the key dimension of history is so often “fiction” that even saying so seems somewhat prosaic. it’s one of these ideas we all agree about but then say “well not my history!” and happily rally around our preconceptions or predilections and so the old saw of “you are entitled to your own opinion, but not your own facts” is oft espoused but rarely applied.

let’s take an example from glenn, who enjoy and respect on a number of topics but whose take here seems to warrant examination.

i choose this not to pick on him (again, i quite like him) but rather because this seems a good example of a common conception:

the free traders were wrong, ross perot was right, and NAFTA resulted in:

(to be a little cheeky)

but is this claim correct? is it “own opinion” or “own facts”?

let’s look at the data:

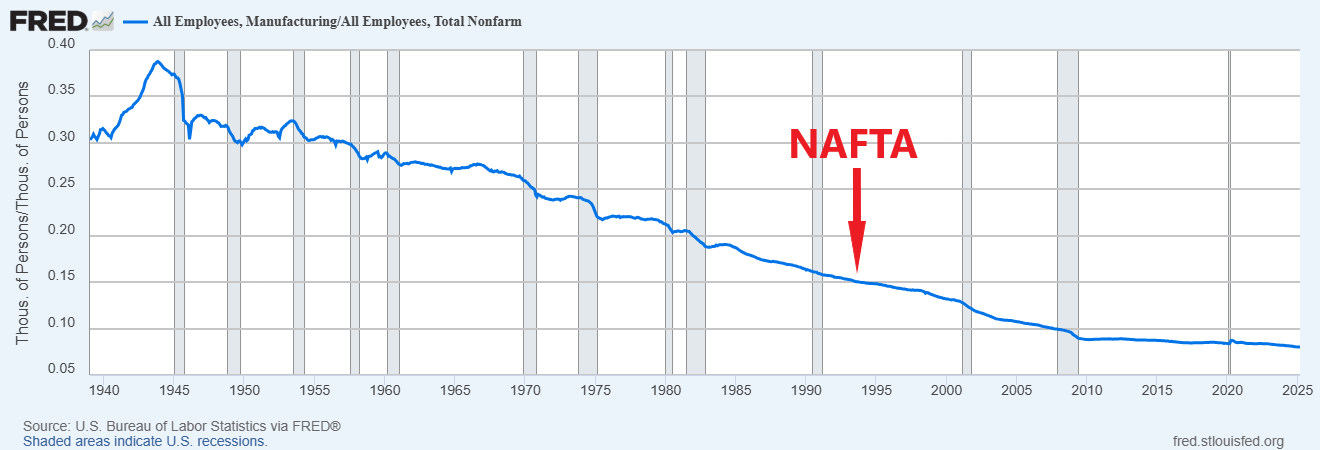

here's a chart of the % of US employment in manufacturing.

it had been dropping for 40 years before NAFTA and dropped for 15 more afterwards all at essentially the exact same rate.

NAFTA did not bend this curve a degree.

you literally cannot even see it.

this makes the idea that it had some sort of profound effect on employment look pretty implausible for while correlation does not prove causality, a lack of correlation sure does make causality unlikely and “the trend went on exactly as before post the thing i think should have affected it” is not much of a thesis upon which to hang one’s hat.

