much mirthiness has emerged around kamala’s newfound penchant for truly terrible economic ideas, and her new “you get a “free” $25k down-payment as a first time home buyer” is no exception. but at least with kamala you can put it down to “populist pandering” and “buying votes, especially from immigrants and illegals” as a cynical political ploy to win office.

it’s long been known that democracy dies in goodie rooms, but this does not stop the politicians who compete to speed that death along. this was a solved matter (in terms of understanding, obviously not in practice) at the time america was born.

this is just another politician buying favor with the demos’ own funds and playing patronage games around who shall gain and who shall pay. my gang gets free stuff. your gang foots the bill.

so far, so predictable.

what amazed me are the truly astonishing takes that allegedly sophisticated people have on this.

i’m going to pick on mark cuban here because, well, picking on mark cuban is fun, the man clearly cannot think in anything beyond cursory first order fashion, and let’s face it: you can always count on mark for some of the the worst economic takes in town. it’s like krugman with a basketball team.

just about everyhting about this analysis is wrong.

"the seller will not adjust the price" despite some buyers having a $25k subsidy?

can he be serious?

has mark ever actually participated in a market?

of course sellers (as an aggregate) will. the whole point of such markets is best bid discovery and such data always and inevitably emerges.

the market for a home (or any specific item) does not clear at just any price. it clears at the best bid, the highest bid. if some have extra money to put toward this then it is their bids that matter. everyone else just does not get to buy or has to pay higher prices to do so.

there is no way this information will remain opaque to realtors or mortgage brokers or that those with subsidies will not simply outbid those without until the equilibrium is higher. this works just like offering some people subsidized rates or lower down payments. remember how that worked out?

even by cuban standards, this is a serious econ 101 fail.

but even that is a gross understatement of how aggressively this will cascade through a system because he’s looking at the whole of the process as one simple single order effect. but it’s not.

consider: this first time buyer is buying the home from someone, probably an existing owner. the extra $25k they wind up paying goes to that owner. they are likely looking for a new home as well. and guess what they have? yup. more money than they would have otherwise had. so they can bid more and outbid others on their new home too. and when they buy, guess what happens again? yup. see the chain of events here? see how quickly this spills through a whole market and not just those at which it was targeted?

and as all these people have more to spend, they WILL have to pay more because they are competing with others who can also pay more and everyhting will get bid up as more money chases the same assets.

but this is not even the bad part.

this whole policy gets MUCH worse and will likely lead to serious overshoot. here’s why:

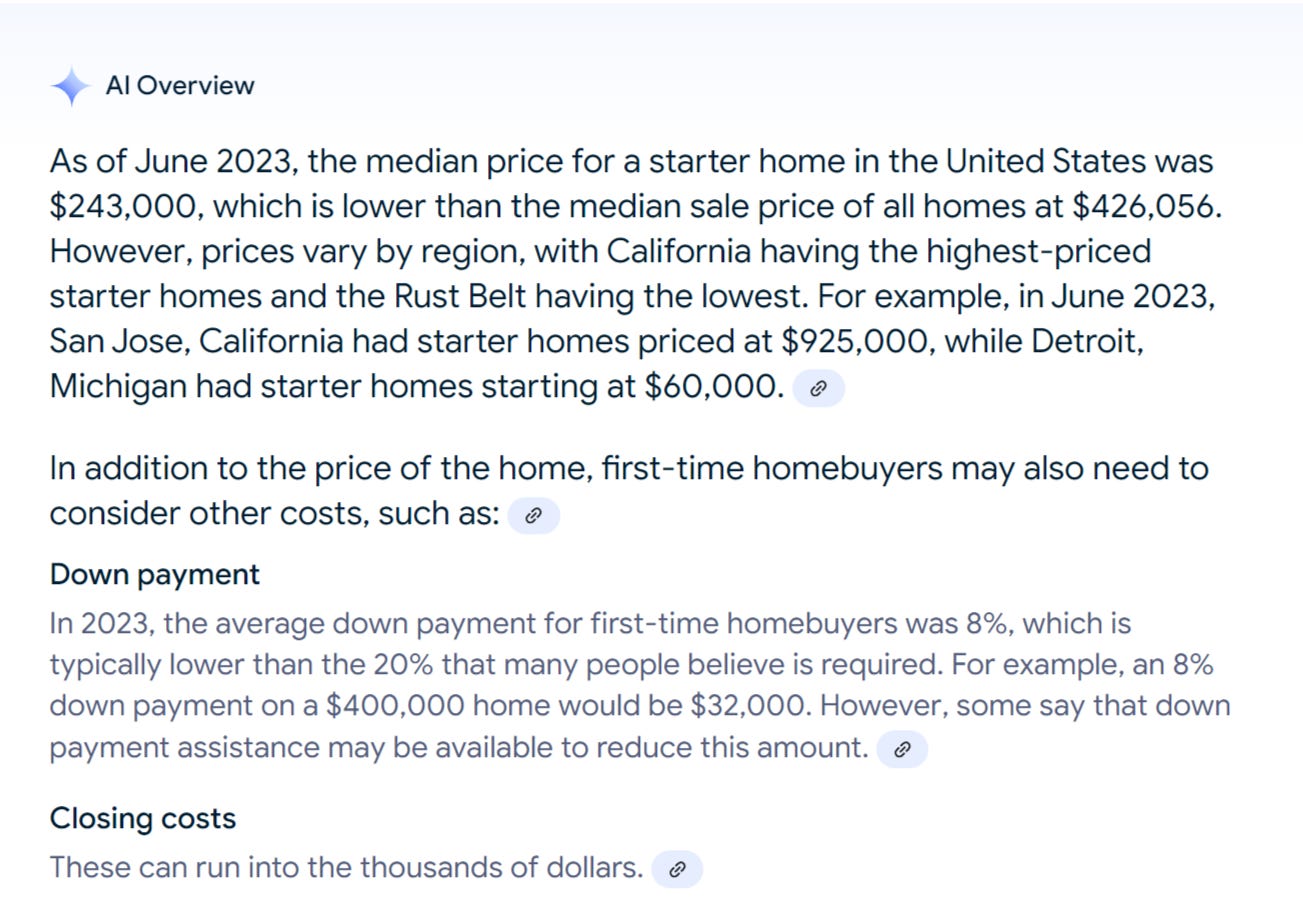

this is data from the national association of realtors and bankrate data. it seems to be sound. (i’m a bit of a tourist in this data, so if people have better sources, let me know)

8% down payment on a $243k starter home is only $19,440. see where the bidding war immediately starts to ramp up? why not spend the full $25k down, it’s free? this will:

induce a staggering number of new buyers to enter the market, especially in low price areas like detroit where this might be ~40% of the whole purchase price

drive down payment size to at least $25k and likely higher as people will compete to go cash in on top of the subsidy. by the time this is said and done, you could expect equilibrium down payment to rise from $19k to over $40k and prices will rise with it. you’re going to equilibrate at pretty much the same monthly payment as before but with more money down to start. that’s how the competitive forces here play out as more bidders than sellers chase scarce homes. will this will place lots of homes out of reach of lots of people if they are not a first time buyer and do not currently own.

this will make basically zero difference in the high cost areas like california where $25k makes little difference on high average home costs. but it will inflate the hell out of the low costs regions and wind up actually depleting stocks of affordable housing in cheap markets while doing nothing about the high cost ones.

there are 1.7-1.8 million first time home buyers in the US each year. imagine what happens if this number suddenly surges to 5 million bidders (likely a low estimate) as suddenly down payments are “free” and people rush through the door to try to grab this benefit before the program goes away. (the US has 45 million renters, so this is not a crazy estimate and could well be low)

only 4.8 million housing units were sold in the US in 2023.

assume the typical 3-4 or so million of other buyers are still in the market

suddenly you have 8-9 million people chasing 5 million homes.

the price rise will be instant. there will be SO much money chasing SO few units.

and it will not be responsibly allocated or covered in terms of affordability. remember sub prime and how people got in WAY over their heads? if your bet is “humanity has gotten smarter and better at finance and won’t make the same mistakes again,” well, i’m making a market on the other side of that one.

this is the wrong solution chasing the wrong problem. it’s just dumping more money into a market and expecting “affordability.”

visit any grocery store.

it does not work like that.

if you boil this down to utter simplicity, it’s really this simple:

subsidy is demand stimulation. you cannot make something more affordable by simulating demand.

the real answer here comes from the supply side because the problem is a supply side problem.

that is the part of the market that has been broken and that needs to be fixed.

