central bank digital currencies and banking crises

how do you get people to leave banks for a CBDC?

longtime gatopal™ jordan schachtel published a very useful piece on the impending shot at central bank digital currencies in the US.

you should read it.

because as JFK famously said:

you can access it here:

jordan lays out the risks and threats of a CBDC. in a nutshell, this is government digital currency. this means they really, truly control the money. it means they can take it right out of your account or fine tune what you are allowed to do with it.

it means they can decide if you are allowed to spend it and on what.

it means they will have instant knowledge of all your transactions.

it’s the end of privacy and agency.

it’s not just a bad idea.

it’s a true blue, no fooling around, weapons grade bad idea.

and it looks to be coming.

this july.

now, the thing about a system like this is that it’s painfully obvious that

this is the febrile fascist fantasy dream.

and to willingly put your head into the mouth of a lion like this, you need serious ignorance or serious incentive.

and they cannot count on ignorance.

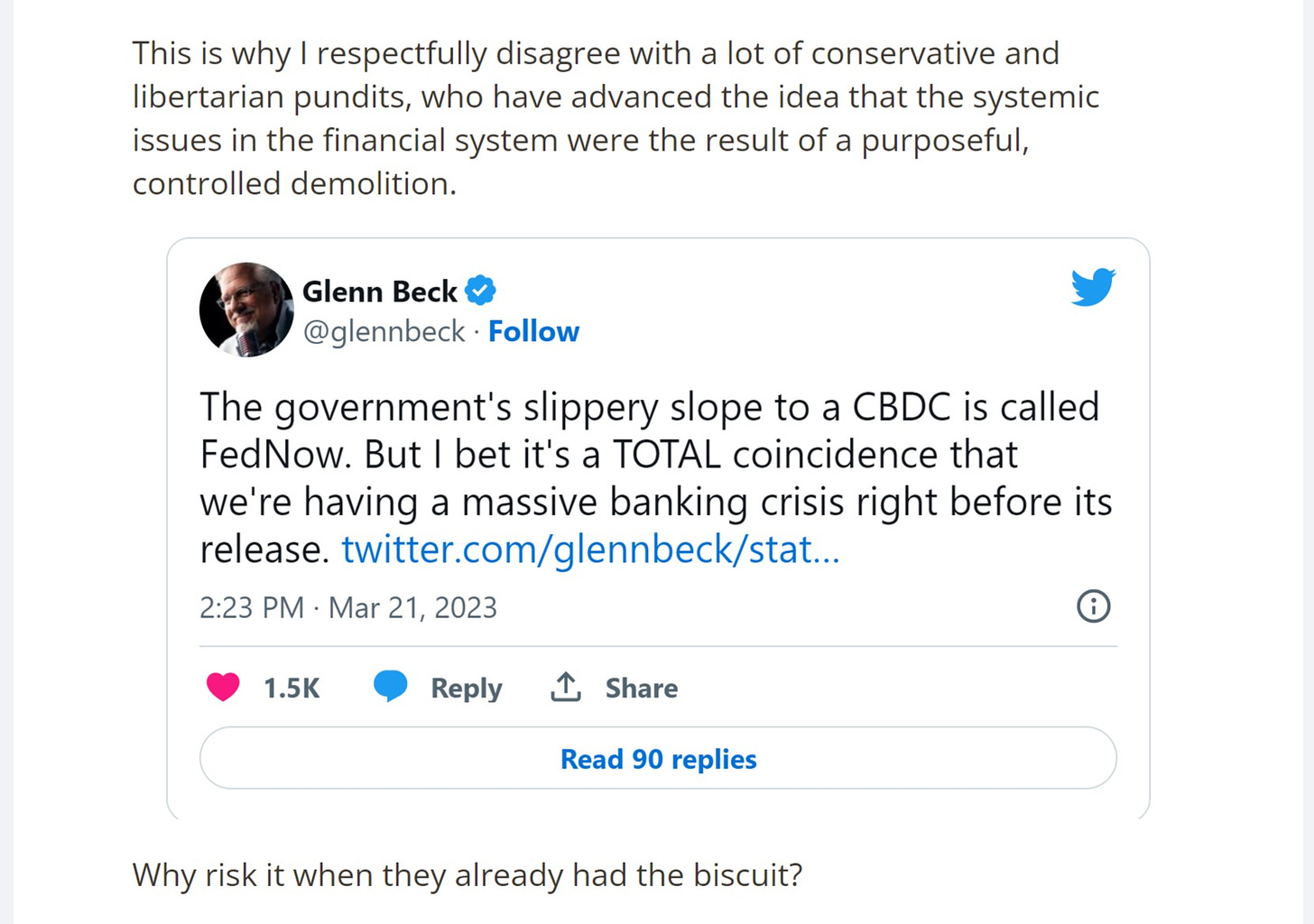

and that is why, in the interest of extending and advancing the discussion here, i’d like to take the other side of this argument from jordan:

there is a strong reason to risk it.

because that’s HOW you get the biscuit.

most initiatives like this are stillborn. they just die on the vine because nobody trusts them or wants to use them.

you cannot just mandate it.

they have to WANT to use it.

and it’s not terribly implausible that the same funhouse gang that brought you “the last 3 years” will go back to the same playbook:

crisis and fearmongering.

in “red october,” how did jack ryan convince ramius to get the sailors off a nuclear submarine?

by making it look too dangerous to stay.