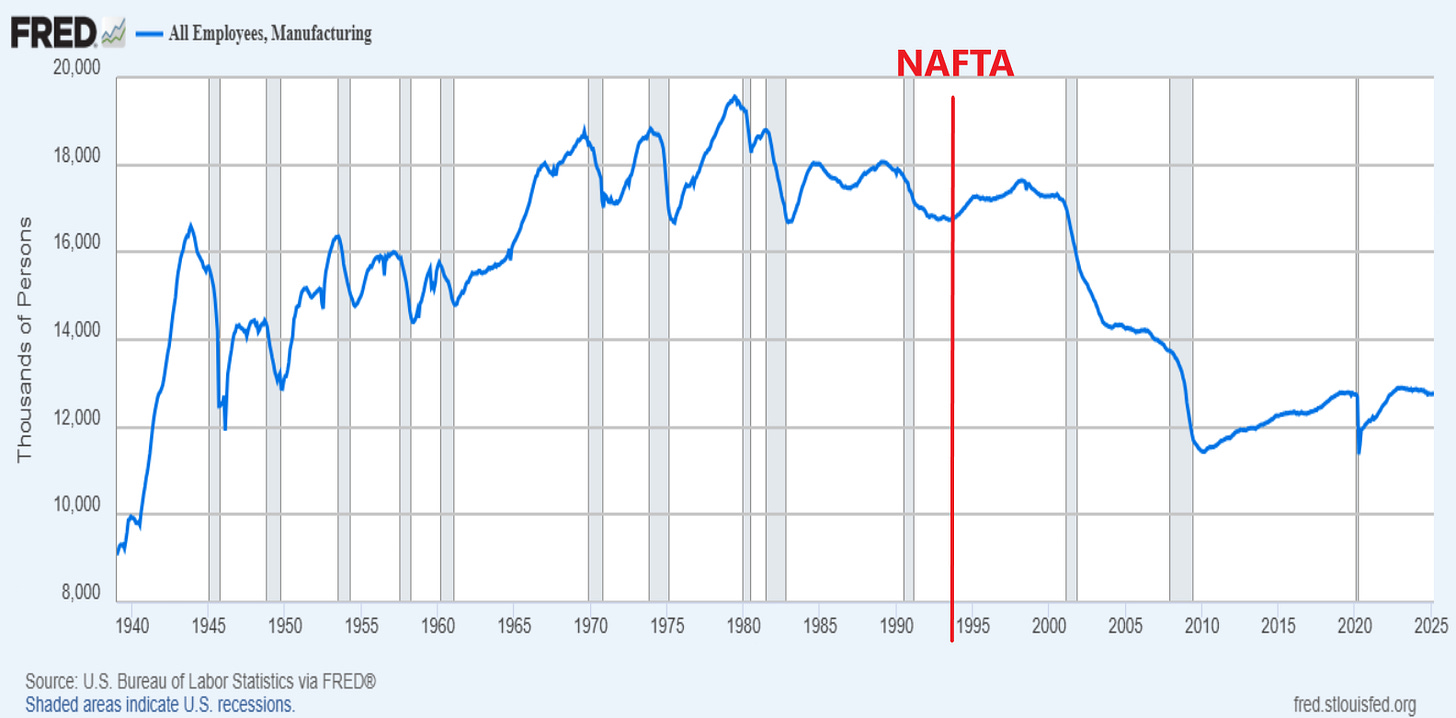

of further interest we may look at the absolute number of workers employed in US manufacturing.

this had been declining since 1979. interestingly, NAFTA coincided with a reversal in that trend and a rise in actual number of manufacturing jobs until the “dotbust” and ongoing post internet era and ZIRP drove a large decline and pushed folks into different sorts of assets and careers.

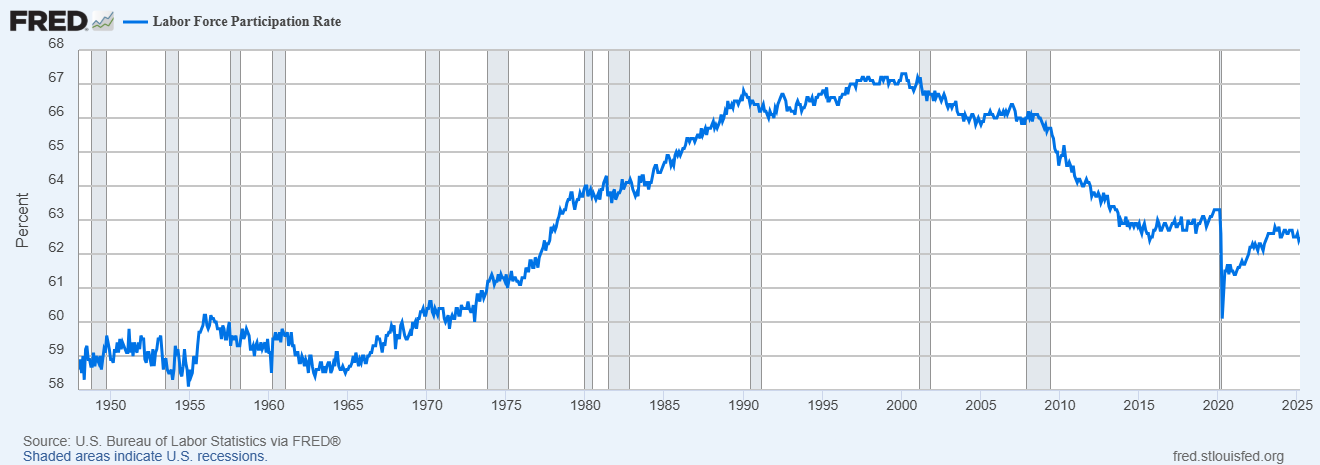

i suppose if one really tried, one could attempt to attribute this to some sort of “delayed blast NAFTA effect” but a lot of it was demographic and driven by drops in overall labor force participation and the relative attractiveness of a number fo new sectors for capital and labor.

i think it’s pretty thin to seek to implicate NAFTA here and to make such a claim would require some pretty compelling evidence that i have not seen.