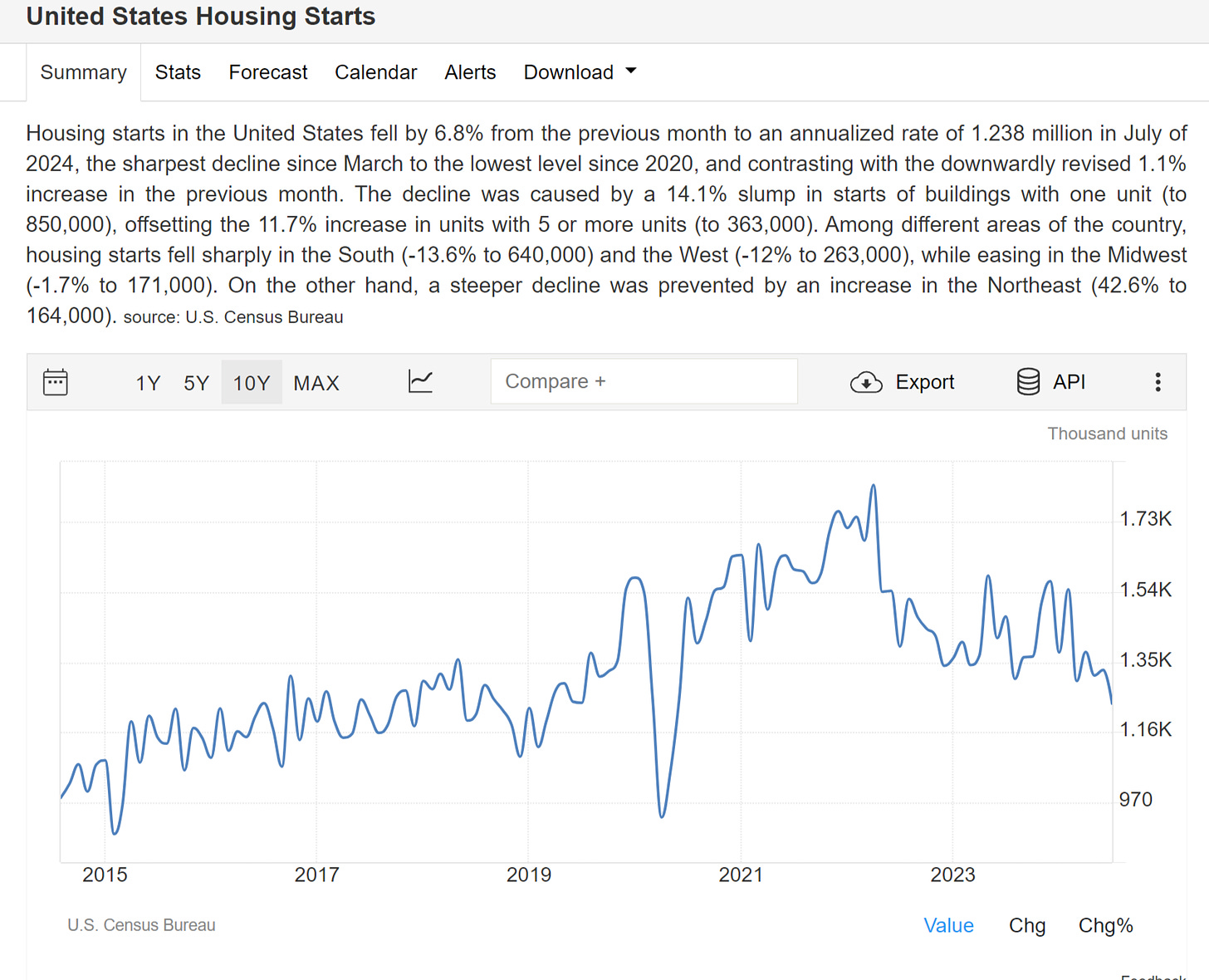

only 1.4 million new homes were started in 2023.

the current rate is more like 1.2.

and if you want to find the real problem, that’s where it lies.

obviously, home prices are a complex and multifactorial issue around economy, desirability, population flows, income etc. but in free markets, the cure for high prices is “high prices.” they induce more supply to enter a market because price is a signal to producers. and when that signal fails to elicit response, it’s because someone (usually government) broke a market.

and you can see it play out in a great many places.

if you want to know why some markets are absurdly expensive and others are affordable, here’s the answer:

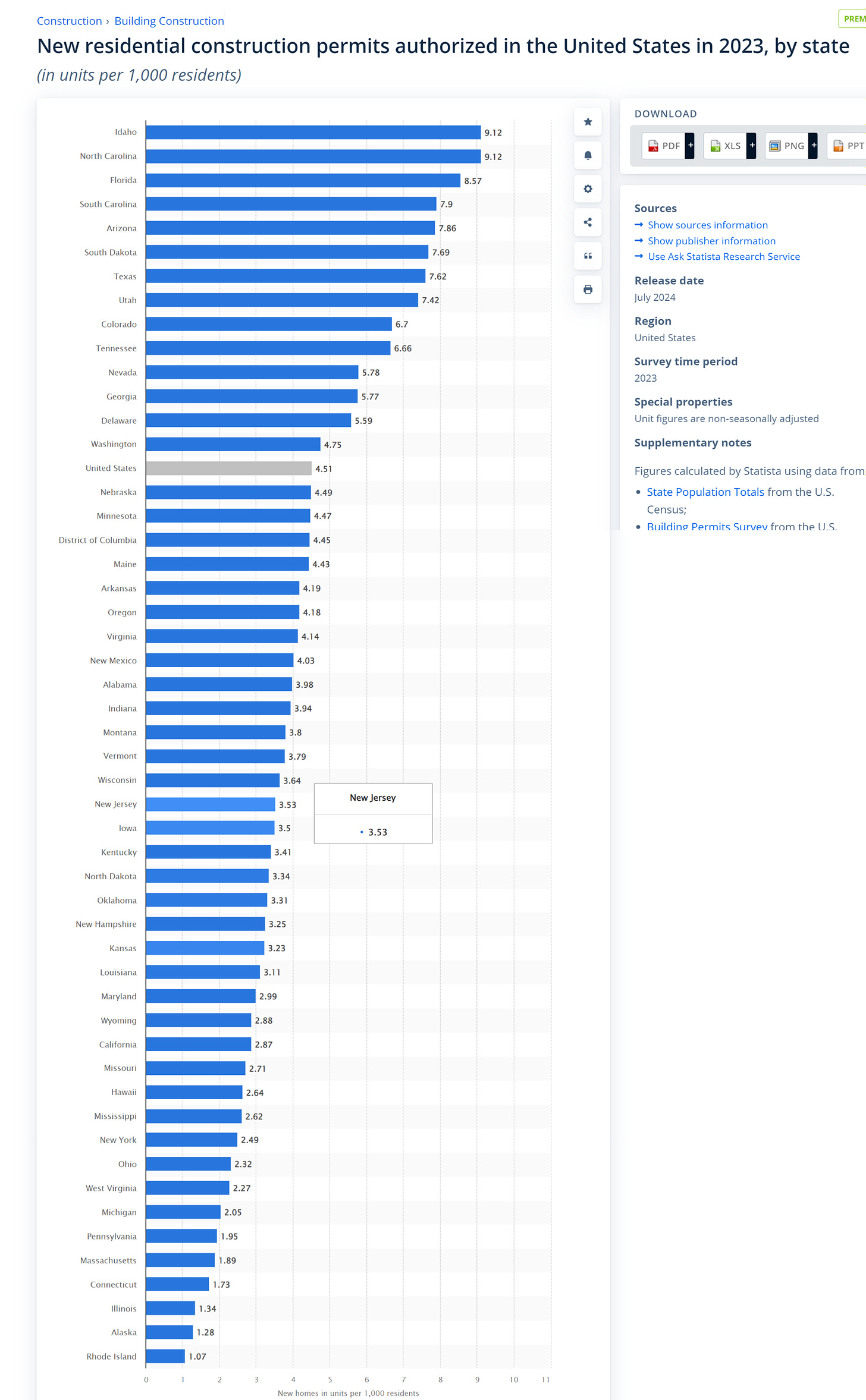

only 14 states are above the US average. that’s remarkable. it speaks to the concentration of housing construction in just a few places.

and many of the places with the highest prices have the lowest construction.

that would not happen naturally if a market were free. it indicates that something is distorting supply response.

it breaks out about like one would expect.

california, population 39mm builds only 80-85k new homes a year.

illinois population 13mm builds fewer than 10k.

new york state, population 20mm builds around 49k.

texas, population 31mm builds over 260k

florida population 23mm builds 125k.

arizona population 7mm builds ~35k

texas has built 23% of all housing in the state since 2010.

utah is 21%.

south carolina is 20%.