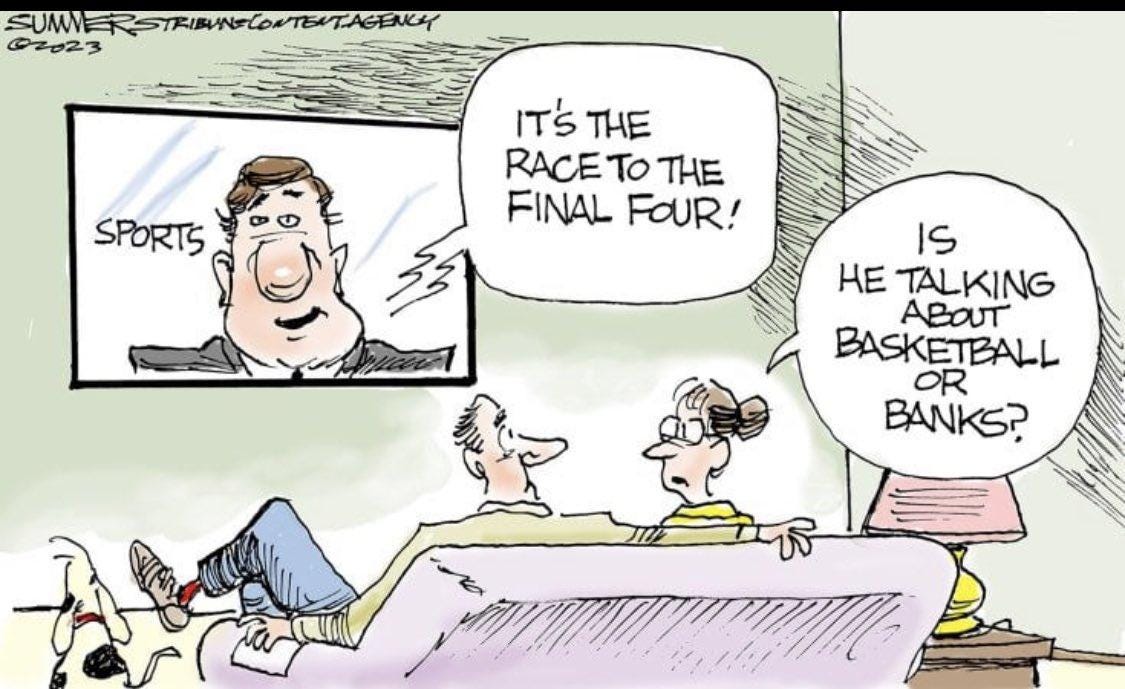

how do you get people to take their money out of banks in droves and put it into the new fednow CBDC?

you got it:

by making it look too dangerous to stay.

people are nervous and banks are un-assessable black boxes that drive banking crisis groundhog day.

and the federales want more concentrated banking that’s easier to control.

CBDC would be a big help as the US gov’t goes insolvent from $100tn of unfunded liabilities.

so how do you get there?

being able to siphon deposits over $250k would lead to A LOT of money into CBDC if you make it 100% guaranteed. it captures the rich. it captures a huge number of businesses and most of the big ones. it’s the easy peasy lemon squeezy low energy path to push a couple trillion dollars into your new scheme in short order and make the banks all clamber to adopt and support it so they can keep the cash as deposits.

it’s a perfect hammer and anvil where they create bank runs to CBDC and then drive instant bank adoption to keep their liquidity.

you could have this in widespread use nearly overnight.

i’m not usually proponent of ascribing strong plotting ability or even rudimentary powers of finding buttocks with both hands 2 times out of 3 to this gang, but this one is so easy and so obvious that even the menacing midwits of the treasury-fed multiplex could figure it out.

did they set it up on purpose? i doubt it.

will they see the shot and take it opportunistically?

i would not underestimate it as a motive or for a reason to keep this “crisis” bubbling along at a low boil while stoking enough fear to add some stick to whatever carrots they have dreamed up here.

it’s really a bit perfect.

they scare you out of the frying pan and onto the skewer.

and by the time you realize it,

this is not one you wanna fall for.

i have not forgotten about the post on “so how do we fix banks?”

will get to it soon.

The major issue is that there's no practical difference between dollars printed out of thin air and dollars printed digitally. The 'experts' can pretend that the digi dollar will stabilize the system, but that system is destined to crash exactly the same as this one is -- this is just another way to kick the can down the road.

I pay in cash as much as possible. If my local chain grocer goes to electronic payments only, I’ll find an independent grocer that accepts greenbacks. Screw this Fedcoin; credit cards are bad enough.