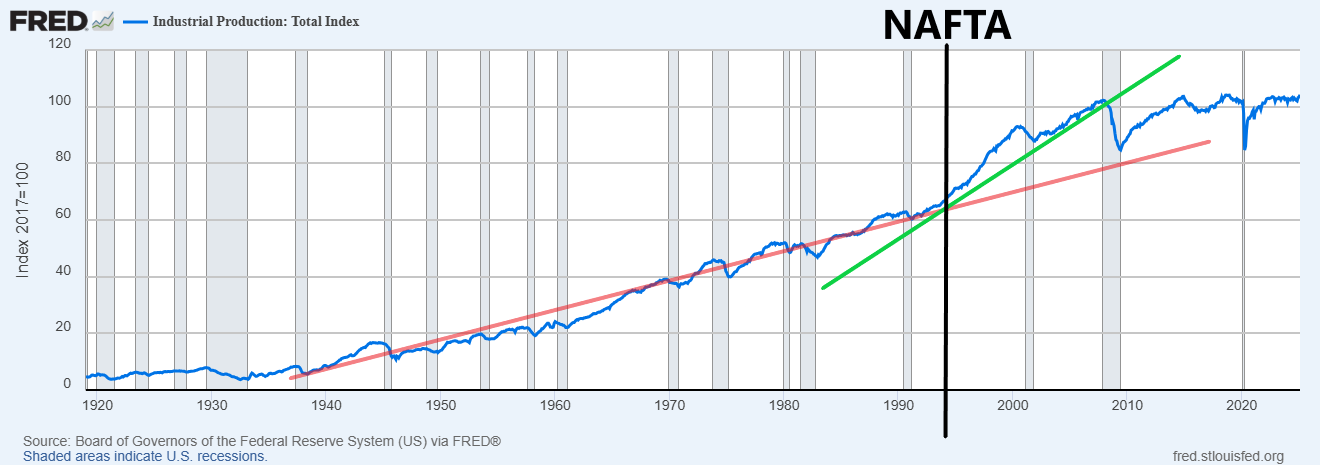

but something interesting did happen right about when NAFTA went into effect. US industrial production surged. (this index is inflation adjusted, so it’s a measure of real output)

in the 10 years prior to NAFTA, industrial output grew 24%.

in the 10 years after, it grew 39%.

that’s quite a material change. 2.2% compounding rose to 3.3%.

sounds small, but it’s not. it’s massive.

over a century, that’s the difference between being 9X the size and being 26X the size.

missing a tripling is missing the whole ballgame.

as ever, correlation does not prove cause, but this is certainly a provocative inflection point. US industrial growth jumped to a higher gear and ran there consistently right up until obama took office and derailed it with regulatory kneecapping.