(source)

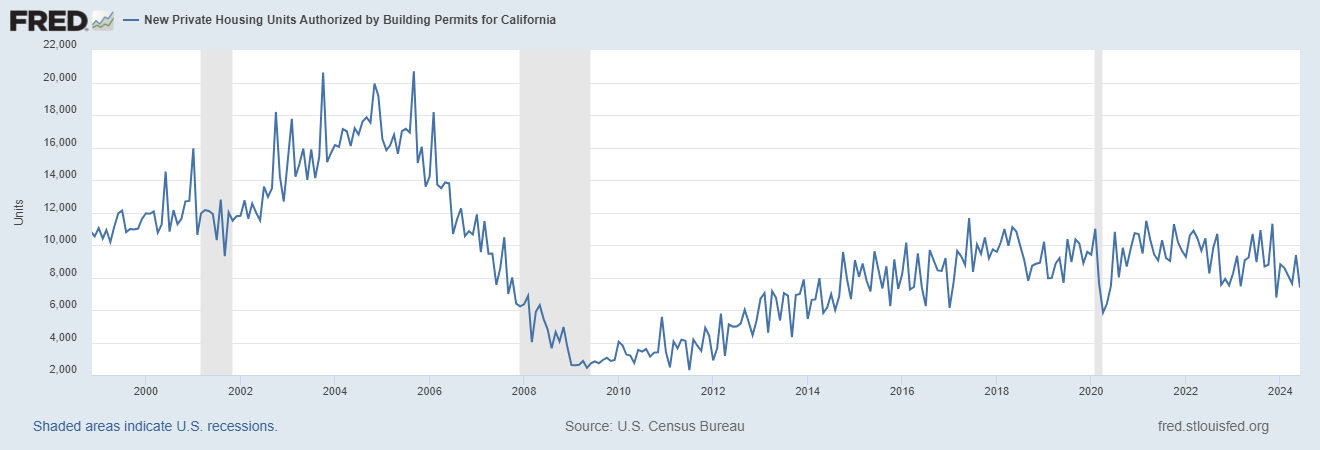

california is building 7,300 housing units/month and dropping.

you want to know why housing there is so absurdly over-priced?

here it is:

only ~1.3 million residential units have been permitted since 2010. and that’s a gross number, not a net one. it does not account for units demolished to make new ones or otherwise lost.

california has 14.4 million housing units. so, only ~9% built since 2010.

its prices are the highest in the US and near double the national average.

imagine what prices would be if california were not bleeding population…

again, the cure for high prices is simple: high prices.

that’s been working like a charm in texas and florida who are getting huge influx of population but are mostly managing to keep up.

so what’s wrong with the golden state?

why is a $900k median home price not attracting builders like jam attracts ants?

it’s because building in california is really, really hard. the regulations, permits, and demands are outlandish.

it’s really that simple.

throwing money at this problem will not and cannot solve it because markets cannot clear if new supply cannot be added. you’ll just get inflation.

the answer is equally simple:

build baby, build.

and to do that, you need to remove regulatory roadblocks.

get rid of the obstreperous red tape and up the supply of homes. this is, of course, something government can easily do and do for free.

it’s a simple, obvious, effective solution that makes literally everyone better off except for pandering politicians and a few connected construction cronies which, of course, is why they won’t do it.

they need to be seen handing out bags of gold, not working to allow market solutions.

and as long as we keep accepting these transparently facile plans and allow politicians to bribe parts of the demos with the money from the other part instead of running these shabby charlatans out of town on a rail, this is just going to keep getting worse and the awful 2008 playbook of “break a market with regulation and meddling, blame the market failure on the free market, and then use that as pretext to meddle and manipulate further” will be the modal outcome.

and that is a disaster curve.

it’s long past time to wake up and smell what is being shoveled here before we all wind up buried in it.

It's like what happened to college prices once student loans became a thing.

Commiefornia Commissar Kamala will fix home affordability like she fixed the border. Mark Cuban is the poster child of lucky and dumb. He sold his company to yahoo at an inflated valuation right before the dot com crash. Yahoo wrote it off a few years later. Mark bought the Mavericks with the proceeds, then played a smart person on shark tank. He is jealous of Elon and Trump because they are far more wealthy and charismatic than he is.