporate tax rates. the total is ~$4.7tn.

the US imported $3.35tn in goods and $814bn in services in 2024, $4.27tn total. to replace income tax, you’d need a 110% tariff on all goods and services (obviously, this is spikes to 157% if we take out the 30% delineated above as free trade).

that’s impossible. if you imposed it, trade would dry up to dramatically lower levels and receipts would plummet. even if we kept FICA, it would be 73% tariffs. same problem.

the simple fact is that back when the US federal government was funded by tariffs, it was about 2% of US GDP. now, it’s 24%, often more. we could, of course, massively cut spending but that takes slashing entitlement spending. i suspect that ~10-20% of social security is fraud and more like 30-40% of medicare/medicaid. even at the high end of those, you’re only cutting about $1tn a year. great start, but you’re still spending $6tn a year, and even if you keep FICA, you’re not going to cover the remaining $4.4tn a year with tariffs. barring massive additional spending cuts (which i’m all for but find implausible in political practice) the basic idea of “we can move to a tariff funded government) looks like fantasy island.

so, all in all, i have to come down against this system of tariffs. it’s just looks like a seriously bad choice in service of bad economic theory and worse ethical foundation with regard to personal liberty and free agency.

i think it’s a mistake.

worse, i think it’s a distraction and a subtraction.

the US does need to grow and to get back to the faster growth rates we once enjoyed. we need to do it while slashing deficits and balancing the federal budget before the debt levels get any more out of control. those are important and achievable (albeit reach) goals, but goals that will take tough action, tough choices, esp on entitlements, and that would inflict a fair bit of near term chaos and economic slowdown from slashed federal spending all on its own.

but shredding regulation and stopping government spend and interference in markets WOULD, once through the adaptation period, free us up to grow again. it would stop crowding out investment and taxing to fund malinvestment. it would stop picking winners and losers in markets and let them find efficiency. it’s the step back to take 3 forward. mercantilism is a step back to take a step back. it’s the path to crony corporatism, not to robust resurgence in manufacturing. that’s the nature of negative sum games.

i’m with conks on this one.

i know people love to make the “well if tariffs are so bad, how come everyone imposes them!?!” argument, but this is a bit like saying “well, if corruption is such a bad thing, why are all governments corrupt?”

tariffs persist because the people who benefit from them pay for play. the “protected” industries make big donations and lobby. they help pander to populist sentiment that they have “created” or “protected” jobs by pointing to the “seen” factories they opened and ignoring the unseen larger number of businesses they drove under or that never were as a result. they generate political support for a regime of plunder because most people simply lack the economics grounding to impute the unavoidable net effect.

perhaps i’ll be proven wrong and this will wind up being the deal of the century and usher in a new world order of widespread free trade and benefit as a tough negotiation toward noble ends, but i doubt it. too many cronies benefit here and they are too entrenched and while there are some early victories, china and the EU are going to set off trade wars in earnest and the US is going to drive them together, especially as the EU keeps going full fascist and totalitarian.

they look to be gearing up to fine X for “disinformation.”

and won’t that just calm things down…

we’re living through a pivotal time, a time of great choosing and change in the american and western zeitgeist.

there’s lots of work to be done, important work.

that’s why, even if one believes in the idea of “forcing a new world order to emerge by inflicting pain on the unfree traders until they capitulate” i still struggle to see how this should be making it to the top of the priorities pile, and it’s alienating allies left, right, and center, unbuilding the bridges trump and DOGE had built to the middle.

it feels to me like a pump in the spokes of the work that ought to be the great focus right now and like hubris, a presumption and a desire to play “dealmaker” with the livelihoods and consumption of others, an aristocratic game where the commoners are the cannon fodder.

with so much positive sum opportunity to drive american growth and prosperity, laying around, i just cannot see any justification to focus on this.

i’m sure this is going to be another comments section for the ages, as ever, have it it, just keep it civil and reasoned.

i would note:

if you cannot fluently explain the difference between absolute advantage and comparative advantage and why even a society with an absolute advantage in the production of all goods and services still benefits and expands its production and consumption possibility frontiers through specialization and trade based on comparative advantage and why that expansion is a clear benefit to (in aggregate) consumers and producers alike and why its disruption is always and everywhere a deadweight loss (opportunity cost), you really might want to be careful opining too much on trade or tariffs.

this constitutes the most rudimentary table-stakes of understanding here, the absolute minimum quanta of useful knowledge.

the benefits of specialization and trade are one of the few truly non-intuitive bodies of economic work. about 5% of people actually understand ricardo. (this is probably generous)

Agree long-term. And as a libertarian the tariff war is antithetical to our ideals.

They are indeed a net-zero sum game....BUT sometimes you win by losing the slowest.

Sometimes you have to knock over the checkerboard, just to show that you can. And just as importantly force other parties to reveal their hands. I think hes just playing "political aikido". Thats a game we will win.

I don't see Trump using tariffs as some ideological bent. It's not as much about using tariffs as a way to reset trade, but more about resetting EVERYTHING. In most cases, if one person in a "boat" starts shooting holes in the bottom, you shouldn't start shooting holes to fix it...unless you have an extra boat and the other party doesn't, and you have a life preserver to save anyone you "need" on the "new" boat.

I wouldn't get too "worried" by what all these so-called experts and politicians are saying.

They're the same people who want us to keep doing what got us $40 trillion in debt and hollowed out our manufacturing base, while they fattened their wallets, all the while the American worker became more productive but got paid less

OK, I'll sit back to have my knuckles swatted...;)

Tariffs are indeed a bargaining tool. This is the purpose. We need to zoom out and take a breath.

This was the last chance to save the dollar. And the gambit may very well work.