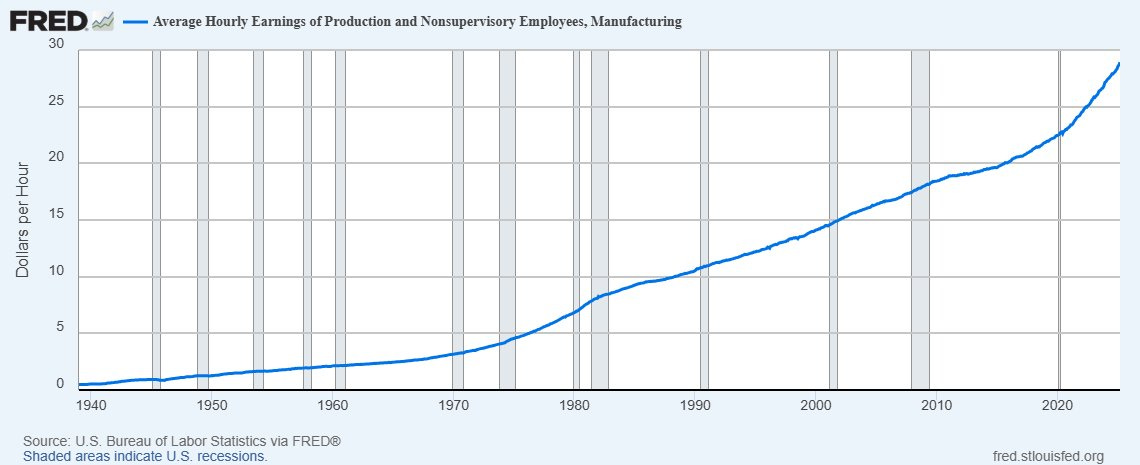

obviously, another possible issue is wages.

it's a good question, so let's look:

here's the raw nominal data: as can be seen, there's no visible change in jan 1994 when NAFTA began in jan 1994.

but i think this is actually a bit misleading

inflation rates varied widely over this period and obviously, people care about the buying power of their wages, not the nominal sum, so let’s put this in real terms.

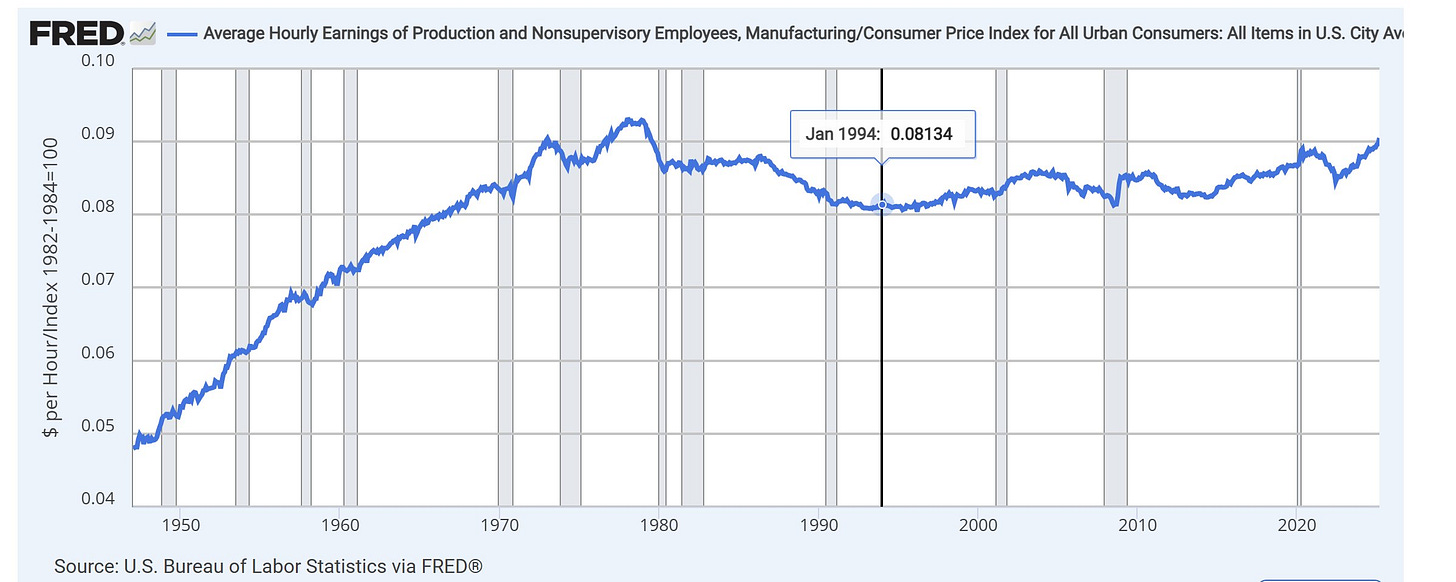

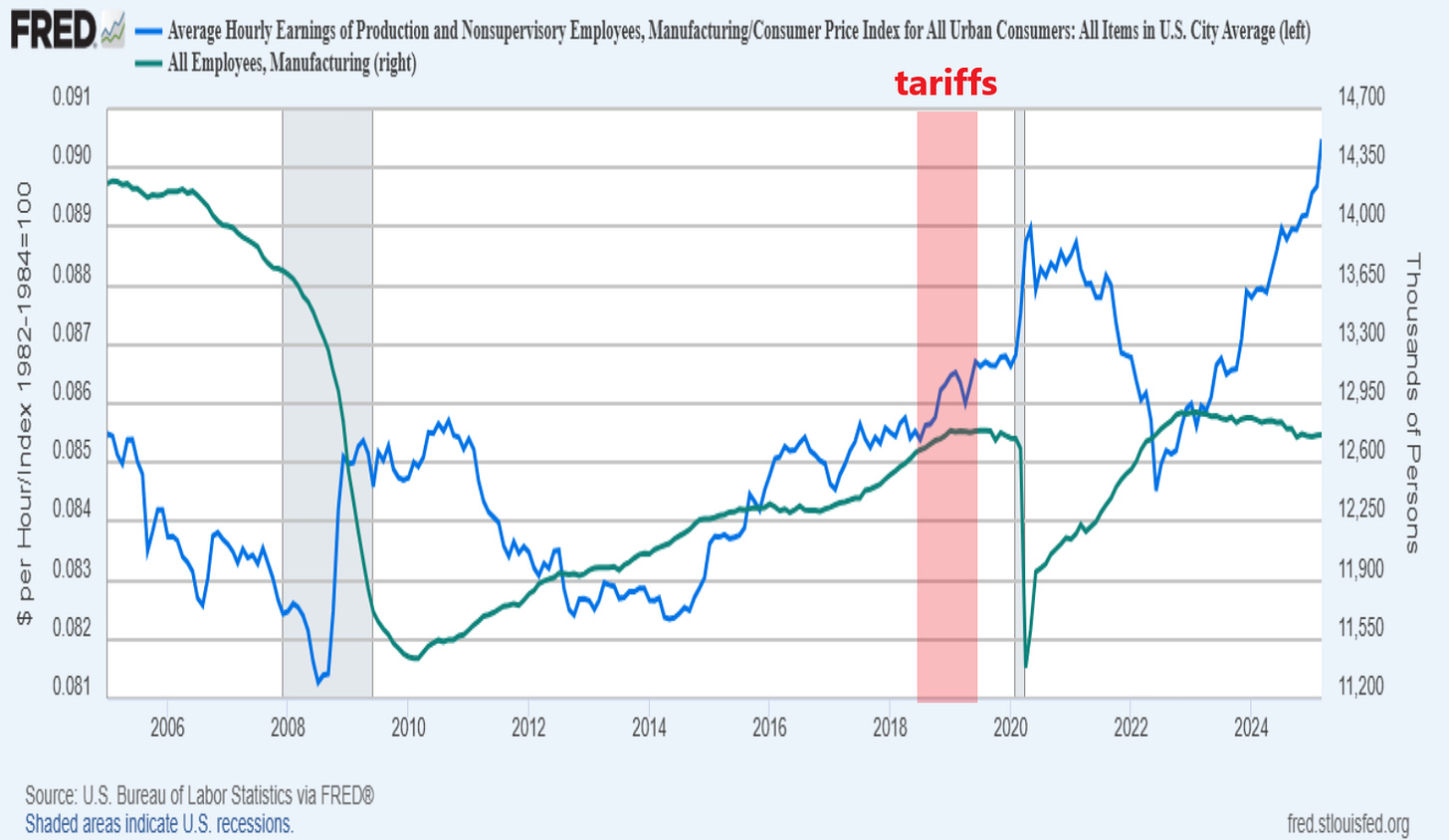

i divided avg hourly earnings for manufacturing by the CPI index. this gives us a real figure (it’s now just an index value and does not map to real dollars, so ignore the absolute value and focus on trend)

now we see a different picture.

real wages for manufacturing had been dropping since the late 70's.

in the 10 years prior to the trade deal, real wages dropped 7%.

in the 10 years after the trade deal, real wages rose 5%.

the change in slope (zero first derivative) is right about where NAFTA began, and obviously, people knew it was coming for some time before it started.

NAFTA actually stopped this decline and seems to have led to a bit of a rise in real wages and, like the production surge, the inflection point aligns quite precisely with the commencement of the trade deal.

as ever, not proof, but quite provocative.

inflection points around a presumed cause, especially when seen in multiple datasets start to look pretty persuasive on causality and we’re never going to have sharp edged perfection here: this is, after all, economic and we cannot perform controlled experiments and see counter-factuals. there is no placebo arm for economies.

but we can try to look at all the cases and similar changes.

“does your theory work in reverse?” is also a useful question.

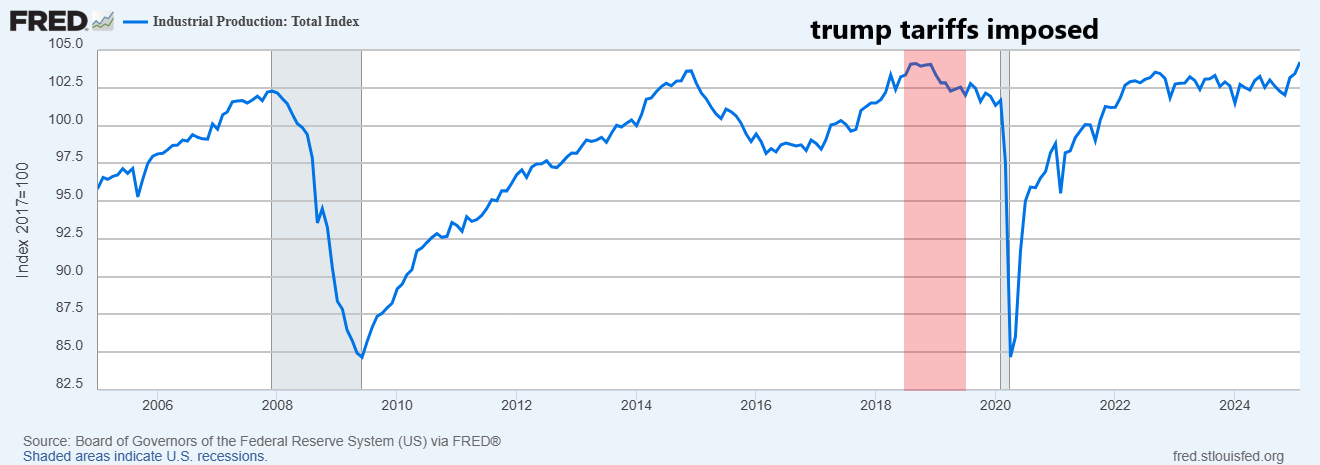

if freeing trade leads to higher industrial output and more jobs at better wages, what do tariffs do?

industrial growth reversed trend and started dropping during the first round of trump tariffs.

it peaked in sept 2018 and had been dropping for 17 months pre covid-lockdown calamity. again, the timing is highly provocative.

in this same period, we saw the expected spike in manufacturing wages that comes from protectionism (or any other monopoly or oligopoly).

employment trend remained unchanged for a bit then rolled over and started to drop pre-lockdowns. (obviously, lockdowns tanked output and employment and spiked wages and made an utter mess of the data)

this is exactly what the “theory” many people seem so anxious to claim “has been debunked” would predict in every single on of these outcomes.

free trade and specialization (especially as so much of what is manufactured is an input for other manufacturing) increase production possibility and overall output. this is good for productivity and productivity is good for wages. productivity gains drive positive sum growth.

you can raise wages through trade restriction/oligopoly, but it comes at a deadweight loss of lower production and has little effect on employment levels which were already rolling over pre lockdown. this is negative sum net loss.

you can see the “lower production, higher cost” productivity loss from the tariffs whereas with free trade you saw higher wages but even greater output acceleration implying more productivity and lower cost goods.

free trade drives real wealth creation, tariffs help a select few at net cost to the many.

the laws of economics are no more optional than the laws of physics and an awful lot of “folk wisdom” about them is more folksy than wise…

Thesis: Mexico production supports US production.

I work in Automotive. We source globally but logistics get to be a pretty significant part of the picture. We'll source small plastic parts in Thailand then pay 30% of their cost in shipping them to the US or Mexico where they go into our assemblies. We have a developing MX supplier that can make small plastic parts. They're 20% more expensive then Thailand but the logistics cost almost nothing because they're a half hour from our plant. We've been investing heavily there because it makes sense financially.

Ford has some very rough launches recently that I would attribute to MX assembly. I think we'll find that the US is the best place for final assembly, but we need to make most of the components in Mexico. Free trade allows us to right-source everything. Tariffs should only apply to actual bad faith actors, which is mostly China.

For me, 1992 was the realization that the Uniparty was a thing. Bush and Clinton were both predatory psychopaths. Not just on the same team, but part of the same crime family.

I support your thesis that Obama did so much damage with his regulatory assault.